- Letter of Intent

- Posts

- ☕ OneVentures arsenal

☕ OneVentures arsenal

VC stalwart launches $200m fund for tech hunt

Good morning.

VC stalwart OneVentures is launching its 7th fund with managing director Michelle Deaker telling Capital Brief’s Brownen Clune the ambition is to have a $200m war chest for investments in later-stage tech firms with a particular focus on those with annual revenues between $5m and $15m.

Deaker, a founding partner, expects plenty of growth gems for Fund VII, particularly as valuations cool from their frothy highs.

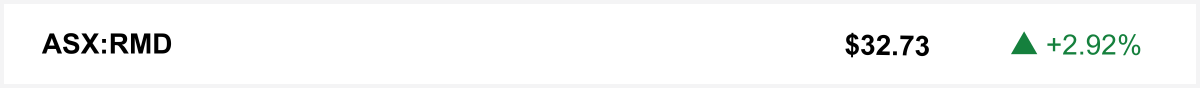

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

In a bloodbath day like yesterday’s, medical equipment maker ResMed emerged as the island of serenity in a sea of chaos. Shares defied the gloom, even if momentarily, rising a very respectable 2.92%, as analysts at Morgans, Macquarie and Citi raised target prices.

The quick sync

Wall Street plunged on Monday amid fears the US economy is deteriorating rapidly. The panic was contained, with markets paring back losses after US July service sector activity data exceeded expectations. (Capital Brief)

Ready of not, ASX 200 companies will be hit with Treasury’s mandatory climate reporting in less than 5 months’ time. Boral, Origin and Transurban are among those lacking 'ambition and rigour' on climate reporting. (Capital Brief)

Tech unicorn SafetyCulture is hunting for a new C-suite exec to take charge of the $2.7b-valued workplace compliance and safety software maker’s AI program, with a multimillion-dollar comp deal on offer. (AFR)

Universities and colleges will be limited to a maximum of 40% of students from overseas from 2025, with the caps to be in place for two years and the numbers based on 2019 figures. (AFR)

Kain Lawyers Managing director John Kain explains the appeal of mid-market transactions and the challenges new merger laws present for public companies in competitive bidding. (Capital Brief)

Trading floor

M&A

TPG Group is reviewing options for selling its fixed network, with discussions with Vocus ongoing but no deal guaranteed. (Capital Brief)

Jefferies bankers, led by Michael Stock, are advising Abu Dhabi’s AI firm MGX and tech investor Silver Lake. (AFR)

EnergyX has bid $US150m to acquire Galan Lithium's Argentinian projects, including leases in the lithium-rich Salar del Hombre Muerto region. (AFR)

Mars is in advanced talks to buy Kellanova, valued at around $46.3bn, in a major food and beverage deal that could face regulatory scrutiny. (Capital Brief)

Superhero will acquire MYOB’s Slate Super, boosting its superannuation assets to over $1.5bn and member count to 100,000-plus. (AFR)

Regis Resources is considering a joint venture for its McPhillamys gold project to mitigate risk and ensure shareholder value. (The Australian)

Woodside Energy will spend $3.7bn on a gas-based ammonia project in Texas, its largest lower-carbon energy investment, raising market concerns about shareholder returns. (AFR)

Centuria Capital is buying a 50% stake in ResetData for $21m. (Capital Brief)

Macquarie will pay $816m for a South Korean data center, while planning to sell its AirTrunk stake for $15bn. (AFR)

Capital Markets

Art Money paused operations due to financial struggles and is now seeking $5m in emergency funding, with backing from family offices and partners. (AFR)

The Queensland Critical Minerals Fund will invest up to $5m in Velox Energy Materials to support the North Queensland Vanadium Project, boosting global vanadium supply and battery storage. (Capital Brief)

Rubicon Water is raising $18m through a discounted share placement and share purchase plan, with chairman Gordon Dickinson contributing $5.5m. (AFR)

Bellevue Gold CEO Darren Stralow defended the $150m capital raise, stating it was not driven by lender pressure but was essential for the Bellevue Gold project. (The Australian)

VC

Hopstep, a SaaS platform for aged care recruitment, is raising $3m in seed capital. (AFR)

Graceview, a legal AI startup, raised $1.5m for international expansion, led by Patrick Linton. (Startup Daily)

Melbourne startup Eyeonic raised $2.6m in an oversubscribed seed round to advance its AI-driven home glaucoma testing technology for laptops and tablets. (Smart Company)

People moves

Rothschild & Co has hired Alex Cartel, formerly Citi’s head of investment banking for Australia and New Zealand, to lead its global advisory in Australia. (AFR)

LGT Crestone has appointed Escala founders Steve Collins and Mason Allamby as partners to enhance its services for high-net-worth clients and family offices. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

Together with Power Writing

This isn’t your typical course. We’re not your typical instructors. That’s why you should read on.

Power Writing was created by Kal & Christopher...

Kal is a former Macquarie banker who started and sold Letter of Intent (yes, this very newsletter).

Christopher is a former McKinsey partner and COO who took a startup from 0 to a $3bn IPO in 5 years.

In other words, we aren’t professors. We’ve seen firsthand the huge impact your writing can have on your professional performance. It sounds obvious, yet no one ever teaches you to write for work. We're changing that.

Don’t let those writing habits from your uni days — big words, long sentences, dense paragraphs with no formatting, conclusions at the end — hold you back at work. Learn the techniques to be concise and precise so your work gets recognised and you get promoted.

Use the code LOI50 to get $50 off + you can typically expense the course to that L&D allowance you never touch.

Level up and write like an elite professional. Learn more here.

The watercooler