- Letter of Intent

- Posts

- ☕️No(r)way, Jose

☕️No(r)way, Jose

Norway's $2t sovereign fund joins James Hardie shareholder revolt.

Good morning.

Norges says nei, slett ikke.

Norges Bank, which manages the world's largest sovereign wealth fund, will oppose the election of five James Hardie directors and will vote against its remuneration report at the ASX-listed building materials company's AGM this Thursday.

The scandi bank said it would oppose the re-election of chair Anne Lloyd and all but one company director up for election this week, joining a flock of irate proxy advisers and institutional investors, Capital Brief reports.

"Shareholders should have the right to seek changes to the board when it does not act in their best interest," Norges, which owned 1.35% of James Hardie before the merger, said in guidance.

James Hardie announced a heavily criticised plan to merge with US decking firm Azek - a move that has wiped $6 billion from its market cap and would see it move its primary listing from the ASX to the US.

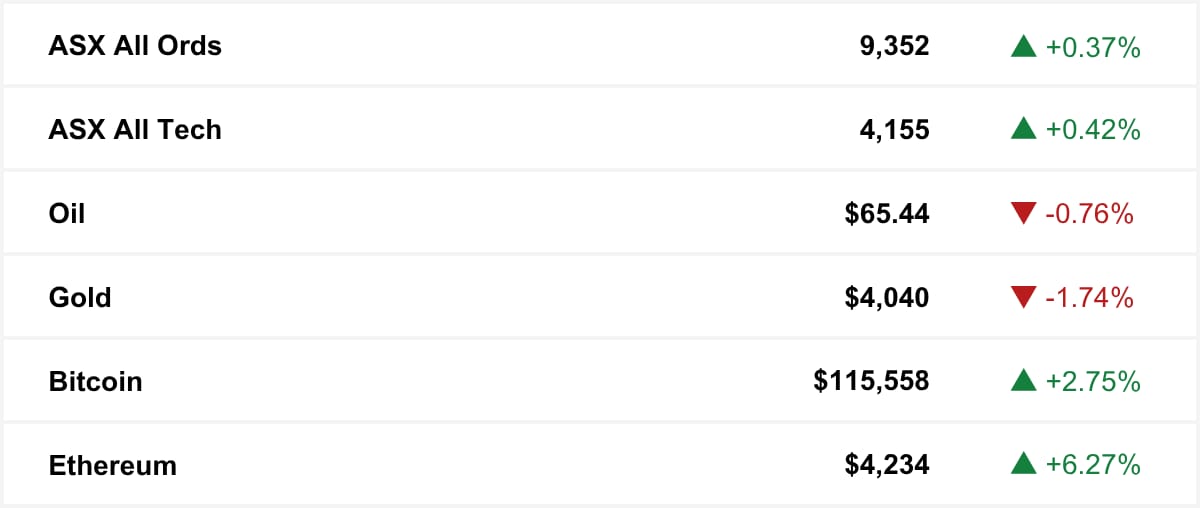

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in insurance broker AUB Group surged over 12% on Monday before entering a trading halt, after The Australian Financial Review reported the company is in advanced talks with EQT after the Swedish private equity firm tabled an informal takeover proposal.

🤝 You’re in good company. You’re reading this alongside new readers from HSF, KPMG and A&M. Know someone who should be here? Forward this on. They can sign up here →

The quick sync

Labor will meet with OpenAI, Microsoft and News Corp this week as the government begins new AI copyright talks. (Capital Brief)

The Albanese government’s rejection of an AI copyright exemption has ended one battle but guarantees the fight over how Australia regulates AI is only beginning. (Capital Brief)

Xero has spent $4b on Melio to push into payments and the US market but faces regulatory risk, strategic doubts and a falling share price. (Capital Brief)

US companies strike USD80b in mergers as Trump boosts dealmaking. (FT)

Trian and General Catalyst lodge USD7b bid for Janus Henderson. (FT)(WSJ)

Trading floor

M&A

David Di Pilla’s HMC Capital under pressure as Mario Verrocchi buys $30m in shares. (AFR)

Roc Partners may sell Pace Farm for $1b after strong growth and surging egg demand. (The Australian)

Xero’s $4b Melio deal drives US expansion into payments, despite high risks and competition. (Capital Brief)

Brazilian Rare Earths is tipped as a $665m takeover target after its 2026 scoping study, with US and Australian buyers likely. (The Australian)

Larvotto blocks $723m US takeover bid over undervaluation concerns. (AFR)

Capital Markets

Viva Energy’s Q3 convenience sales fell 12.5% as tobacco and retail fuel demand weakened, but recovery is expected next quarter. (Capital Brief)

Boman-backed Openmarkets seeks $77m for DeFi expansion into Asia and the US. (AFR)

Netwealth seeks government aid after $101m loss from First Guardian fund collapse linked to fraud. (Capital Brief)

PwC probed over misuse of legal privilege and misleading FIRB advice. (AFR)

ACCC sues Microsoft for misleading 2.7m users over hidden cheaper 365 plan after Copilot price hike. (Capital Brief)

AUB Group draws private equity interest after share underperformance. (AFR)

MinRes to get $200m payment from MSIP after hitting Onslow Iron production target. (Capital Brief)

Ramelius shares drop after Q1 gold output and costs miss market expectations. (Capital Brief)

Tabcorp’s turnaround puts CEO Gillon McLachlan in focus for new deals. (AFR)

Albanese unveils $251.5m investments to deepen Australia’s economic engagement with Southeast Asia. (Capital Brief)

Nikkei 225 tops 50,000 for first time on optimism over Japan’s new PM and easing trade tensions. (Capital Brief)

UK fashion brand Never Fully Dressed is seeking an Australian investment partner to support its expansion amid growing sales. (AFR)

Government to mandate public outage registers for telcos after Optus triple zero failure. (Capital Brief)

Norway’s $2t fund joins James Hardie revolt, opposing directors and pay after $6b US merger backlash. (Capital Brief)

Tesla chair warned Musk that he may quit if shareholders reject his USD1t pay deal. (Capital Brief)

Qualcomm unveils AI200 and AI250 chips to rival Nvidia and AMD in data centre market. (Capital Brief)

Jim Chalmers says the super performance test will not be weakened, only limited changes are under review to support long-term asset investment. (AFR)

VC

NRFC invests $10m in Hypersonix to advance hydrogen-powered hypersonic aircraft development. (Capital Brief)

Overnight Success launches angel syndicate with Aussie Angels to back early-stage AI startups. (Startup Daily)

AI startup Maincode invests $30m in Melbourne AI facility using AMD chips for LLM development. (AFR)

Victoria invests $75m via Breakthrough Victoria into five VCs backing climate-tech, life sciences, and female founders. (Startup Daily)

Melbourne biotech ENA Respiratory raised $34m in a Series B round led by Brandon Capital and Uniseed for virus-fighting nasal spray development. (Smart Company)

Sydney startup DDLoop wins 2025 Legal Pitch Night for its AI-powered due diligence platform. (Startup Daily)

People moves

Nuix CEO Jonathan Rubinsztein resigns; John Ruthven named interim replacement. (Capital Brief)

Paul Scurrah named new Fiji Airways CEO. (AFR)

PolyNovo chair David Williams resigns amid bullying probe; Leon Hoare named successor. (Capital Brief)

CalPERS, CalSTRS, and the Florida State Board have voted to oust James Hardie chair Anne Lloyd and two directors over the company’s $14b Azek merger. (AFR)

Bain Capital appoints ex-Blackstone MD Matt Koskinen to lead real estate strategy. (AFR)

Savana names ex-Global X CEO Evan Metcalf executive director, launches new capital raise to grow ETF portfolio. (Capital Brief)

Baker McKenzie has strengthened its partnership by hiring Sarah Birrell as energy partner in Melbourne and Victoria Lanyon as tax partner in Sydney. (AFR)

Zambrero names veteran executive Daryl McCormack as CEO to drive global growth. (Capital Brief)

Westpac restructures business bank; senior leader Shane Howell departs after 20 years. (AFR)

Mark Zuckerberg appoints Vishal Shah to AI team to boost AI efforts. (FT)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler