- Letter of Intent

- Posts

- ☕️ M&A pays

☕️ M&A pays

What if accepted wisdom about M&A deals is wrong?

Good morning.

It’s become accepted wisdom in market circles that M&A deals typically don’t work out well for the acquiring company. There are plenty of examples over the years of empire building CEOs and board chairs burning billions on reckless deals, and a commonly cited Harvard study suggests between 70% and 90% of M&A deals ‘fail’.

But what if that conventional wisdom is wrong? The Wall Street Journal had a story on the weekend citing new research which found that since the GFC, the share prices of companies engaging in deals worth more than US$100m outperformed their peers 53% of the time. That’s (slightly) better than even odds 😜!

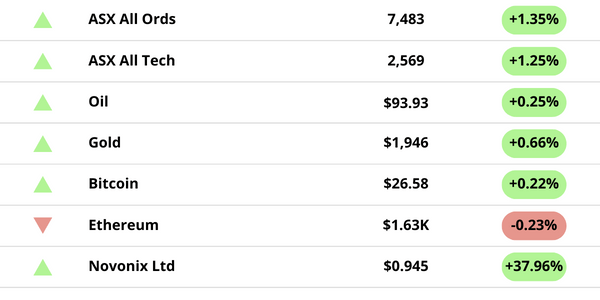

*Stock data as of the market close. Commodities and crypto data in USD.

LOI Subscriber #TBD

MARKET MOVERS

Market News: At the smaller end of the market, shares of lithium-ion battery technology business Novonix caught a bid after the company doubled production targets at its facility in Tennessee. It’s an eye popping move, but the stock has still lost about a third of its value over the past year.

Together with Stake | Invest on Wall St and the ASX

THE QUICK SYNC

Instacart has lifted the indicative price range on its IPO, but is it actually justified? (TechCrunch)

The $19b case for Australia to produce greener airline fuels onshore. (Capital Brief)

Ray Dalio has advised investors to hold cash and avoid bonds. (CNBC)

The rise of electric vehicles is at the centre of the US auto workers strike. (New York Times)

A new book on Elon Musk highlights the perils of access journalism. (The Information)

TRADING FLOOR

M&A:

Paine Schwartz Partners is set to unveil an updated acquisition offer for Costa Group. (AFR)

The sale of Aurora Healthcare may face uncertainty, with its future and timing now in question. (The Australian)

Quadrant has fired up the sale of Barbeques Galore with adviser E&P Financial Group fielding interest from offshore strategic buyers (Capital Brief)

Perpetual's recent reduction in its holdings in ARN Media has reignited discussions about potential consolidation within the broadcasting sector. (The Australian)

Longreach Credit Investors has completed the sale of its exposure to the high-end wristwatch retailer Kennedy to the private credit fund Muzinich & Co. (Capital Brief)

While Bigtincan may have stated that it's still engaged in takeover discussions, the market appears skeptical of this claim. (The Australian)

Grant Thornton takes on the task of facilitating the sale of Nourish Foods. (BNA)

Colinton Partners is initiating a potential $350m exit strategy for Dimeo. (AFR)

Aria has been in discussions to acquire a minority share in Ultra Violette. (AFR)

Ares has entered the VetPartners auction and is gearing up to submit a binding bid, competing with EQT Partners and Affinity Equity Partners. (AFR)

Capital Markets:

Alligator Energy conducted investor meetings last week, which fund managers believe served as a preparatory step for an upcoming equity raising. (AFR)

VC:

Climasens secures a $5m grant from Google.org for their AI-powered climate risk tool. (Smart Company)

EnergyLab, the climate tech accelerator, has selected 13 startups for its latest program, Climate Tech Charge. (Smart Company)

Leigh Dunsford aims to promote wealth creation among Gen Z through his new venture, Nine25. (BNA)

Others:

Perpetual is reportedly in the process of handing out redundancies among support staff, including relationship managers and salespeople. (AFR)

Iluka's CEO, Tom O'Leary, has been working diligently to reassure investors regarding cost overruns at their new refinery. (The Australian)