- Letter of Intent

- Posts

- ☕️V Plates

☕️V Plates

Virgin’s day one pop raises red flags for market players.

Good morning.

Virgin Australia certainly popped its cherry IPO on Tuesday, closing 11% higher on its first day back on the ASX, but that doesn’t necessarily bode well for the airline’s longer-term performance.

Capital Brief reports that of the largest 20 ASX floats by volume over the last decade, most that had a day one pop typically saw their stock fade or reverse within three months, according to data from Dealogic.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

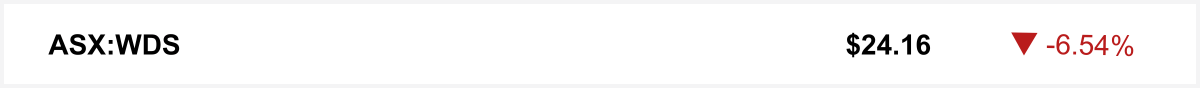

Shares in Woodside plunged over 6% on Tuesday after oil prices fell under US$69, leading the 3.9% dive in the ASX energy sector.

REFER A FRIEND

Letter of Intent referral rewards just dropped.

1 referral: Go in the monthly draw for a $200 tab at your city’s most regrettable venue. 🍻

3 referrals: 45 days of Capital Brief access, on us. ⚡️

5 referrals: We’ll shout you a coffee. ☕️

20 referrals: Post your own message in Letter of Intent. 📣

First to 200 referrals: Claim the coveted #1 LOI subscriber number. 🥇

Or copy and paste your unique referral link: {{rp_refer_url}}

House rules:

Only verified referrals count. Terms apply to all rewards. By participating, you agree to the terms and conditions.

The quick sync

As high-growth startups stay private longer, savvy Aussie VCs are tapping continuation funds to keep backing winners, without forcing the exit. (Capital Brief)

Meliora kicked off with strategic AI plays, as Clive Dickens backs Fluency and Relevance to blend capital, connections and code in a global push. (Capital Brief)

AI is cutting hours for junior bankers but can’t yet replace complex work on Wall Street. (The Information)

OpenAI, Jony Ive accused of corporate bullying after launching AI hardware venture under name strikingly similar to a smaller rival’s, sparking a court-ordered marketing takedown. (FT)

A MESSAGE FROM VANTA

From compliance to confidence

A robust vendor management program isn’t just a compliance checkbox for frameworks like SOC 2 and ISO 27001 — it’s a core component of a holistic trust management strategy.

In our guide, “From reactive to proactive: How to minimise third-party risk with strong vendor management,” you’ll learn:

Insights from other leaders on how to proactively manage third-party vendor risk

Tips on dealing with challenges like limited resources and repetitive manual processes

How security teams can enable business to move quickly instead of being inadvertent gatekeepers

Join 11,000 companies like Atlassian, Relevance AI, Handle, InDebted, FireAnt, Traffyk.ai, Everlab, Lumin Sports and Tactiq.io that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

Scape and NPS buy Aveo for $3.85b and rebrand all assets as The Living Company. (AFR)

Humm Group shares have jumped over 11% amid speculation of renewed takeover interest in the BNPL company. (AFR)

MinRes may sell mining services stake for up to $1.1b to raise cash. (The Australian)

Riverside takes majority stake in mining software firm Dingo. (AFR)

Barrenjoey analysts believe the FIRB is likely to approve the $36.4b Santos takeover, despite some calls for domestic gas safeguards. (AFR)

Wall Street firms, TPG and Aquarian, emerge as top bidders for insurer Brighthouse. (FT)

Capital Markets

Collins Foods’ net profit plunged 89% to $8.8m due to $40.8m in write-downs. (Capital Brief)

Bannerman Energy is raising $85m via discounted share placement amid strong uranium prices. (AFR)

Treasury Wine plans share buyback, cuts FY26 outlook for key brands. (Capital Brief)

Treasury Wine’s $65m class action settlement approved, with no admission of wrongdoing. (Capital Brief)

Develop Global launches $180m raise to fund copper and base metals mines after shares double in 2025. (AFR)

Morgans upgrades Adairs to ‘buy’ after sharp share decline. (Capital Brief)

Luciano split puts remaining 6.6% Regal stake under spotlight. (AFR)

Rio and Hancock to invest $2.5b in new Pilbara iron ore project. (Capital Brief)

MTM Critical Metals launches $50m equity raise targeting fund managers. (AFR)

Dexus posts slight portfolio growth and announces APAC court hearing delayed to November. (Capital Brief)

Forrest-backed Greatland jumps 12% on ASX debut after $490m IPO. (AFR)

UK may curb Google’s search dominance under new digital market rules. (Capital Brief)

Martin Holland’s Rapid Critical Minerals is raising $10m via placement at 2.4¢ per share, with $8m cornerstone backing secured. (AFR)

Markets rise and oil drops on hopes Israel-Iran truce holds and China resumes Iranian oil purchases. (Capital Brief)

Blue Sky brewery fund investors hit with 44% loss on Lord Hobo Brewing stake. (AFR)

VC

Melbourne startup NexusMD raises $6.3m to expand hospital AI, backed by Square Peg. (Capital Brief)

NZ agtech Halter hits unicorn status with $155m raise led by Bond. (Startup Daily)(Capital Brief)

Meliora, led by Clive Dickens, makes early AI bets on startups Fluency and Relevance AI to support its new advisory business. (Capital Brief)

Cauldron named World Economic Forum Technology Pioneer for its fermentation tech. (Smart Company)

Australian VCs are adopting continuation funds to handle liquidity and hold onto high-potential startups as exits take longer. (Capital Brief)

NZ startup Kiki is relaunching in London after leaving NYC due to regulatory pressure. (Smart Company)

People moves

NAB hires Lloyds’ Pete Steel as first digital, data and AI chief. (Capital Brief)

Chris de Bruin named inaugural CEO of merged Acenda Group. (Capital Brief)

Rival firm PAG quickly snaps up ex-BlackRock dealmaker Charlie Reid. (AFR)

Growthpoint CFO Dion Andrews to step down after 15 years. (Capital Brief)

CDO Nikhil Ravishankar is a top contender for the Air New Zealand CEO role. (The Australian)

ACCR urges Glencore to appoint a climate expert director to strengthen governance and strategy oversight. (Capital Brief)

Articore activists seek to oust new chair Robin Mendelson after recent board shake-up. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler