- Letter of Intent

- Posts

- ☕️Maynetaining Optimism

☕️Maynetaining Optimism

Mayne Pharma shareholders given glimmer of hope that Cosette deal will complete.

Good morning.

The Takeovers Panel ordered Cosette Pharmaceuticals to agree to “any conditions reasonably required” by Treasurer Jim Chalmers with respect to Mayne Pharmaceuticals’ South Australian factory, “including conditions reasonably restraining its closure”.

The US-based private equity-backed suitor has been trying to get out of the deal for months, but its attempts to terminate the deal were blocked by the NSW Supreme Court.

The update provides a glimmer of hope to investors that had resigned to the fact that the deal was “effectively dead”, as the Treasurer now holds a stronger position to back the completion of the sale, given the requirement for Cosette to accept conditions that restrain it from closing the factory.

The Treasurer's office has previously disputed whether it could keep the facility open through conditional approval. The Foreign Investment Review Board is due to release its decision on the takeover today.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

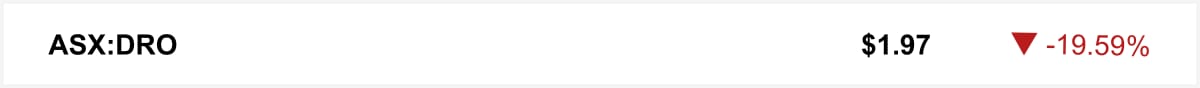

Shares in defence tech company DroneShield collapsed a further 20% Wednesday, after the immediate resignation of its US chief executive Matt McCrann. The sell-off deepened losses from last week, when the company’s CEO, chair and a director sold $66.8 million worth of shares.

🤝 You’re in good company. You’re reading this alongside new readers from Robert Half, CBA and Lendlease. If your colleagues aren’t on board yet, it’s time to change that. They can sign up to LOI here →

The quick sync

Block expands its Bitcoin bet to real-world payments despite volatility and regulation hurdles. (Capital Brief)

Australia has what it takes to lead in climate tech, but still holds itself back, writes Mick Liubinskas. (Capital Brief)

ASIC’s expanding powers and resistance to reform are driving innovation and investment away from Australia’s markets, write Dimitri Burshtein and Peter Swan. (Capital Brief)

India’s Zupee acquires Sydney AI startup Nucanon in rare AI and gaming deal to build interactive storytelling for a global audience.. (Capital Brief)

Paul Twomey warns companies are underestimating cyber threats amid rising attacks and growing boardroom fatigue. (Capital Brief)

Culture Amp is cutting staff to fund AI, showing older unicorns are being forced to adapt or fall behind. (Capital Brief)

Trading floor

M&A

Helloworld’s $353m bid sends Webjet shares soaring despite weaker earnings. (Capital Brief)

Regulator audit puts Sandilands and Jackie O’s $200m KIIS FM deal at risk. (AFR)

Flight Centre denied reaching any deal to buy Iglu, saying talks are ongoing and no agreement exists. (Capital Brief)

Jefferies returns to advise Quadrant on Amart Furniture sale or listing amid wider PE portfolio moves. (The Australian)

Quadrant PE seeks buyer for Fitness & Lifestyle Group, Asia-Pacific gym operator. (AFR)

Elon Musk’s xAI will partner with Nvidia and Humain to build 500MW AI data centre in Saudi Arabia. (Capital Brief)

EQT may drop out of Aidacare auction, leaving Pacific Equity and Warburg Pincus as main bidders; Aidacare makes $424m in sales and $80m EBITDA. (The Australian)

Perseus may bid for Predictive Discovery amid record gold prices. (AFR)

Indian gaming firm Zupee acquires Sydney AI startup Nucanon in rare cross-border exit. (Capital Brief)

Capital Markets

TPG cut its reinvestment plan to $300m amid a Triple Zero incident and market weakness, using the funds to pay down debt. (Capital Brief)

Australian wages grew 3.4% year-on-year to September, led by the public sector, matching expectations. (Capital Brief)

MA Financial locks in $100m cornerstone for $300m private credit IPO. (AFR)

Block is pushing Bitcoin as a mainstream payment system, boosting its Australian presence. (Capital Brief)

KMD Brands’ sales rise, but discounting pressures margins amid turnaround. (AFR)

Vulcan Energy shares dip as Citi cuts stake, despite promising Lionheart drilling results. (Capital Brief)

Carma shares tumble post-IPO, but Canaccord backs its growth in the $118b used-car market. (The Australian)

Lynas shares jump as UBS upgrades to ‘buy’ on strong rare earth prices and expansion prospects. (Capital Brief)

Firmus Technologies seeks billions in debt to fund new AI data centres. (AFR)

ASIC cautions that excessive regulation may hinder growth, despite not causing fewer listings. (Capital Brief)

Ridley shares dip as shareholders oppose MD incentives amid modest business growth. (Capital Brief)

Aldi Australia prioritises private brands to boost profits against Woolworths and Coles. (AFR)

Cosette must keep Mayne’s SA factory open under Takeovers Panel orders and Treasurer conditions. (Capital Brief)

xAI seeks USD15b raise, potentially doubling its valuation to $230b. (Capital Brief) (WSJ)

Meta to block Australian under-16s from social apps under new age-restriction law. (Capital Brief)

US trade deficit falls 24% in August after tariffs cut imports.(Capital Brief)

VC

Kiki Club fined $230k in New York for breaking short-term rental rules. (AFR)

Twelve WA innovators and startups secure $5m from the Innovation Seed Fund 2024-25 to advance health and medical innovations. (Startup Daily)

Australia’s superannuation funds are underinvesting in startups and fast-growth companies due to regulatory barriers, potentially withholding $54b from private equity and venture capital. (AFR)

People moves

Nufarm appointed Rico Christensen as its next CEO and posted a $165m loss, but crop protection earnings and debt levels are improving. (Capital Brief)

Glenn McGrath dropped from ABC Ashes commentary over Bet365 ad conflict. (AFR)

DroneShield shares drop after US CEO Matt McCrann resigns, following major executive share sales. (Capital Brief)

Magellan probes global equities chief Arvid Streimann over alleged employee relationship with a junior employee. (AFR)

REA Group’s CFO Janelle Hopkins will retire in 2026 and be replaced by News Corp executive Andrew Cramer. (Capital Brief)

Star Entertainment cuts 40 senior roles ahead of new ownership takeover. (AFR)

Seek appointed CAR Group co-founder Greg Roebuck as its next chair, effective 2026. (Capital Brief)

Larry Summers quits OpenAI board amid Epstein correspondence revelations. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler