- Letter of Intent

- Posts

- ☕️Basic Arbitrage

☕️Basic Arbitrage

Jane Street deposits over US$550m in efforts to resume India trading.

Good morning.

US hedge fund Jane Street deposited US$567 million ($866 million) of what India’s markets watchdog dubbed “illegal gains” into an escrow account to comply with a trading ban in the country.

The storied quant fund is squaring up for a fight with the Securities and Exchange Board of India after the regulator last week accused the firm of a “sinister scheme” to manipulate stocks and derivatives in the country.

Jane Street has vehemently denied wrongdoing, arguing that its exceedingly lucrative business in India (which has bagged the firm over US$4 billion in profits in the past two years) is merely the pursuit of “basic index arbitrage,” the FT reports.

The deposit is a precursor to lifting the trading ban, with the request from Jane Street still under consideration.

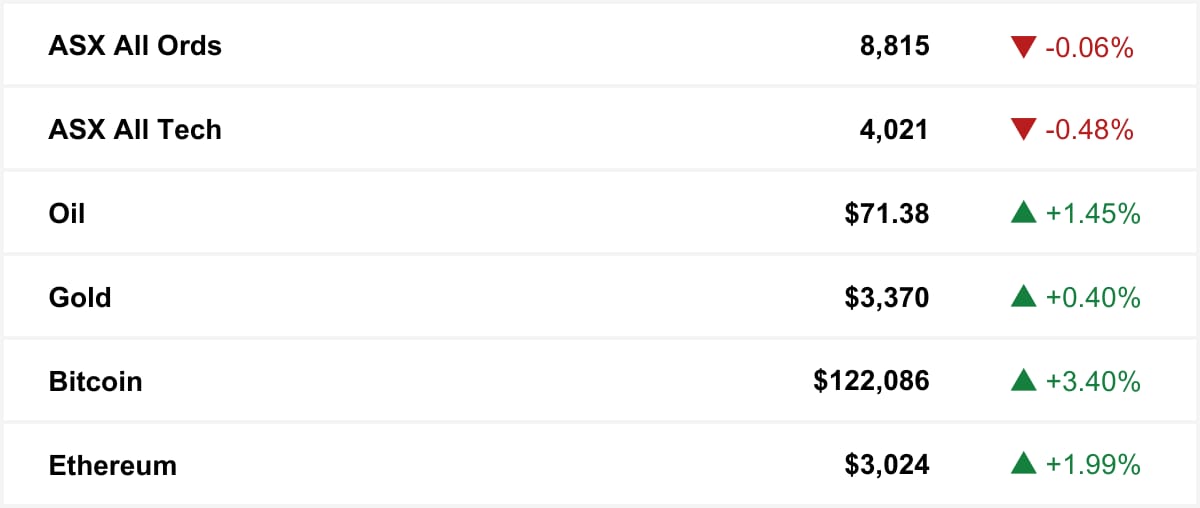

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

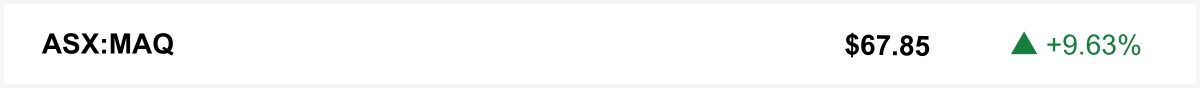

Shares in Macquarie Technology rose almost 10% after its data centre unit secured a $240m land option in Sydney for a future 150MW campus build, with construction expected in a few years.

REFER A FRIEND

48 hours until the draw. Last chance for that tab.

Refer just one person to Letter of Intent and you're in with a chance to win a $200 tab at your city's most regrettable local*.

We're drawing this month’s winner tomorrow. Don’t miss out.

*Regrettable is a subjective term. By participating, you agree to the terms and conditions.

