- Letter of Intent

- Posts

- ☕️Well Pegged

☕️Well Pegged

Square Peg Capital locks in $650m as new fund vintage hits first close.

Good morning.

One of Australia's 'big three' venture firms Square Peg Capital has completed the first close for its latest vintage of funds, locking in $650 million from new and returning institutional investors, despite the global slowdown in VC fundraising.

The Melbourne-based firm told Capital Brief it is now investing from its Fund 6 and Opportunities Fund 3 ahead of a final close, with the final raise amount yet to be determined. Via the new vehicles, Square Peg recently participated in flagship portfolio company Airwallex's USD500 million ($719.2 million) Series G round, which valued the Melbourne-founded payments platform at USD8 billion.

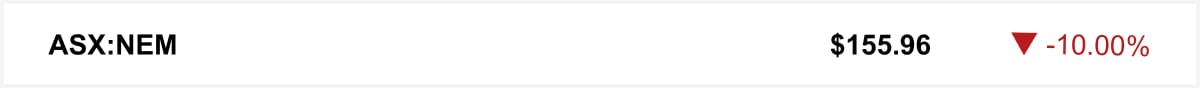

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in Newmont plunged 10% Monday as a wave of selling in gold and silver, triggered Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair, smashed ASX-listed miners, pushing the index to its worst drop since November. Its shares in New York were trading slightly lower at time of writing.

The quick sync

Blue Owl sees AI fears as overblown and makes Australia a key focus in its data centre strategy. (Capital Brief)

Treating women’s health as core economic policy could unlock productivity gains and build national capability, writes Anthony Liveris. (Capital Brief)

Corporate Travel remains suspended from trade as founder Jamie Pherous abruptly steps down while accounting investigations continue. (Capital Brief)

Labor received large donations from Sportsbet and Tabcorp last financial year as it delayed action on a proposed ban on gambling advertising. (Capital Brief)

Mastercard has processed Australia’s first agentic payments, saying the tech is ready if retailers are. (Capital Brief)

The High Court starts 2026 with a key challenge to Victoria’s donation laws and the limits of political speech. (Capital Brief)

Trading floor

M&A

IMDEX buys remaining Datarock stake for $31m. (Capital Brief)

GE Vernova identified as potential $1b buyer of NOJA Power. (AFR)

Ausgrid’s $2.5b Plus ES smart metering unit attracts interest from Macquarie, KKR, and EQT, with RBC Capital Markets advising the sale. (The Australian)

Aware Super launches sale of half of Victoria’s $4b land registry, SERV. (AFR)

Devon and Coterra merge into USD58b US shale group. (Capital Brief)

NRMA considers selling Manly Fast Ferry in a potential $100m deal. (AFR)

Capital Markets

KMD Brands posts 8% sales growth on Kathmandu strength. (Capital Brief)

EOS has not decided on shifting HQ or listing to Europe. (Capital Brief)

Greencross progresses IPO with investor site visits; pricing and AustralianSuper preferences remain crucial. (The Australian)

GrainCorp flags FY26 earnings drop on grain oversupply. (Capital Brief)

Recce Pharmaceuticals teams up with US Army on burn wound gel. (Capital Brief)

PYC Therapeutics launches $653m cash call to advance RNA therapies. (AFR)

Capricorn Metals slumps on Yalgoo Project sale delay. (Capital Brief)

Mastercard launches first AI-powered agentic commerce in Australia. (Capital Brief)

Sharon AI aims to beat Firmus to an ASX IPO, securing $723m debt to expand its AI infrastructure. (The Australian)

Gold miners drag ASX down after historic gold price drop. (Capital Brief)

Regis Resources revives $1b McPhillamys gold project with new plan to address heritage issues. (AFR)

Sportsbet and Tabcorp boost Labor donations amid gambling ad reform delays. (Capital Brief)

BlueScope $150m productivity boost may lift shares $3: RBC. (Capital Brief)

Blue Owl Capital targets Australia while defending AI strategy. (Capital Brief)

TPG, Telstra losing internet customers as cheaper rivals gain market share. (AFR)

Science and Technology Australia calls for inflation-linked research funding. (Capital Brief)

Trump to launch USD12b critical-minerals stockpile to counter China. (Capital Brief) (Bloomberg)

Qoria faces investor caution amid AI trends, pausing trading for a US merger and planned capital raising. (The Australian)

Disney Q1 beats estimates on record parks revenue and strong streaming growth. (Capital Brief)

Diversa faces client exits and an ASIC lawsuit over its role in the $300m First Guardian fraud. (AFR)

Diraq raises $20m NRF investment to put quantum chips in data centres, targeting commercial launch in 2029. (Capital Brief)

Women’s health is Australia’s underpriced asset; better care could lift productivity, participation, and cut costs. (Capital Brief)

China bans hidden car door handles in world-first safety policy. (Bloomberg)

Crypto exchanges buckle as stock losses mount amid exodus. (Bloomberg)

Rookie trader’s rapid 84% wipeout shows depth of China gold bust. (Bloomberg)

Trump’s dollar ‘yo-yo’ has investors looking overseas. (Bloomberg)

Gold and silver deepen historic slump. (FT)

Epstein asked for Snow White costume weeks before ex-Barclays’ Jes Staley email. (FT)

VC

Australian startups raise $5.1b in 2025, Q4 strongest since 2021. (Capital Brief)

Kevin Parker’s Orchid synth hits 10,000 sales, $12m revenue since 2024 launch. (AFR)

GrazeMate, a drone-based cattle mustering startup by 19-year-old Sam Rogers, secures $1.2m pre-seed from Y Combinator to target US ranches. (Startup Daily)

Farmers2Founders helps investors de-risk agtech by using multi-season farm trials to show startups’ real-world traction. (Capital Brief)

Square Peg raises $650 m for new funds, kicks off investments including Airwallex. (Capital Brief)

Mandelson leaked sensitive UK government tax plans to Epstein. (FT)

People moves

Tania Archibald starts as BlueScope CEO. (Capital Brief)

CTM founder Jamie Pherous quits as MD. (Capital Brief)

CTM shareholders stuck as CEO exits amid trading halt. (Capital Brief)

Palisade CEO Roger Lloyd to become executive chairman as part of company restructure. (AFR)

Gillian Swaby steps down from Deep Yellow board. (Capital Brief)

Catalyst Metals appoints Mark Connelly as new chair. (Capital Brief)

Piper Alderman names James Macdonald head partner, targets top-tier legal work with new leadership trio. (AFR)

Sarah Court will succeed Joe Longo as ASIC chair on 1 June 2026, becoming the first woman to lead the corporate regulator. (Capital Brief)

Cory Bernardi joins One Nation to lead SA election ticket. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler