- Letter of Intent

- Posts

- ☕️Word of Warning

☕️Word of Warning

Adobe cautions Australian government over AI risks.

Good morning.

Adobe has rung the alarm bells about the misuse of AI in its submission to an Australian Senate Committee investigating the risks and rewards of AI adoption in the country. The software giant said that as “AI technologies become ever more sophisticated it will become increasingly difficult for an average person to distinguish deepfake images, video and audio clips from authentic media.”

It isn’t the first time Adobe has raised concerns about synthetic media – and with good reason. Earlier this year a Hong Kong multinational found itself down US$26 million ($39.4 million) after scammers used deepfake video technology to trick an employee into transferring company funds to the fraudster’s bank accounts.

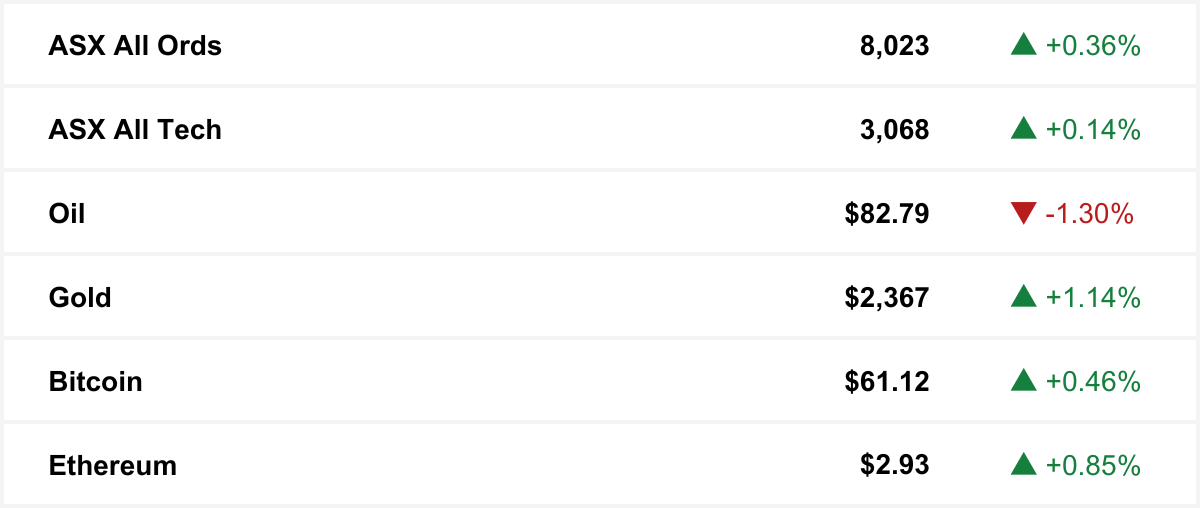

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

🚨 Subscription offer ends this week

Capital Brief covers finance, tech and politics for professionals in the new Australian economy. Its only agenda is to present information that's relevant and valuable to people like you.

Sign up today to save $10 a month for 12-months.

/

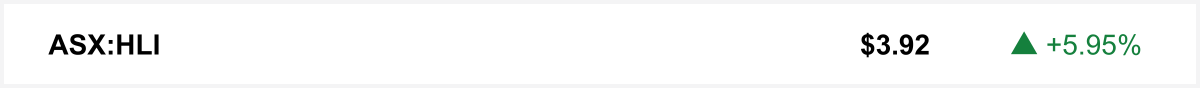

Market movers

Shares in Helia Group climbed almost 6% during trading on Friday to close at $3.92, after the mortgage insurance provider announced its intention to commence an on-market share buyback of up to $100 million. Helia said the total number of shares to be purchased by the company in the buyback will depend on business and market conditions, the prevailing share price, market volumes and other considerations. During FY23, Helia completed a $156 million on-market share buyback and also had a $100 million on-market share buyback that ended on 30 April 2024.

The quick sync

Treasury forecasts released with Tuesday’s budget will show inflation has moderated faster than Treasury expected, with Jim Chalmers set to argue the government's cost-of-living policies are working. (Capital Brief)

ASIC is investigating ANZ over concerns the bank’s traders manipulated the sale of government debt during 2023. (AFR)

APA has delayed signing-off on its South West Queensland Pipeline expansion over regulatory uncertainty. (The Australian)

Albanese’s budget will extend the instant asset write-off scheme for SMEs. (AFR)

The eSafety regulator and X Corp’s first appearance in court last week hinted that the legal showdown will test the Commissioner’s enforcement powers. (Capital Brief)

Pfizer and AstraZeneca will invest nearly US$1b in France, with Pfizer focusing on research and development and AstraZeneca investing in its Dunkirk site. (Capital Brief)

M&A

HMC Capital acquires 10% stake in retailer Baby Bunting. (The Australian)

Accolade Wines, owned by Bain Capital, is considering deals with both Pernod Ricard and Australian Vintage, despite advanced talks with the latter. (The Australian)

Karoon CEO engages with investors as stock continues to slide and activists maintain pressure. (AFR)

Private equity firm behind Bonza and Melbourne Victory enlist insolvency advisors over operational issues. (AFR)

Proposed merger between Tim Gurner's company and Roberts Co falls through due to rising construction costs, valuation issues and lack of ‘chemistry’. (AFR)

The future of Beston Global Food is uncertain as NAB attempted to sell $55m of the company's debt to credit funds without success. (The Australian)

Capital Markets

Gold Road Resources participated in De Grey Mining's $600m equity raise but didn't contribute enough to keep its 19.99% holding. (The Australian)

VC

None

People moves

Adam Gregory, previously an adviser to billionaire Radek Sali, has moved to the family office of Dennis Bastas, founder of Arrotex Pharmaceuticals. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

Together with Silversea

Suite upgrades on worldwide ultra-luxury Silversea voyages

Whether you’re seeking a Mediterranean summer in the sapphire waters of the Greek Islands or an immersive expedition through the British Isles and stunning fjords of northern Europe, indulge your wanderlust with Silversea’s suite upgrades– plus a $1,000 shipboard credit per suite and 15% reduced deposit on voyages departing May 2024 through 2026. Learn more at silversea.com.

The watercooler