The quick sync

Bank of America’s Nick Stenner, one of the few to correctly predict the RBA’s July hold, sees slower rate cuts ahead as inflation and labour data justify caution. (Capital Brief)

Nine ramps up Stan hiring push to build its Premier League streaming team ahead of 16 August kickoff. (Capital Brief)

Stablecoins are overtaking traditional finance, and without urgent reform Australia could miss the moment, Edward Carroll writes. (Capital Brief)

NRF probe ends with no serious misconduct found, closing a turbulent chapter but prompting recommendations to improve governance at the $15b fund. (Capital Brief)

A MESSAGE FROM VANTA

From compliance to confidence

A robust vendor management program isn’t just a compliance checkbox for frameworks like SOC 2 and ISO 27001 — it’s a core component of a holistic trust management strategy.

In our guide, “From reactive to proactive: How to minimise third-party risk with strong vendor management,” you’ll learn:

Insights from other leaders on how to proactively manage third-party vendor risk

Tips on dealing with challenges like limited resources and repetitive manual processes

How security teams can enable business to move quickly instead of being inadvertent gatekeepers

Join 11,000 companies like Atlassian, Relevance AI, Handle, InDebted, FireAnt, Traffyk.ai, Everlab, Lumin Sports and Tactiq.io that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

Abacus grants due diligence after $2.2b improved takeover offer from Ki and Public Storage. (Capital Brief)

Humm board delays due diligence access on Abercrombie’s $286m bid. (AFR)

Kiwibank seeks a NZ buyer and $500m boost ahead of possible IPO. (The Australian)

Macquarie signs $240m land deal for new 150MW Sydney data centre campus. (Capital Brief)

Network 10 and Sky News sign new deal to extend regional broadcasts. (Capital Brief)

Bidding for Keyton has been delayed, with buyers including Scape and major investors eyeing a potential full sale if the offer is strong. (The Australian)

Riparian Capital Partners wins $75m superannuation mandate from Brighter Super. (AFR)

Ramelius-Spartan merger wins shareholder approval, leading gold rally on tariff-driven demand. (Capital Brief)

General Atlantic seeks $1b sale of NDIS care platform Mable. (AFR)

Scalare to buy Tank Stream Labs for $5.5m, plans capital raise to fund growth. (Capital Brief)

Kraft Heinz may revisit selling its Australia–NZ unit as it plans to split its global operations. (The Australian)

Adriatic shareholders to vote on US$1.25b Dundee takeover on 13 August. (Capital Brief)

Padua buys Wealth Data after $7m raise from Acorn. (AFR)

Capital Markets

DroneShield to invest $13m in Sydney site to scale up after major contract wins. (Capital Brief)

South32 warns of Mozal impairment amid power supply and pricing uncertainty. (Capital Brief)

KPMG’s government consulting revenue has dropped sharply due to public service cuts, while rival Accenture has nearly doubled its business. (AFR)

City Chic swings to profit but misses earnings and sales targets for FY2025. (Capital Brief)

Perennial’s IPO plays pay off, but 2020–21 pre-IPO investors face valuation headwinds. (AFR)

Queensland’s battery sector pushes to revive $200m hub after state pulls support. (Capital Brief)

Computershare drops after Morgan Stanley downgrade on valuation and rate concerns. (Capital Brief)

Bitcoin tops US$120k as US Congress prepares to debate major crypto bills. (Capital Brief)(WSJ)

City Chic returns to profit but misses full-year targets due to US struggles. (AFR)

Meta to invest hundreds of billions in AI data centres as it pursues superintelligence. (Capital Brief)

Oil falls as Trump gives Russia 50 days to avoid new sanctions. (Reuters)

Investment banking is set to extend its worst run in over a decade. (FT)

VC

Startup dealmaking hits $2.9b in 2025 H1, nearly topping all of 2024. (AFR)

People moves

Nine begins Stan hiring spree ahead of EPL launch, eyes former Optus Sport exec. (Capital Brief)

Indeed and Glassdoor will cut 1,300 jobs, with parent Recruit citing AI adoption as the reason. (Smart Company)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler