- Letter of Intent

- Posts

- ☕️Seminal Slugfest

☕️Seminal Slugfest

The Mayne Pharma v Cosette battle was a formative experience for G+T partners.

Good morning.

The Mayne Pharma v Cosette battle was a formative matter for G+T partners.

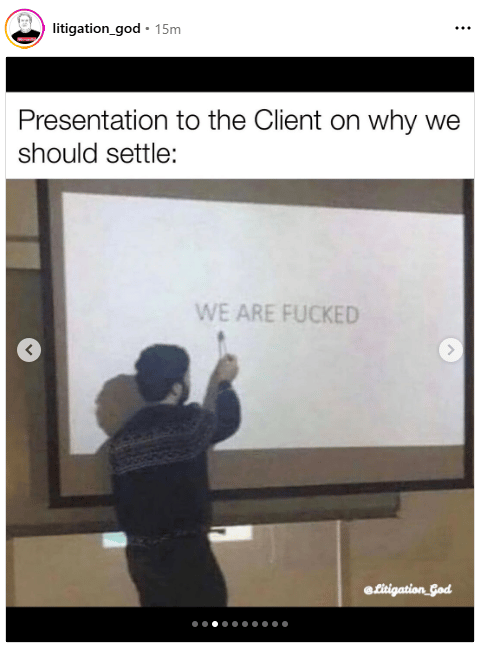

The Mayne Pharma and Cosette Pharmaceuticals battle that played out across the NSW Supreme Court during September to October was more than ‘just a matter’ to the litigators running the proceedings.

“It’s our Musk v Twitter,” Gilbert + Tobin litigation partner Alex Whitby gushed to Capital Brief.

An email sent by Cosette’s legal team late on a Saturday night in May set off a legal slugfest that was settled on 15 October, when Justice Ashley Black of the NSW Supreme Court rejected Cosette's Material Adverse Change (MAC) claim and affirmed the scheme of implementation deed, forcing Cosette to follow through with its buyout of Mayne.

This intro has been updated to note that G+T partner Alex Whitby made the comment, not Adam Laura.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in oil and gas explorer Karoon Energy jumped on Thursday, leading the ASX 200 after the company posted a rise in third-quarter revenue despite lower production. The lift was driven by higher realised oil prices, with revenue up 3%, even as output fell 12% and sales volumes slipped due to shipment timing.

🗓️ Join Capital Brief and the Tech Council of Australia for an exclusive breakfast at Parliament House on Digital Regulation After the Economic Reform Roundtable on Wednesday, 29th October.

With a keynote by the Hon Dr Daniel Mulino MP, Assistant Treasurer and Minister for Financial Services and hosted by John McDuling, Capital Brief editor-in-chief, the event will bring together senior business leaders, policymakers and economists to explore the next phase of Australia's competition and productivity reform agenda.

If you’d like to be part of the discussion, register your interest.

The quick sync

Proxy advisors are increasing pressure on ASX-listed companies over directors with past ties to their external auditor, as new board member and former PwC partner Anne Loveridge faced a protest vote at the ASX AGM. (Capital Brief)

Australia is on track to be 1.3m tech workers short by 2030, and closing the gap depends on getting more women into tech, writes Carolyn Breeze. (Capital Brief)

ASX’s David Clarke says testing of the CHESS replacement is progressing without red flags, after a year marked by outages, a $250m write-down and regulatory investigations. (Capital Brief)

As with ATMs and digital systems, AI in banking is expected to shift roles rather than eliminate them, writes Jonathan Tanner.(Capital Brief)

Blackstone says era of bumper private credit returns has ended. (FT)

A MESSAGE FROM VANTA

Scaling a company? Don’t SOC-block your best engineer.

You need compliance to sign deals. But you also need your engineers to build your product, instead of worrying about pulling compliance evidence. Enter a third option: make Vanta your first security hire.

Vanta uses AI and automation to get you compliant fast, simplify your audit process, and unblock deals — so you can signal to customers that you take security seriously.

Plus, Vanta scales right along with you, backed by startup-speed support every step of the way, so you're not stuck ripping out one of those check-the-box solutions later...and rebuilding your whole program under pressure.

That's why top startups like Instant, Everlab, and File.ai use Vanta to get secure early.

Don’t SOC-block your best engineer. Set them free with Vanta.

Trading floor

M&A

Woodside sold stakes in its US LNG project to Williams for $378m. (Capital Brief)

Lendlease’s Keyton sale stalls as top bidders pull out. (AFR)

BHP launches sale process for nickel assets via virtual data room. (The Australian)

Regis Healthcare buys two Victorian aged care homes for $45m, expanding its portfolio. (Capital Brief)

Premier Foods eyes KKR’s Arnott’s meals unit for Australian expansion. (The Australian)

Superannuation software platform Grow is being put up for sale with expectations of fetching $250m or more. (AFR)

Quadrant delays My Muscle Chef sale to maximize value. (The Australian)

Lawyers, including Gilbert + Tobin’s Alex Whitby, salvaged Mayne Pharma’s $615m takeover by Cosette. (Capital Brief)

Allianz leads $100m+ bid for NIB’s travel insurance unit. (AFR)

Capital Markets

Tesla hit record revenue but lower profit from higher costs led to a share dip. (Capital Brief)

Challenger Gold raises $25m amid gold sector surge. (AFR)

IAG lifted its outlook after acquiring RACQ Insurance for $855m. (Capital Brief)

Northern Minerals launches $60m raise for rare earths projects. (AFR)

Super Retail sales rose 4.5%, driven by Macpac and Supercheap Auto. (Capital Brief)

Coronado’s Buchanan mine collapse sparks share drop and sale uncertainty. (The Australian)

Bapcor shareholders support Angus McKay amid board spill attempt. (AFR)

Fortescue posts record Q1 iron ore shipments, maintains full-year guidance. (Capital Brief)

Trion Battery Technologies is preparing for its ASX IPO by arranging investor meetings through lead manager Canaccord Genuity. (AFR)

Karoon Energy lifts Q3 revenue on higher oil prices despite lower output. (Capital Brief)

RBA launches new Searchers Index to improve labour market measurement. (Capital Brief)

Rex’s US owner to operate Saab 340s for 15 more years. (AFR)

BHP shares drop as CEO calls for faster investment reforms. (Capital Brief)

Takeovers Panel warns it will punish disruptive or uncooperative parties. (AFR)

Origin Energy suffers data breach affecting 700 customers. (Capital Brief)

Aldi Australia posts $13.3b sales, pays $500m dividend. (AFR)

ASX AGM quiet as chair defends CHESS progress amid past issues. (Capital Brief)

Inpex underreports emissions and confirms 36,000L oil spill near Darwin. (Capital Brief)

Blackstone profits surged 48% as dealmaking rebounded and assets hit a record USD1.24t. (Capital Brief)

T-Mobile lifts 2025 forecast after adding 1 million subscribers and completing US Cellular acquisition. (Capital Brief)

Super Micro shares drop after Q1 revenue cut on delayed AI server shipments. (Capital Brief)

ASX directors face scrutiny over ex–Big Four audit ties amid conflict-of-interest concerns. (Capital Brief)

White House releases donor list for Trump ballroom amid East Wing demolition. (The Hill)

Santos investors are livid after private briefings failed to explain CFO Sherry Duhe’s sudden departure, which she linked to tensions with CEO Kevin Gallagher.(AFR)

Viva Energy cannot confirm that Russian crude refined in India isn’t powering Australian military equipment, despite a $450m Defence fuel contract. (AFR)

Trump administration in talks to take equity stakes in quantum-computing firms. (WSJ)

VC

Kaggle founders raise $59m for new startup Sumble. (Capital Brief)

Accounting start-up Squeeze Group raises $12m to fund acquisitions. (AFR)

People moves

South32 chair Karen Wood will retire in 2026, with Stephen Pearce named her successor. (Capital Brief)

Morgan Stanley hires senior staff from Bank of America. (AFR)

Optus CFO Michael Venter and CIO Mark Potter will depart in 2026, following triple-zero failures. (Capital Brief)

Trump pardons Binance founder Changpeng Zhao, ending Biden-era crypto crackdown. (Capital Brief)

Australia risks a 1.3 million tech worker shortfall by 2030 unless more women enter the industry. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler