- Letter of Intent

- Posts

- ☕️Twisted Knickers

☕️Twisted Knickers

BBRC billionaire Brett Blundy demands Victoria’s Secret board change.

Good morning.

The Victoria’s Secret board is still getting BBRC chief Brett Blundy hot under the collar for all the wrong reasons.

Blundy on Tuesday fired off another letter (following earlier hate mail in June) calling for changes to the lingerie brand’s board, after criticising the retailer of failing to properly engage on steps to improve shareholder value.

Blundy demanded the removal of chair Donna James who has served on the retailer’s board of directors for 18 years as well as the appointment of a new independent chair.

“By any measure, [James] is an “over-tenured” director with a “stale perspective” that lacks objectivity regarding the Company’s operations.” Blundy penned.

Interestingly, we didn’t hear any complaints from Blundy about the long-term tenure of Victoria’s Secret angels when the VS veterans Candice Swanepoel, Heidi Klum and Naomi Campbell hit the catwalk last month.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

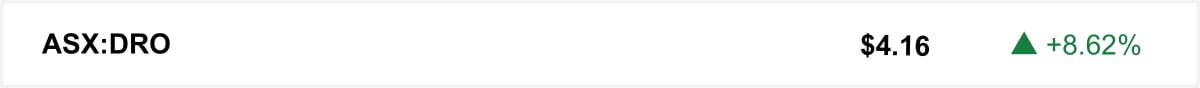

Shares in counter-drone company DroneShield rose over 8% on Tuesday after it announced a $25.3 million contract via a local reseller to supply a Latin American government defence customer. The equipment will be delivered across Q4 2025 and Q1 2026, with payment expected in the same period.

🤝 You’re in good company. You’re reading this alongside new readers from HSF, KPMG and A&M. Know someone who should be here? Forward this on. They can sign up here →

The quick sync

Australian startups risk losing deals if they don’t match US speed, writes Peta Ellis. (Capital Brief)

Radium Capital has lent $1 billion by repurposing delayed R&D refunds into short-term funding. (Capital Brief)

The Nationals' net zero exit puts Sussan Ley under pressure to unify the Coalition on climate. (Capital Brief)

AI is reshaping society, but without built-in accessibility, it will exclude millions, writes Zack Alcott. (Capital Brief)

A MESSAGE FROM HSBC

Ready to scale globally?

Our reach across the global innovation ecosystem can open new opportunities – connecting your ambition with what’s next. Find out more.

Trading floor

M&A

Kroll says the Southern Cross–Seven merger is fair despite no shareholder vote, with completion expected by December 2025. (Capital Brief)

TPG Rise buys Kinetic in $4b-plus deal. (AFR)

GYG pauses buyback amid fast-food slump; El Jannah eyes $1b sale as Retail Zoo and Grill’d prep for future deals. (The Australian)

Starbucks sells 60% of China arm to Boyu in $4b deal amid local rivalry. (Bloomberg)

PRP buys Alto Imaging to boost regional NSW presence. (AFR)

IREN signed a $14.8b deal with Microsoft, shifting from Bitcoin mining to AI-focused “neocloud” operations. (Capital Brief)

Macquarie sells ElectraNet stake to ART in $600m-plus deal. (AFR)

Bain Capital regains exclusivity in Perpetual Wealth deal. (AFR)

Pfizer and Novo Nordisk boost bids in $15b battle for obesity drug maker Metsera. (Capital Brief)

Igneo Infrastructure Partners hires Lazard for BayWa renewables sale. (AFR)

Igneo to sell its stake in $1b+ bulk storage firm Quantem via Macquarie amid broader shareholder and ESG pressures. (The Australian)

Capital Markets

GS and MS expect a 10-20% market correction in 1-2 years and flag Asia as a strong investment theme. (CNBC)

Scion Capital’s Michael Burry unloads new puts on Nvidia and Palantir after raising alarm over inflated AI valuations. (Bloomberg)

Palantir shares slide after Michael Burry reveals bet against stock. (FT)

Palantir posts record revenue and profit growth, with upgraded forecasts and a new Nvidia AI partnership. (Capital Brief)

Fletcher Building has handed the delayed NZICC to SkyCity, with opening set for February 2026 after years of setbacks and a $330m damages claim. (Capital Brief)

GreenCollar launches $100m carbon credit fund to meet rising corporate demand. (The Australian)

Norway’s wealth fund rejects Musk’s huge Tesla stock award over size and risk concerns. (Bloomberg)

Alliance Aviation halted trading after warning of sharply lower FY26 earnings from higher costs. (Capital Brief)

G8 Education shares fell after slashing FY25 earnings guidance due to weak demand and rising costs. (Capital Brief)

Tasmania extends Rio Tinto’s Bell Bay power deal, averting closure until 2026. (AFR)

Coherence Neuro raised $10m to develop its SOMA device that tracks and treats brain cancer using electrical stimulation. (Capital Brief)

The RBA held rates at 3.6% and warned there may be no more cuts as inflation stays above target until late 2026. (Capital Brief)

RBA’s Bullock said “anything’s possible” on rates as inflation stays above target and policy remains focused on price control. (Capital Brief)

Crypto trading boom lifts Swyftx profit to $50.5m. (AFR)

The government granted Rex a $60m loan alongside $50m from US buyer Air T to keep the regional airline flying. (Capital Brief)

Tesla’s China-made EV sales fell 9.9% in October amid weaker demand and expiring US tax incentives. (Capital Brief)

Farm Frites to build $300m Victorian plant to meet fast food demand. (AFR)

ASIC plans light-touch reforms to boost transparency in private markets and improve governance across Australia’s investment sector. (Capital Brief)

ASIC’s private credit reforms win cautious support amid warnings of enforcement action. (Capital Brief)

CEFC invests $40m in Brighte to fund discounted green loans for home energy upgrades. (Startup Daily)

Australia adds Reddit and Kick to under-16 social media ban starting December. (Capital Brief)

Radium Capital tops $1b in R&D lending by turning tax incentives into quick cashflow advances. (Capital Brief)

Cochlear and ResMed warn Trump’s tariff plan risks higher costs, less innovation and supply chain disruption in US healthcare. (AFR)

VC

Queensland agtech startup Nbryo raises $10m to scale bovine IVF tech for global cattle breeding. (Startup Daily)

Startup neo-cloud operator Sharon AI launches pre-IPO funding ahead of 2026 listing. (AFR)

Hullbot raised $16m to expand globally and scale its underwater robots that clean ship hulls, cutting fuel use and emissions. (Capital Brief)(Startup Daily)

People moves

Ex-Metigy CEO David Fairfull pleaded guilty to misleading investors and using $7.7m in company funds for personal gain. (Capital Brief)

Rod Levis exits as Cue HQ goes on sale; Hilco restructures brand and shifts production offshore amid retail pressures. (The Australian)

Former US Vice President Dick Cheney, key architect of post-9/11 policy, died at 84 from pneumonia and heart disease. (Capital Brief)

QuintessenceLabs founder Vikram Sharma wins PM’s science prize for quantum cybersecurity innovation. (Startup Daily)

Brett Blundy demands leadership changes at Victoria’s Secret over poor performance and governance. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler