- Letter of Intent

- Posts

- ☕️ Tax Climax

☕️ Tax Climax

Landmark tax appeal lights up the High Court’s Christmas docket.

Good morning.

The final High Court docket of the year may be a broad church of cases, Capital Brief reports, but this week’s tax showdown (Commissioner of Taxation v Bendel) specifically has been described by the Tax Institute as “a landmark case for tax practitioners, taxpayers and the tax system”.

The Full Federal Court ruled for taxpayer Steven Bendel — a sole director, secretary and beneficial owner of shares he had placed in a trust that was under his control. The trust provided a discretion to set aside any part of its income for one or more of the beneficiaries and allowed for the lending of money with or without interest.

According to the Tax Institute, if the Commissioner’s view is correct, a share of net income taxed to a corporate beneficiary in one year would again be included in the trust’s net income the following year.

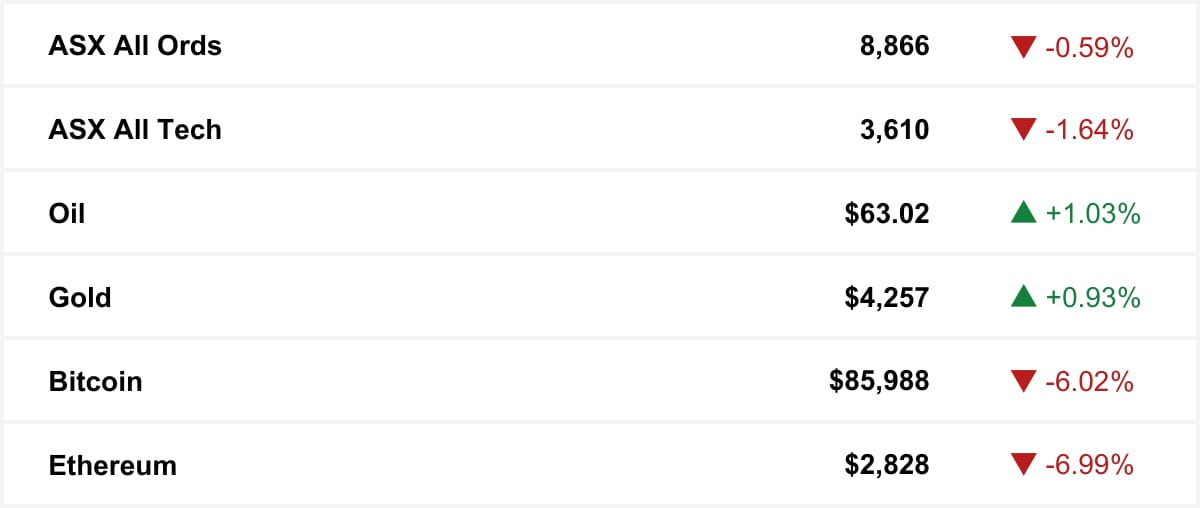

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

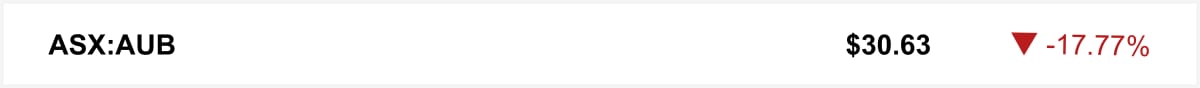

Shares in insurance broker AUB Group plunged on Monday after private equity firms EQT and CVC Asia Pacific walked away from a proposed $45-per-share takeover. The consortium withdrew following exclusive due diligence, prompting AUB to terminate talks and refocus on organic growth and acquisitions.

🤝 You’re in good company. You’re reading this alongside new readers from KPMG, Andersen and Sodali. Know someone who should be here? Forward this. They can sign up here →

The quick sync

One Nation could win 12 seats as Coalition support drops and its vote surges 10 points since May. (Capital Brief)

The ANZ and Culture Amp news signal a corporate shift away from ESG and DEI priorities. (Capital Brief)

Top consulting firms freeze graduate pay and cut junior roles for third consecutive year as AI dismantles the industry's decades-old pyramid model. (FT)

US troops are growing wealth through stocks and crypto as investing reshapes military culture. (WSJ)

A MESSAGE FROM DEEL

AI Is Reshaping Work...Are You Ready?

AI is transforming jobs fast: 66% of companies expect slower entry-level hiring and 91% report roles already shifting. But with 67% investing in AI skills, there’s a path forward. Discover how organisations are adapting and what comes next. Download the full report today.

Trading floor

M&A

Pro Medicus won a $25m deal to provide BayCare with its cloud imaging archive, expanding their existing partnership. (Capital Brief)

A global investor eyed Monash IVF after share price turmoil but was rebuffed. (AFR)

CIMIC sells UGL unit to Sojitz; merger with CPB Contractors speculated but denied. (The Australian)

APA struck a hard-won deal to take 80% of the Brigalow gas plant, securing guaranteed revenue as the ~$1b project moves toward 2028 operation. (Capital Brief)

$100M TPC energy sale risks collapse as Chinese buyer misses FIRB approval. (AFR)

RACQ pauses bank sale amid APRA review; $300 m price expected, buyers sought. (The Australian)

Brookfield’s $4b bid caps a seven-year pursuit of National Storage REIT. (AFR)

HSBC teams with Mistral to accelerate internal generative AI adoption for banking operations. (Capital Brief)

Quadrant Private Equity sells 30m Adore Beauty shares at $1.10, completing its exit. (AFR)

EMR Capital revives USD3b Kestrel coal sale with Indonesian suitor, potential buyers include Adaro or Stanmore backers. (The Australian)

Nvidia takes $2b stake in Synopsys to boost AI chip design and joint initiatives. (Capital Brief)

Goldman Sachs is buying Innovator Capital for USD2b to grow in buffer ETFs and active investing. (WSJ)

Capital Markets

Fremantle Seaweed secured new funding to scale its methane-reducing seaweed and roll out commercial trials. (Capital Brief)

KPMG auditors misused AI on tests, producing flawed work and sparking a scandal. (AFR)

Treasury Wine shares dropped after it flagged a $687m impairment in its US operations due to weaker long-term market outlook. (Capital Brief)

Corporate Travel investors slash stock value after accounting errors; shares remain suspended. (AFR)

NextDC raised FY26 capex by $400m after strong new contract wins increased utilisation and orders. (Capital Brief)

NDIS system chaos leads to serviette invoices, prompting calls for urgent reform. (AFR)

Metcash posted small profit and revenue gains, but underlying profit fell despite early signs of recovery in hardware. (Capital Brief)

Super funds accused of greenwashing as they back fossil fuel expansion. (AFR)

The ASX suffered a three-hour announcements outage but has mostly resolved the issue and resumed publishing. (Capital Brief)

AI investments weigh on profits of Australian tech firms, including Deputy. (AFR)

AUB shares sank after EQT and CVC pulled their $45-per-share takeover bid. (Capital Brief)

Fortescue rolled out its first big BYD battery in the Pilbara as part of its large-scale shift to renewable-powered operations. (Capital Brief)

APA joins CS Energy in $1b Brigalow gas plant, first new Queensland gas power in 10+ years. (AFR)

CEFC backs Plico with $35m to grow its virtual power plant services for households. (Capital Brief)

Cochlear-backed biotech Epiminder successfully debuted on the ASX despite recent market outages and disruptions. (AFR)

Centuria shares rise after buying Arrow Funds Management and its $444m agri-portfolio. (Capital Brief)

Hawke’s XPA hits Aldi at $13.99 to boost sales during tough year. (Smart Company)

Cuscal shares dip after closing $75m Indue deal, despite expected cost synergies and earnings growth. (Capital Brief)

Companies are scaling back on DEI and ESG, highlighted by ANZ cuts and Culture Amp challenges. (Capital Brief)

Australia’s GDP set to hit three-year high as rate hikes debated. (Bloomberg)

Strategy Inc shares plunge as investors looked past its new USD1.4b reserve and focused on possible Bitcoin sales. (Bloomberg)

VC

SecondQuarter Ventures raises third fund to back top-tier venture startups amid $4b market demand. (Capital Brief)

Telehealth startup Eucalyptus revenue jumps to $250m on rising UK and Australian demand for weight-loss drugs. (AFR)

People moves

Bruce Mathieson Jr named Star Entertainment chair after equity conversion boosts his stake. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler