- Letter of Intent

- Posts

- ☕️Spill the Tea

☕️Spill the Tea

CSL faces shareholder reckoning at AGM after $40b rout.

Good morning.

Tea won’t be the only thing spilled this week, where biotech giant CSL faces the serious prospect of a rebuke from shareholders at its AGM after a torrid year which has seen almost $40 billion wiped from its market value.

Influential proxy advisory firm CGI Glass Lewis earlier in October specifically called out CSL chief executive Paul McKenzie for selling millions of dollars’ worth of shares in the biotech, and recommended shareholders hit the board with a second strike against its remuneration report.

“Significant shareholder losses in FY2025 have revealed a disconnect between the CSL remuneration structure and shareholder returns,” CGI Glass Lewis said in its proxy paper, seen by Capital Brief.

In a letter responding to the proxy advisor's position, CSL director Megan Clark said the company “strongly disagrees” with its rationale and called the risks posed by a board spill “entirely disproportionate to the perceived shortfalls identified.”

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

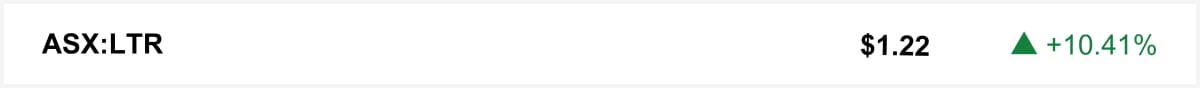

Shares in lithium miner Liontown Resources jumped over 10% on Friday, amid a strong rally across the critical minerals sector. There were also sharp rises for Pilbara Minerals, IGO and Mineral Resources, capping off a week where investors chased triple-digit returns as lithium prices rebounded.

🤝 You’re in good company. You’re reading this alongside new readers from HSF, KPMG and A&M. Know someone who should be here? Forward this on. They can sign up here →

The quick sync

Optus began removing staff perks and vacating one of six buildings at its Sydney campus as part of a broader cost cutting drive. (Capital Brief)

Nine faces second strike threat as proxy criticises CEO’s pay rise. (Capital Brief)

Lithium producers IGO and Pilbara Minerals say a price floor won’t shield Australia from global oversupply. (Capital Brief)

Fund managers have criticised Macquarie’s decision to cut 243 funds from its super platform. (Capital Brief)

As hackers grow bolder and AI supercharges scams, Australians are on a digital frontline that demands stronger everyday defences, Raff Ciccone. (Capital Brief)

A MESSAGE FROM HSBC

Ready to scale globally?

Our reach across the global innovation ecosystem can open new opportunities – connecting your ambition with what’s next. Find out more.

Trading floor

M&A

Kennards and BlackRock lead bids for Blackstone’s $200m WA self-storage assets as it shifts focus to higher-yield US markets. (The Australian)

UBS will relaunch the $1b Scottish Pacific sale next year, with Warburg Pincus possibly returning as a bidder after earlier price disputes. (The Australian)

BayWa launches sale of Australian renewable assets; Macquarie Capital appointed, Igneo interested. (AFR)

NAB hires Macquarie to pursue HSBC’s Australian retail banking arm amid integration and competition concerns. (The Australian)

GIC may block APG’s $2b Transgrid bid by exercising its rights to buy ADIA’s 20 per cent stake. (The Australian)

Novartis to buy Avidity Biosciences for USD12b. (FT)

Capital Markets

Bill Gates and local investors back ENA Respiratory’s $34m raise for nasal spray trials. (AFR)

Ivanhoe Atlantic plans $300m ASX float, stressing US ties amid China tensions. (AFR)

CSL investors set to rebuke CEO Paul McKenzie over major share sales after $40b loss. (Capital Brief)

Jetstar fills Virgin’s long-haul gap, boosting Qantas but squeezing travel agency margins. (AFR)

Stannards doubles staff, targets $100m revenue amid PE-backed growth push. (AFR)

Optus cuts perks and plans Sydney campus sublease to slash costs under Singtel pressure. (Capital Brief)

PwC pilots $1.5b AI audit platform to outpace Big Four rivals. (AFR)

Anteris raises $38.5m in oversubscribed placement backed by L1 Capital. (AFR)

All eyes on Wednesday’s inflation print as the RBA weighs a rate cut or hold for Melbourne Cup Day. (Capital Brief)

Grindr shareholders offer to take dating app private for USD3.46b. (Reuters)

Citi opens Riyadh HQ as Wall Street CEOs forge deeper Saudi ties. (Bloomberg)

Private credit titans eye opportunity in Saudi liquidity squeeze. (Bloomberg)

VC

None

People moves

☝️ Know about a deal or people move we don’t? Hit reply.