- Letter of Intent

- Posts

- ☕️Backdoor Brokers

☕️Backdoor Brokers

Why are Aussie platforms offering secondary share trading in these unicorns?

Good morning.

Private market platforms based in Australia are offering local wholesale investors the chance to buy into some of the world's most valuable and highly touted startups, from AI developers OpenAI and Anthropic to UK fintech Revolut and more.

But there's just one problem. The startups themselves say they don't permit secondary trading in their shares, and that the platforms have no right to facilitate it, raising risks that any equity transacted could be voided.

About a dozen startups contacted by Capital Brief don’t allow their stock to be bought and sold on secondary marketplaces, with some requiring strict board approval on any and all share transfers.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

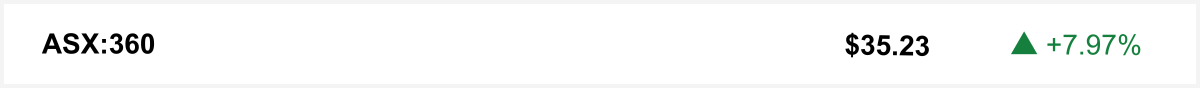

Life360 led an ASX tech surge on Monday that pushed the benchmark index to a record close, fuelled by AI chip hopes and upbeat US signals.

REFER A FRIEND

Draw is at 5pm today. Last chance for that tab.

Refer just one person to Letter of Intent and you're in with a chance to win a $200 tab at your city's most regrettable local*.

We're drawing this month’s winner later today. Don’t miss out.

*Regrettable is a subjective term. By participating, you agree to the terms and conditions.

The quick sync

Bitcoin-backed home loans are set to launch in Australia, with Block Earner moving ahead post-ASIC win with a first-of-its-kind offering for crypto-rich buyers. (Capital Brief)

Google slashes deal values with Australian publishers as regulatory delays stall Labor's news bargaining reforms. (Capital Brief)

The RBA’s ambitious proposal to ban card surcharges is setting the stage for a high-stakes battle before reforms land by year’s end. (Capital Brief)

NAB board backs CEO Andrew Irvine amid investor unrest over conduct concerns and recent leadership exits.(AFR)

A MESSAGE FROM DEEL

Explore the shifting expectations of Australian workers

Over half of Australian workers used a financial service while waiting for pay. Deel’s new report explores how cost-of-living pressures are reshaping employee needs—and why it’s important for businesses to modernise payroll and support financial wellbeing.

Trading floor

M&A

oOh!media loses Auckland Transport deal, stays confident in NZ market. (Capital Brief)

Fullers360 ferry business up for sale as Souter Holdings explores exit. (The Australian)

BlueScope wins right-of-last-offer for Whyalla Steelworks deal. (AFR)

MLC teams with TAL, Challenger on new flexible super product for retirees. (Capital Brief)

JSW nears deal for stake in Coronado’s Curragh coal mine amid debt talks. (The Australian)

Scalare Partners to acquire Tank Stream Labs for $5.5m; CEO to stay on. (Smart Company)

CC Capital’s $3.4b Insignia bid delayed but still alive. (AFR)

Dexus buys $40m Sydney warehouse, to sell Brisbane offices. (Capital Brief)

Nippon, Mitsui may back Peabody’s $5.8b Anglo coal mine deal amid setbacks. (The Australian)

Bega teams with FrieslandCampina to bid for Fonterra’s Aussie assets. (AFR)

Capital Markets

Hub24 hits $19.8b inflows, FUA up 30% to $136.4b. (Capital Brief)

Cromwell Property Group will develop a $201m office building for a Commonwealth government department with a 15-year lease. (Capital Brief)

Hansen Technologies tipped as next ASX delisting target despite CEO denial. (The Australian)

Morgans upgrades Telstra to 'hold' on rising mobile prices. (Capital Brief)

Regal fund gains 14.7% in June, boosted by key unlisted asset. (AFR)

RBA plans to ban card surcharges, saving shoppers $1.2b yearly. (AFR)

Paladin shares rise as Bell Potter lifts target price 40%. (Capital Brief)

Bowen Coking Coal halts trading over $15m debt demand from BUMA. (Capital Brief)

Bunnings CEO calls for law change to allow in-store facial recognition. (AFR)

Infratil joins ASX 200, replacing takeover target Spartan. (Capital Brief)

BlackRock AUM hits US$12.5T in Q2, boosted by markets and private funds. (Capital Brief)

JP Morgan posts surprise Q2 gains in dealmaking and trading. (Capital Brief)

APA warns AEMO against underestimating LNG import costs, backs local gas. (AFR)

Citi Q2 profit jumps 25% on record trading and deal rebound. (Capital Brief)

US clears Nvidia, AMD AI chip sales to China, boosting shares. (Capital Brief)

Smart50 winner Pay.com.au plans U.S. expansion and growth push. (Smart Company)

Bitcoin-backed home loans launching in Australia via Block Earner. (Capital Brief)

Australian private market platforms list unicorn shares without approval, risking legal issues. (Capital Brief)

VC

Eclipse Ingredients raises $7m to scale lactoferrin production. (Smart Company)

New Zealand tech firm Blackpearl Group will dual list on the ASX to expand in Australia and has agreed to acquire US AI sales company B2B Rocket. (Startup Daily)

Linkby raises $23m to build AI tools as brands move beyond SEO. (Smart Company)

People moves

Newmont CFO Karyn Ovelmen resigns; Peter Wexler named interim. (Capital Brief)

Simon Trott named Rio Tinto CEO, replacing Stausholm in August. (Capital Brief)

Tesla shares fall on VP Troy Jones' exit amid sales, legal woes. (Capital Brief)(WSJ)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler