- Letter of Intent

- Posts

- ☕️SPY bears

☕️SPY bears

Short sellers mint US$159b as stocks plummet.

Good morning.

Despite the wall of red that seems to intensify with every new trading session (with the US and China now seemingly in a race to the bottom), some of the more cynical shrewd operators have been netting eyewatering gains.

Short sellers have accumulated a whopping US$159 billion ($265 billion) in paper profits in just over six trading days. Traders wagering that the ETF that tracks the S&P 500 Index, known as SPY, would fall, have so far accumulated paper profits of more than US$6.1 billion this month, Bloomberg reports. April’s most profitable shorts coming in from SPY, Apple, Nvidia and Tesla.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

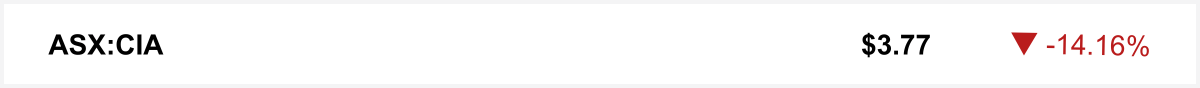

Another volatile day saw the ASX tumble 1.8% Wednesday on Trump’s tariffs, with Champion Iron the biggest loser, sliding 14.2% amid a broad commodities selloff.

📍 Get the latest from the trail. Political Capital now lands every weekday during the campaign. Join Capital Brief chief political correspondent Anthony Galloway, alongside Jennifer Duke and Finn McHugh as they deliver actionable news from the campaign trail.

Sign up to Political Capital here →

(Receiving the newsletter is free; full access is just for paid subscribers.)

The quick sync

As Tom King writes, Trump’s energy rollback is rattling markets, but clean tech’s global momentum is proving hard to kill. (Capital Brief)

Australian banks stay the course on net zero despite global political pushback, but face growing scrutiny over Scope 3 emissions and financed climate risk. (Capital Brief)

CoStar’s $2.8b Domain bid remains unaffected by a capital structure review following pressure from hedge funds Third Point and D.E. Shaw. (Capital Brief)

Atlassian is giving away its AI to prove a point: AI will deepen, not diminish, demand for engineers. (Capital Brief)

A MESSAGE FROM GOVERNANCE INSTITUTE OF AUSTRALIA

Join industry leaders at the 2025 Governance & Risk Management Forum

Connect with governance, risk and compliance leaders at the 2025 Governance and Risk Management Forum. Explore critical issues shaping today’s boardrooms, from regulatory change to AI and ESG. Gain practical insights, hear from expert speakers and strengthen your impact in an evolving governance landscape.

Trading floor

M&A

TPG has acquired a majority stake in home care provider Five Good Friends, joining its co-founders, while EQT retains a minority interest. (Capital Brief)

Peabody Energy may reconsider its $6b deal for Anglo's Queensland coal mines after a second fire at an underground site in less than a year. (AFR)

Dingo is exploring a deal with a forecasted $16m revenue, enlisting Lazard’s bankers. (AFR)

The ACCC has approved Woolworths’ acquisition of ready meals maker Beak & Johnston, finding it unlikely to harm competition. (Capital Brief)

Quadrant's buyout of Mediaworks could influence Australian media players like Nine Entertainment, which plans to return proceeds from the $2.8b Domain sale to shareholders. (The Australian)

MinRes is under scrutiny for possibly selling its Wodgina lithium operation and considering an equity raise amid significant debt and liquidity concerns. (The Australian)

Mayfly Ventures merges with Oka Studio to target larger corporate innovation projects, expanding its team to 12 staff. (BNA)

Capital Markets

ASX drops 1.7% as Trump's tariffs hit Australian and global markets. (Capital Brief)

Trump has signed executive orders to boost the coal industry, aiming to power AI centres and dismantle Biden-era climate rules, despite coal’s environmental impact. (Capital Brief)

Trump plans to impose tariffs on pharmaceutical imports to push drug companies to relocate production to the US. (Capital Brief)

Markets, including bonds, react to Trump’s tariffs amid fears of inflation and capital flight. (Breaking bonds — Capital Brief)

Economists are pressuring the RBA to deliver an early rate cut in response to global trade turmoil sparked by Trump’s tariff plans. (Capital Brief)

Trump’s tariffs spark global bond selloff, signaling potential shift away from US Treasuries. (Capital Brief)

US defends tariffs on Australia, citing trade imbalances, while Australia condemns the move as damaging. (Capital Brief)

Trump cuts most tariffs to 10% for 90 days, hikes China's to 125%, sparking a surge in US stocks and commodities. (Capital Brief)

Trump's policies may slow clean energy growth in the US, but global forces continue driving the energy transition forward. (Capital Brief)

China imposes 84% tariffs on US goods, deepening market declines and raising recession fears. (Capital Brief)

Chalmers rejects recession fears, defends Australia’s economic strength amid global trade challenges. (Capital Brief)

Galan Lithium is considering capital raising after rejecting a takeover bid, aiming to continue developing its Argentinian projects. (AFR)

GQG Partners increased its funds under management in March and is repositioning portfolios to reduce risk amid market volatility. (Capital Brief)

Healthscope faces a key deadline on May 18 regarding its $1.4b debt, with Brookfield at odds with HMC Capital. (The Australian)

Metrics paused funding for a Sam Mustaca-led development in Warriewood amid a legal dispute. (AFR)

Liontown starts underground lithium mining at Kathleen Valley. (Capital Brief)

Tanarra Capital, led by John Wylie, invests in Endeavour amid leadership uncertainty and a business review. (AFR)

Lendlease is facing unrest from its institutional investment clients, with some seeking legal advice to move their funds due to poor performance and Lendlease’s retreat from international markets. (The Australian)

Miniso Australia faces a winding-up order after two voluntary administrations in five years, with market issues contributing to its collapse. (Smart Company)

Merricks Capital defends private credit as stable during market volatility, with its $1.19b fund returning 8.1% in 2024 despite real estate corrections. (Capital Brief)

Fed officials warn of rising stagflation risks as Trump’s tariffs stoke inflation fears and cloud the 2025 economic outlook. (Bloomberg)

Goldman Sachs U-turned on its recession call after Trump blinked on tariffs, but markets and economists aren’t buying the all-clear. (Bloomberg)

VC

None

People moves

Point72 hires Jay Ditmarsch from Carlyle Credit to lead a new strategy, marking a significant move for the hedge fund. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler