- Letter of Intent

- Posts

- ☕️ Sh*t-ass Returns

☕️ Sh*t-ass Returns

Fundie Geoff Wilson accuses L1 Group of 'stealing money' due to Platinum LIC fee hike.

Good morning.

Prominent fund manager Geoff Wilson has accused L1 Capital of "stealing money from shareholders" after it proposed to change the management fees of one of Platinum Asset Management's listed investment companies.

“If L1 eventually does get in as manager, one day, they'll be paying a 20% performance fee on zero. And currently they've got a credit of $315 million underperformance at 15% per annum. So the shareholders are 35% worse off,” Wilson opined to Capital Brief.

When asked by Wilson during the EGM on whether he supported the change in fees, elected independent director David Gray said the more important factor is investment performance: “It's not much point having low fees if you have sh*t-ass returns.”

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

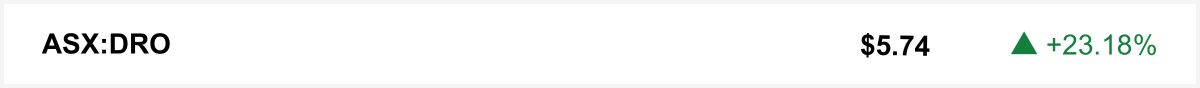

Shares in DroneShield soared over 23% Wednesday, fuelling a blistering rally that has lifted the stock more than 50% in a week on hopes Europe’s ‘drone wall’ will spark fresh defence spending.

The quick sync

Short-term pay breeds short-term thinking and only decade-long founder-style incentives will push Australian companies onto the world stage, writes Lawrence Lam. (Capital Brief)

The Allan government received a review into Breakthrough Victoria, the state’s $2b innovation fund, fuelling speculation it may no longer make further investments. (Capital Brief)

ANZ is shutting down 1835i, cutting staff and moving its startup investments in-house, amid a broader cost-cutting push. (Capital Brief)

IFM Investors to wind down PE division despite strong returns, cannot scale the strategy enough to remain viable within the $4.3 trillion super system. (AFR)

The Seven West-Southern Cross merger draws ASIC deeper into concerns the ASX’s listing rules are out of step with major markets. (AFR)

A MESSAGE FROM AIRBNB

Airbnb contributes estimated $20 billion to Australia’s GDP

New Oxford Economics research found Airbnb contributed an estimated $20 billion to Australia’s GDP in 2024, with 107,000 jobs supported. Guest spending reached $16b, much of it outside capital cities, with 33% of accommodation spend being regional. The figures underscore the platform’s role in tourism dispersal & community-level economic activity. Read more.

Trading floor

M&A

Ridley buys Incitec Pivot fertiliser distribution business for $300m. (Capital Brief)

Private equity firms circle NIB’s $200m travel insurance sale. (The Australian)

Southern Launch signs deal with Varda for 20 spacecraft re-entries at Koonibba through 2028. (Capital Brief)

Glencore is assessing BHP’s WA nickel assets for potential acquisition. (AFR)

Geoff Wilson lost his bid to control Platinum Capital’s board, with L1 Capital’s nominees winning. (Capital Brief)

Bain Capital flagged as a possible future buyer of Healius, with Tanarra Capital key to any deal. (The Australian)

Prime Creative Media bought Money Management and four other finance titles. (AFR)

OpenAI teamed up with Samsung and SK Hynix to boost AI chip supply and data centres in Korea. (Capital Brief)

Exxon weighs sale of New Zealand fuel assets, drawing interest from Australian buyers. (The Australian)

The Southern Cross–Seven merger sparked criticism that ASX rules lag global standards. (AFR)

Capital Markets

New Zealand power companies Meridian, Contact, and Mercury support reforms to boost supply, security, and market efficiency. (Capital Brief)

Eagers halts trading ahead of acquisition and equity raise. (Capital Brief)

Tuas raises $75m from shareholders to help buy M1. (Capital Brief)

Saluda Medical plans a $1b ASX IPO in November to fund US expansion. (AFR)

Brambles leverages AI to improve pallet efficiency and reduce resource use across 60 countries. (Capital Brief)

Pilbara Minerals, Liontown, and other lithium miners fell as China approved CATL and Gotion High-Tech mine reserves, boosting potential supply. (Capital Brief)

Cochlear-backed Epiminder is planning a $100m+ ASX IPO after US approval. (AFR)

Quinbrook has launched the first stage of its Supernode battery in Queensland, aiming to expand capacity to 780 MW and beyond. (Capital Brief)

Austal shares rose after cutting its US Navy T-ATS contract from five ships to three. (Capital Brief)

SwarmFarm Robotics raised $30m from QIC and CEFC to grow its farm robot business. (AFR)

Westgold shares jumped on a plan to boost gold output from 326,000 to 470,000 ounces by FY28. (Capital Brief)

BHP shares dipped after China halted new cargo purchases, seen as a negotiation move. (Capital Brief)

IFM Investors is winding down its private equity arm as super funds shift offshore. (AFR)

DroneShield shares surged on EU talks of a “drone wall” for defence. (Capital Brief)

Rio Tinto signalled Gladstone Power Station could shut in 2029, six years early. (Capital Brief)

US manufacturing shrank again in September as orders and jobs weakened. (Capital Brief)

Gary Weiss is firing off terse letters at Webjet, attacking its judgment and demanding board seats in his latest round of suit warfare. (AFR)

VC

Breakthrough Victoria’s future is uncertain as the government reviews the $2b fund. (Capital Brief)

NRMA gave $100k grants to five climate-tech startups under its $1m Help Fund. (Startup Daily)

ANZ is shutting its VC arm 1835i after $500m in startup investments. (Capital Brief)

Lift Women, a crowdfunding platform for women-led startups, raises $1.3m to back women entrepreneurs. (Smart Company)

People moves

GDG adds Shenaz Waples to board; Bessemer to retire. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler