- Letter of Intent

- Posts

- ☕️ Trump duality

☕️ Trump duality

Bond investors worry as Trump triumph ignites stocks

Good morning.

Welcome to Trump 2.0. US stocks surged to fresh record highs as equity investors on Wall Street celebrated Donald Trump’s stunning comeback to the White House in a decisive election result.

The bond vigilantes didn’t join the party though. US 30-year Treasury yields surged 20 basis points to 4.63%, while the 10-year Treasury yield spiked 15 basis points to 4.44%, its highest level since July.

Bond investors seem to be looking through promises that deregulation, tariffs and lower taxes will fuel domestic growth and boost tax proceeds. Instead, they reckon Trump’s policies are likely going to lead to larger deficits and more borrowing, while the duties will hike prices and lower supply, leading to higher inflation. We’ll just have to wait and see who’s right.

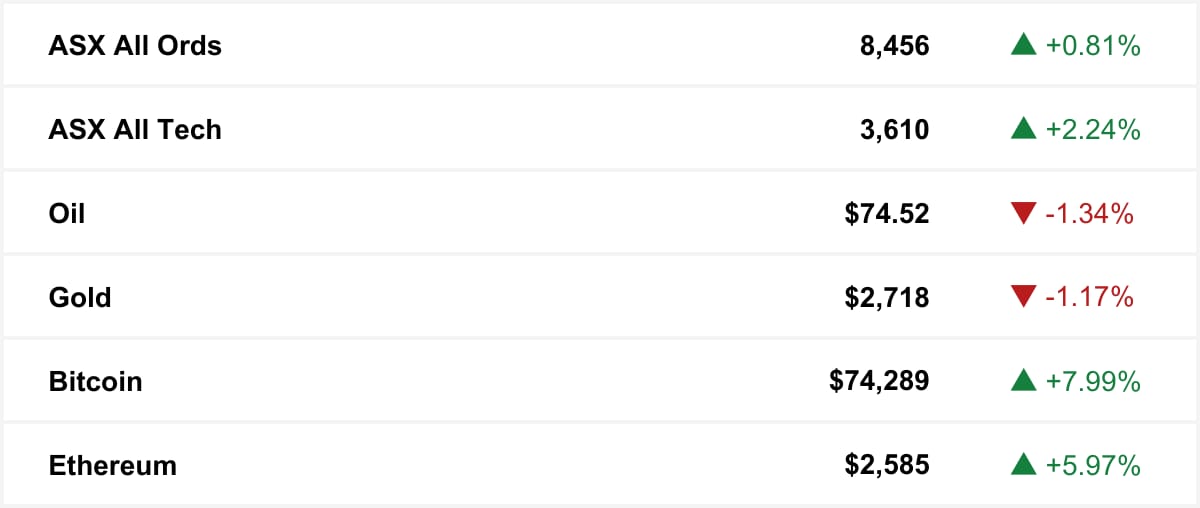

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

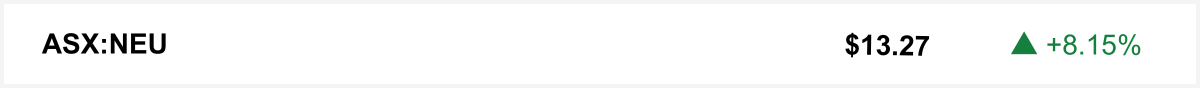

Neuren shares soared on Wednesday after its partner Acadia Pharmaceuticals sold its Rare Pediatric Disease PRV—for US$150 million ($227.93 million). Neuren’s cut is a third of the proceeds.

The quick sync

Labor's streaming quotas face new delays as the government navigates US trade deal concerns and Donald Trump's return, frustrating the industry. (Capital Brief)

Review warns AI-powered malware and state-sponsored hackers are embedding in Australia’s critical infrastructure, posing an escalating threat that outpaces current defences and exploits human vulnerabilities. (Capital Brief)

Future Fund says it asked Mineral Resources for more information on the conduct of CEO Chris Ellison after it found he had enriched himself at the company’s expense. (AFR)

CME customers criticise futures exchange after it wins approval to also act as broker. (FT)

M&A watchers expect Donald Trump to fan flames of dealmaking recovery. (Bloomberg)

A MESSAGE FROM AUTOMIC GROUP

The only single platform for registry & employee share plans

Experience the genuine step up for your employees and shareholders with Automic Group – Australia’s leading provider of company registry, employee share plans, and fund registry services.

Trading floor

M&A

Magellan paid a significant multiple for its $138.5m acquisition of Vinva Investment Management. (AFR)

PEP is in talks to buy MotorOne, though pricing remains a sticking point, similar to last year's Hoyts acquisition discussions. (The Australian)

BP is selling a 51% stake in its Australian renewables portfolio to help reduce its $37bn debt. (AFR)

Neuren Pharmaceuticals will get a third of the proceeds from selling an FDA priority review voucher awarded after its rare pediatric drug, Daybue, was approved. (Capital Brief)

Private equity firms lead the bid for Questas, a $400m industrial business, with the sale likely finalized by Christmas. (The Australian)

Sushi Sushi teams with Stanley Greene to expand to 35 locations in New Zealand. (BNA)

M&A watchers expect Donald Trump to fan flames of dealmaking recovery. (Bloomberg)

Blackstone strikes US$4b deal for shopping-center landlord. (Bloomberg)

Advent mulls €5b sale of generic drugmaker Zentiva. (Bloomberg)

Elliott is said to take stake in RWE, call for share buyback. (Bloomberg)

Capital Markets

Fortescue aims to lease its fleet management system, Fortex, to other miners, leveraging its green tech investment. (Capital Brief)

Hyperion Asset Management’s fund rose 39.8% due to strong gains in AI and tech holdings. (AFR)

Mosaic Brands faces potential partial liquidation and a major restructuring with over half of its stores and some distribution centers closing. (The Australian)

Early US election results boosted the US dollar and Bitcoin, with Trump’s rising odds benefiting both due to his crypto support and trade policies. (Capital Brief)

Key Nufarm investors support a crop protection unit spin-off but are adopting a wait-and-see approach. (The Australian)

VC

Australia cancels its $7bn military satellite project, a major setback to defense capabilities. (Startup Daily)

People moves

Eucalyptus co-founder Charlie Gearside steps back from daily operations as the startup navigates growth and regulatory challenges in its weight loss telehealth services. (Capital Brief)

Morgan Stanley hired Macquarie's David Bailey to lead Australian healthcare coverage, reinforcing its top research rankings. (AFR)

Domain chair Nick Falloon avoided specifying if the next CEO will be an internal or external hire after announcing Jason Pellegrino’s departure. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler