- Letter of Intent

- Posts

- ☕️Make it Rain

☕️Make it Rain

More than US$1 trillion in closed deals rained down on dealmakers this summer.

Good morning.

Aside from Taylor Swift locking in the biggest merger of all time August this year, the mortal dealmakers among us have also bucked the norm by making it rain during the height of the northern hemisphere’s summer.

During what are typically the year’s slowest months, over US$1 trillion in transactions crossed the line since the beginning of June, Bloomberg reports, up 30% from a year earlier and the highest tally for this spell since the summer of 2021.

Led by a clutch of mega deals, almost US$300 billion of transactions have been inked in August alone, which head of the Americas corporate practice at Clifford Chance, Ben Sibbet, says has been spurred on by the change in the US administration.

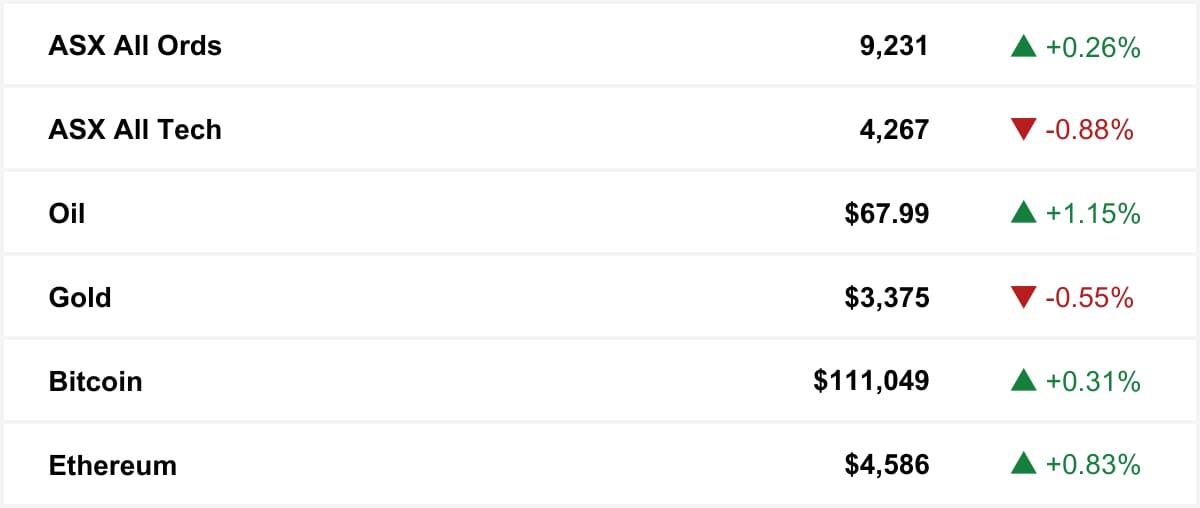

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in wagering giant Tabcorp skyrocketed Wednesday, soaring nearly 24% after swinging to profit and slashing costs. It led a rally of earnings beats, with SiteMinder (21.1%), Lovisa (13.2%) and Worley (11%) all posting double-digit gains on stronger-than-expected results. But the sell-offs were just as brutal, with Domino’s shares down 22%, Woolworths falling almost 15% and WiseTech Global shares close to 12%. lower

Share Letter of Intent. Earn Rewards.

It’s altruistic. Your colleagues should be reading anyway.

By participating, you agree to the terms and conditions.

The quick sync

HSBC and Pollination’s climate fund is lining up US$800m for its next nature play, as investors weigh the shaky economics of natural capital. (Capital Brief)

While Canberra debates copyright, Australian businesses are stuck dabbling with AI, leaving real productivity gains on the table, writes David Brudenell. (Capital Brief)

Labor uneasy as reports suggest Trump-era intelligence directive may be cutting Australia out of Five Eyes sharing on Ukraine peace talks. (Capital Brief)

As his term winds down, Joe Longo pushes a bolder, more visible ASIC to build public confidence. (Capital Brief)

Procreate’s AI holdout puts creative labour back in the copyright fight. (Capital Brief)

A MESSAGE FROM THE EVEREST

Join us at The Summit, presented with The Everest.

You’re invited to Capital Brief’s unofficial start to the season with The Everest.

It’s a party, but we called it The Summit so you can expense the Uber. Only item on the agenda: a very, very good night.

📅 Thursday 9 October. 6pm to late.

📍Sydney CBD rooftop

Spots limited. Get on the list to The Summit →

Trading floor

M&A

Revolution AM secures $1b+ bids for $400m credit trust before ASX debut. (Capital Brief)

Perpetual delays Oaktree wealth sale announcement, but deal still in play to cut $740m debt. (The Australian)

MIXI secures 42% of PointsBet as Betr ups scrip offer and buy-back terms. (Capital Brief)

Allegro takes majority stake in BE Campbell. (AFR)

Leidos secures $46m Defence counter-drone contract; EOS, Acacia, Dept 13 to supply systems, revenue impact from 2026. (Capital Brief)

Healthscope bids due Friday, with Knox Private highly sought; not-for-profits circling but cash-constrained, while government may intervene if process falters. (The Australian)

Nine to return $780m from Domain sale; CEO Stanton hints at $600m for growth but plays down big acquisitions. (Capital Brief)

Vector merges Showpad with Bigtincan to form global sales enablement giant. (Startup Daily)

Capital Markets

EBOS profit drops 21% to $215m, but guides for 7% earnings growth in FY26. (Capital Brief)

SiteMinder revenue up 18% to $224m, posts first positive free cash flow as losses narrow. (Capital Brief)

Aware Super, UK launch $1b battery venture named Eelpower Energy. (AFR)

Domino’s posts $3.7m loss, slashes dividend, and slows store growth amid tough global markets. (Capital Brief)

Flight Centre profit down 10% to $289m, but record sales and steady dividend suggest rebound potential. (Capital Brief)

Nexsen biotech launches IPO for ASX listing. (AFR)

Lovisa profit up 5% to $86m on store growth, but dividend reduced. (Capital Brief)

Sigma posts $530m profit post-merger, ups synergies, CFO to step down. (Capital Brief)

Woolworths profit slumps 19%, trims dividend, eyes FY26 rebound. (Capital Brief)(AFR)

Core Lithium raises $60m to restart mining. (AFR)

Nine profit down, $150m cost cuts planned. (Capital Brief)

DroneShield swings to profit on soaring sales. (Capital Brief)

EY lifts partner pay despite revenue drop. (AFR)

Tabcorp back to profit, boosts dividend. (Capital Brief)

Adairs profit down 17% to $25.7m, dividend cut. (Capital Brief)

WiseTech profit rises 17%, forecasts 80% revenue growth on e2open deal. (Capital Brief)

Agright seeks capital partner with Stanton’s help. (AFR)

Worley profit up 14% in FY25, eyes moderate growth for FY26. (Capital Brief)

Karoon profit sinks 61% on weaker sales, but reserves at Brazil’s Baúna rise 35%. (Capital Brief)

Neuren profit jumps 88% on Daybue royalties; eyes growth with new drug trials. (Capital Brief)

ARN Media posts $11.9m loss on weaker radio revenue; cost cuts, digital growth to aid H2. (Capital Brief)

Wilson opposes Pengana’s LIC private credit plan. (AFR)

CPI up 2.8% in July, beating forecasts as power costs surge; ABS warns data volatile. (Capital Brief)

Big super fights ATO over franking credit losses. (AFR)

Macquarie Technology posts $34.85m profit, boosts capex for IC3 SuperWest data centre and AI infrastructure. (Capital Brief)

Mecca reinvests $110m dividend into expansion. (Capital Brief)

Flight Centre profit hit by geopolitics, weak US. (AFR)

ByteDance, TikTok’s owner, plans an employee share buyback valuing the company at over US$330b. (Capital Brief) (Reuters)

CAM plans $800m second fund after first’s success. (Capital Brief)

Surveillance is becoming the trade-off for WFH, employers say. (AFR)

Nvidia modestly beats expectations, launches US$60b buyback, shares fall. (Capital Brief)

Nvidia says any request for a percentage of rev from the Trump administration “may be subject US to litigation” (Bloomberg)

Inflation data shocked economists with a power price surge, but the RBA isn’t spooked and November’s rate cut is still in play. (Capital Brief)

VC

Melbourne startup Akula Tech successfully launched its first smart satellite aboard a SpaceX Falcon 9. (Startup Daily)

Sydney medtech startup Eyes of AI secures $2.2m grant for AI gum disease tool. (Startup Daily)

Alfred Travel launches AI trip planner with future crypto rewards. (Startup Daily)

Coursebox raises $750k for AI course creation tool. (Startup Daily)

Auckland cleantech startup Nurox Hydrothermal partners with Interwaste for clean waste disposal tech. (Startup Daily)

People moves

Champion Iron CFO Donald Tremblay will step down after Q2 FY25 results (Capital Brief)

G+T succession plan collapses, with Danny Gilbert resuming control of the firm. (AFR)

Rio Tinto consolidates into three product groups, Iron Ore, Aluminium & Lithium, and Copper; minerals head Kaufman and Australia CEO Parker to leave. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler