- Letter of Intent

- Posts

- ☕️What Women Want

☕️What Women Want

Why female VCs are decamping in favour of coveted operator roles.

Good morning.

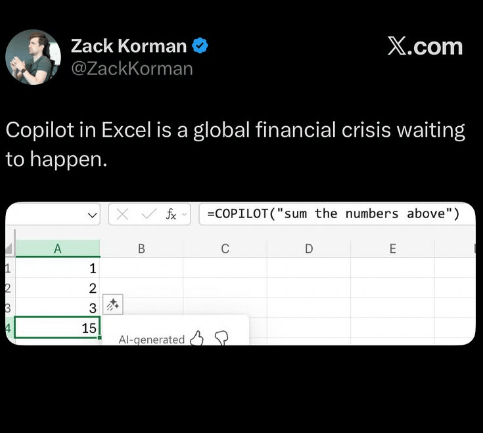

In venture capital, they call it “pattern matching” — identifying similarities in successful investments — but Claire Bristow and Adele Moynihan spotted a different pattern: the escape route their female colleagues were taking. Both women recently left roles in Aussie VC for chief of staff positions at high-growth startups.

Bristow departed Skalata Ventures for pet food company Lyka, while Moynihan left her role establishing Bupa Ventures to join telehealth provider Hola Health.

"When you're looking up and you're looking forward, you ask yourself, where does this go?" Bristow told Capital Brief’s Bronwen Clune.

They’re part of a broader trend of women leaving VC for operational roles — including Casey Flint moving from Square Peg Capital to San Francisco-based ReflectionAI, Lucy Tan leaving Square Peg for Traild, Britt Bloom transitioning from EVP to BlendAI, and Kat Throssell departing Giant Leap for Ovom Care.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

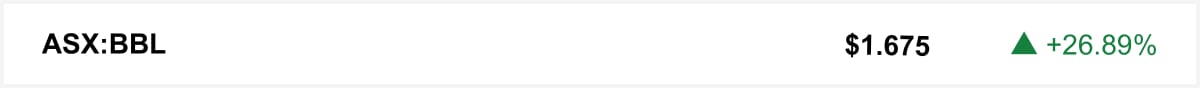

Shares in professional sports club Brisbane Broncos surged almost 27% to record highs after the club’s men’s and women’s teams both claimed NRL premierships, marking its first men’s title since 2006. The double triumph capped a breakout season that lifted profits, memberships and sponsorships, delivering a windfall for major shareholders News Corp and real estate developer Phil Murphy.

The quick sync

With the RBA expected to hold rates longer, strategists say the window to secure high yields on Australian government bonds remains open. (Capital Brief)

Michele Bullock fronts Senate Estimates on Friday with the RBA’s cautious rates approach under scrutiny amid renewed property price pressures. (Capital Brief)

In the middle of New Zealand’s toughest downturn since the GFC, startups like Halter and Tracksuit are thriving, showing that pressure still breeds innovation. (Capital Brief)

Nuclear energy is back in the Liberal debate, with calls to lift Australia’s moratorium amid a global “renaissance.” (Capital Brief)

A MESSAGE FROM AIRBNB

Airbnb contributes estimated $20 billion to Australia’s GDP

New Oxford Economics research found Airbnb contributed an estimated $20 billion to Australia’s GDP in 2024, with 107,000 jobs supported. Guest spending reached $16b, much of it outside capital cities, with 33% of accommodation spend being regional. The figures underscore the platform’s role in tourism dispersal & community-level economic activity. Read more.

Trading floor

M&A

Predictive Discovery and Robex merge to form $2.35b West African gold miner producing 400,000+ ounces annually by 2029. (Capital Brief)

Hamilton Locke owner HPX Group is preparing for a potential sale, engaging bankers to gauge buyer interest. (AFR)

OpenAI inks multi-billion-dollar deal to buy AMD chips, gaining option for 10% stake as AMD shares surge 25%. (Capital Brief)

Igneo sells Clarus Group to Brookfield for $1.8b after nearly four years of preparation. (AFR)

Ideagen acquires Adelaide’s WorkSafe Guardian, giving Eastend Ventures an exit and boosting the safety app’s global growth plans. (Startup Daily)

Fifth Third to buy Comerica for USD10.9b in stock, forming ninth-largest US bank with USD288b in assets. (Capital Brief)

Primavera Capital is seeking buyers for Vitaco, its Australia–NZ vitamin maker behind Musashi and Healtheries, in a deal valued at up to $500m. (The Australian)

Paul Lederer’s group pushes for forensic accountants at Elanor fund amid takeover bid and fee concerns. (AFR)

Partners Group is reviving efforts to sell childcare operator Guardian Early Learning, aiming for a $1b valuation after previous failed sale attempts. (The Australian)

Ex-Anchorage investor Jesse Alderton makes first deal, acquiring Hire Intelligence’s ANZ operations. (AFR)

Jefferies earned undisclosed fees on First Brands ‘side letter’ financing (FT)

Capital Markets

Political chaos drives gold and Bitcoin to records as French yields spike and markets wobble. (Capital Brief)

Pure Asset Management faces investor anger as its $100m fund remains frozen after poor performance. (AFR)

Employment Hero expects first annual profit amid ongoing legal battle with Seek. (AFR)

Saluda Medical, led by former Cochlear executive John Parker, is preparing a $150m IPO valuing it up to $1b. (The Australian)

Australia’s LNG export earnings to drop 25% as oil prices fall and oversupply hits global gas markets. (AFR)

ANZ and Seven West Media mark down View Media Group stakes as the property platform raises fresh capital. (AFR)

Deloitte will refund part of a $439,000 Australian government contract after admitting it used AI to help produce a report that contained fake citations and errors. (FT)

The sudden push to a fresh records in Bitcoin has options traders adding to bets that the largest cryptocurrency will rally to USD140,000. (Bloomberg)

Orsted raised 60b Danish kroner ($14.2b) through a rights offering that’s critical for the company to tackle the downturn facing the wind power industry. (Bloomberg)

VC

AI health startup Heidi raises $98m at $711m valuation, outpacing Canva’s early growth. (Capital Brief)

US-based Australian startup OpenSolar raises USD20m to boost AI capabilities and global reach for its solar design and sales platform. (Startup Daily)

Australian AI startup Lorikeet tops Canva and Perplexity in Andreessen Horowitz’s global AI spend report, ranking 8th worldwide for startup AI spending. (Smart Company)

People moves

PEXA reshapes leadership, hiring Xero’s Peter Bonney and MoneyPlace’s Kylie Waldock, and promoting three executives ahead of 2026 expansion. (Capital Brief)

Ex-HMC Capital energy transition head Angela Karl may join EQT Partners to support its Australian infrastructure push. (AFR)

Women are quitting VC for startup roles, frustrated by slow advancement and diversity fatigue. (Capital Brief)

Paramount buys Bari Weiss’ Free Press for USD150m; Weiss named CBS editor-in-chief. (Capital Brief)

JPMorgan replaces European banking boss who was doing job from New York (FT)

EY narrows US leadership race to three candidates (FT)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler