- Letter of Intent

- Posts

- ☕️P(E)mpty hat

☕️P(E)mpty hat

Seven-year low shows PE isn’t buying love with cut-price fees

Good morning.

Private equity is passing the hat and finding it mostly empty. According to Preqin, global fundraising has slumped to a seven-year low of US$592 billion ($921.1 billion) in the 12 months to June, despite firms dangling cut-price fees and investor sweeteners that would have been unthinkable a few years ago.

High rates, frozen exits and a glut of managers (think mega-fund targets from the likes of Advent, Permira and Bridgepoint) have turned the once-glittering asset class into a buyer’s market, and investors still seem perfectly content to walk away from the bargain bin.

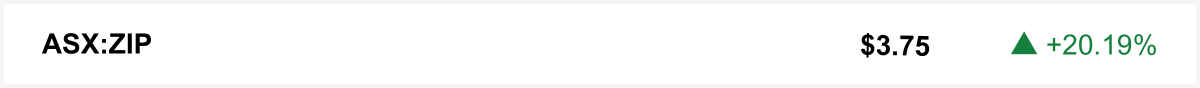

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares of buy now pay later company Zip Co skyrocketed Friday after it posted a stronger-than-expected $79.89 million full-year profit and flagged a potential Nasdaq listing to support its growing US business. The company said more than 80% of divisional cash earnings now come from the US, where customer numbers and transaction volumes are rising sharply.

But at the other end of the spectrum, shares in Guzman y Gomez and Inghams plummeted by over 18% and 20% respectively, capping a brutal day for consumer stocks.

Share Letter of Intent. Earn Rewards.

It’s altruistic. Your colleagues should be reading anyway.

By participating, you agree to the terms and conditions.

The quick sync

XRG and Carlyle remain committed to their $36.4b bid for Santos, and expect to clarify soon whether a formal offer is imminent. (Capital Brief)

Ted O’Brien throws shade at Labor’s AI caution, backing a freer hand on tech to stop Australia missing out on the AI boom. (Capital Brief)

Tech Council rift deepens as Farquhar’s AI copyright push sparks backlash from creatives and Canberra. (Capital Brief)

Chalmers rules out new super tax moves this week, shelving changes to high-balance concessions as pressure builds for broader reform. (Capital Brief)

Jim Chalmers’ tax talk bought time, but the real decisions were punted to the next election. (Capital Brief)

A MESSAGE FROM VISA

Productive and Secure Growth with Agentic AI

An online transaction – checked against over 500 data points in less than the blink of an eye – helps identify you from a fraudster. This capability helps Visa deliver a better buyer experience and more sales for sellers – less fraud and fewer declines. As AI transforms how we shop and pay, the potential goes beyond security to deliver new opportunities for Australian people and businesses.

Trading floor

M&A

Cuscal shareholders set to sell as IPO escrows lift. (AFR)

Macquarie may sell $2.5bn Paraway Pastoral amid investor pressure. (The Australian)

XRG and Carlyle stress national interest in $36.4b Santos bid. (Capital Brief)

Allegro prepares $500m sale of Strait Link sea freight business. (AFR)

Bega weighs reclaiming brands after losing Mainland bid to Lactalis. (The Australian)

Breville is betting on China’s growing homemade coffee trend. (AFR)

National Storage stake complicates Public Storage’s bid for Abacus. (The Australian)

ACL sells Healius stake, merger hopes fade. (The Australian)

Capital Markets

US law firm, The Schall Law Firm, probes James Hardie after profit collapse. (AFR)

Rio Tinto halts Simandou project after fatality. (AFR)

HSBC to drop 1,000+ wealthy Middle East clients after AML breaches. (Capital Brief)

AAM seeks exit for poultry fund after ProTen’s $1.3b sale. (AFR)

InfraBuild CEO battles imports as Gupta’s empire unravels. (AFR)

Trump’s tariffs are smashing ASX earnings and the final week could bring more bruising surprises. (Capital Brief)

GYG’s record sales and first dividend couldn’t stop a $1b wipeout, as soft guidance and looming exits smashed investor confidence. (Capital Brief)

Secret audio surveillance of remote staff lands compliance giant Safetrac in legal hot water. (AFR)

NSW unveils plan for 10,000 homes and Sydney’s first new heavy rail station in a decade at Woollahra. (AFR)

Big super pressures Qantas on exec pay, warning cultural fixes can’t just be for show. (AFR)

Wall Street is ditching VIX calls in favour of S&P 500 put spreads as investors brace for Nvidia earnings and the Fed’s next move. (Bloomberg)

Powell opened the door to a rate cut in September, but the Fed is anything but united. (Bloomberg)

VC

People moves

HSBC to cut jobs, tighten corporate lending in Australia. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler