- Letter of Intent

- Posts

- ☕️S(AI)do Maasochists

☕️S(AI)do Maasochists

Market baulks at Maas Group’s radical AI pivot.

Good morning.

The unusual step taken by industrial conglomerate Maas Group to agree to a billion-dollar sale of its core construction materials business without using any financial advisers as part of a radical pivot into AI infrastructure, perhaps unsurprisingly, prompted shares in the ASX small cap to plummet nearly 25% on Thursday.

But despite the brutal market response, one of Maas' biggest investors Wilson Asset Management has backed the moves, confidently telling Capital Brief that management has made the right call.

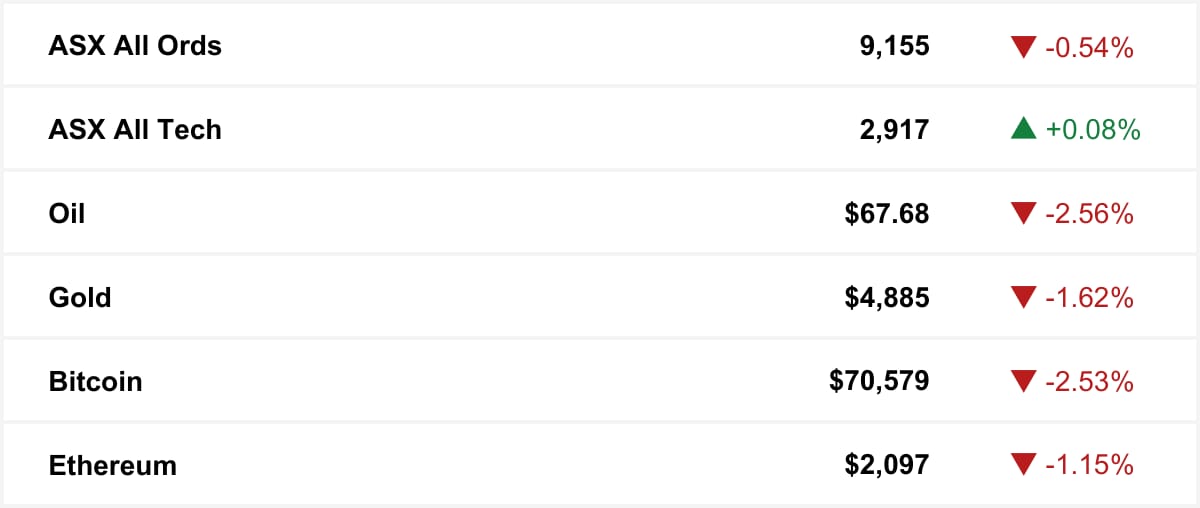

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

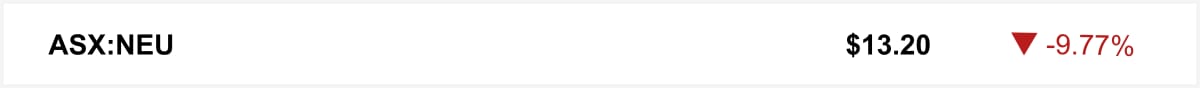

Shares in Neuren Pharmaceuticals fell almost 10% Thursday after the company disclosed it had received only written feedback from the US Food and Drug Administration on its NNZ-2591 treatment for rare neurological disorders, disappointing investors looking for stronger regulatory signals.

The quick sync

Trump’s critical minerals push killed Ivanhoe’s $300m ASX float but may drive future listings. (Capital Brief)

The High Court will rule on whether Bitcoin counts as property that can be possessed. (Capital Brief)

With Sarah Court leading ASIC from June, a tougher enforcement agenda looms as the government decides who will back her as deputy. (Capital Brief)

Canberra dampens EU trade deal hype, as real progress hinges on unresolved agricultural barriers. (Capital Brief)(Capital Brief)

Anthropic releases new AI model that’s adept at financial research. (Bloomberg)(Reuters)

Anthropic takes aim at OpenAI’s ChatGPT in Super Bowl ad debut. (WSJ)

A MESSAGE FROM MERGERLOOP

New ACCC merger notifications show who’s buying

Australia’s merger reforms have made M&A activity more visible, with the ACCC now publishing the key parties, structure and details from deal notifications.

MergerLoop distils the latest deals into a no-noise weekly digest. See who’s active, what’s being notified, and where capital is moving.

Free to subscribe. 1 email a week. Get the next digest.

Trading floor

M&A

Regal Partners announces a $75m buyback to return capital and signal confidence. (Capital Brief)

Rio Tinto abandons USD260b Glencore merger over valuation disputes. (Capital Brief)

KKR to buy sports investment group Arctos for USD1.4b. (FT)

Capital Markets

Alphabet beat expectations on revenue as AI growth accelerates, backing it with far higher-than-expected AI investment. (Capital Brief)

Horizon Nexus launches with Big Four veterans to compete in professional services. (AFR)

Qualcomm stock slid after a soft outlook spooked investors, overshadowing modest revenue growth. (Capital Brief)

UBS posts $1.2b profit as investment banking rebounds. (The Australian)

Maas stock sank as investors reacted negatively to a major asset sale and AI-focused reinvestment. (Capital Brief) (Capital Brief)

CoStar preps Domain for REA fight, hiring 125 photographers and eyeing price cuts. (AFR)

Arm stock slid as its outlook failed to impress an AI-hyped market. (Capital Brief)

Insurers profit from inflation, sparking M&A talk; Suncorp eyed in Australia. (The Australian)

Beach Energy slid after floods and lower prices hit profits. (Capital Brief)

KKR backs HMC Capital’s green push with $600m investment. (AFR)

APRA partly lifts liquidity requirements on Macquarie as controls improve. (Capital Brief)

Koala Furniture IPO hit by sell-off in small-cap industrials. (The Australian)

Neuren slid as FDA feedback raised additional study requirements. (Capital Brief)

Australia-EU free trade deal “not done yet,” says Trade Minister Farrell. (Capital Brief)

OpenAI launches Frontier to coordinate AI agents for business tasks. (AFR)

CBA plans AI limits for customers and sets strict internal AI safety rules. (Capital Brief)

New Australian retail council targets Temu and Shein over compliance. (Smart Company)

Resolute Mining wins long-term permit for Côte d’Ivoire gold project. (Capital Brief)

Healthscope lenders back plan to become not-for-profit, keeping 32 hospitals open. (AFR) (The Australian)

Australia’s trade surplus rises $776m in December on higher iron ore exports. (Capital Brief)

Ardea Resources wins $1b funding for nickel-cobalt project from US and Australia. (AFR)

High Court to decide if cryptocurrency counts as property in Bitcoin dispute. (Capital Brief)

Ivanhoe scraps ASX float, shifts to US listing tied to Trump’s minerals plan. (Capital Brief)

OpenAI unveils platform to help companies deploy ‘AI coworkers’ (Bloomberg)(Axios)(WSJ)

Bitcoin drops below USD70,000, wiping out gain since Trump’s win. (Bloomberg)

How Anthropic achieved AI coding breakthroughs — and rattled business. (FT)

Anthropic releases new AI model that’s adept at financial research. (Bloomberg)

Top Goldman Sachs lawyer referenced Jeffrey Epstein’s ‘Russians’ in email. (FT)

Epstein fallout hits British pound. (WSJ)

Private capital giants warn AI risks could slow growth. (FT)

Barrick to spin off North American gold assets through IPO. (Bloomberg)

VC

Sydney startup Advanced Navigation clears US Army GPS-jamming test. (Startup Daily)

Perth-based mining software startup CorePlan raises $5m to grow mining software operations globally. (Startup Daily)

People moves

Stone & Chalk’s CEO Chris Kirk will step down after 10 years, triggering a leadership transition. (Capital Brief)

Citi hires Kriss Pachauri from Houlihan Lokey as director in ANZ asset management deals. (AFR)

Ivanhoe Atlantic is being sued by former CEO Bronwyn Barnes for unfair dismissal, seeking damages and legal costs. (AFR)

Elders names ex-Fonterra executive René Dedoncker as incoming CEO. (Capital Brief)

Lance Rosenberg appears at scandal-hit TerraCom. (AFR)

A&O Shearman poaches Clayton James from Herbert Smith Freehills to boost private equity practice. (AFR)

Viva Energy names Teresa Rendo as new CEO of convenience and mobility. (Capital Brief)

Argonaut hires ex-Citi vice chairman Jon Gidney as strategic adviser. (AFR)

Paul Weiss chair Brad Karp resigns amid Epstein email controversy. (AFR)

US January layoffs hit 108,000, the highest since 2009. (Capital Brief)(FT)

Ainsworth execs got $15m secret bonuses after Novomatic stake sale. (AFR)

Gemini cuts 200 jobs, exits UK, EU, and Australia to focus on key markets. (Capital Brief)

John Overdeck’s divorce and co-founder dispute are converging, creating new risks for the stability and secrecy of Two Sigma. (Bloomberg)

HSBC is cutting bonuses and culling staff in a hard-edged overhaul under CEO Georges Elhedery. (Bloomberg)

Brad Karp quits as Paul Weiss chairman after Epstein emails expose social ties and job-seeking requests. (CNN)(FT)(WSJ)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler