- Letter of Intent

- Posts

- ☕️ Jingle Deals

☕️ Jingle Deals

Webjet pushes pre-Christmas clarity as takeover contest heats up.

Good morning.

Webjet Group is pushing to bring its takeover battle to a head before Christmas, with a source telling Capital Brief that Webjet wants the tussle between BGH Capital and Helloworld resolved within the next month to reduce uncertainty for shareholders.

Private equity group BGH hiked its bid to 91 cents per share on Friday, edging out a 90-cent offer by Webjet rival Helloworld two days earlier. Webjet’s shares, which last closed at 90.5 cents, have remained roughly flat since BGH’s initial offer of 80 cents per share was rejected in May.

Since then, both BGH and Helloworld have built up blocking stakes in Webjet of 18.3% and 17.27% respectively, limiting each other’s ability to secure control without broader shareholder support.

Due to the accumulated stakes “somebody's probably going to have to force the issue”, the fund manager said. That could mean a joint bid, an asset split, or, perhaps the entry of a third bidder.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

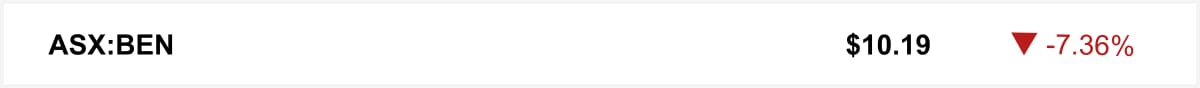

Shares in Bendigo and Adelaide Bank fell 7.4% on Tuesday after the regional lender disclosed a Deloitte review uncovered weaknesses and deficiencies in its approach to managing money laundering and terrorism financing risks. The findings extended beyond one branch and pointed to broader failings across the bank’s systems and oversight.

🤝 You’re in good company. You’re reading this alongside new readers from Corrs, AustralianSuper and Pitcher Partners. Know someone who should be here? Forward this. They can sign up here →

The quick sync

The US is probing Labor’s streaming quotas for free trade breaches as the Albanese government rushes to legislate. (Capital Brief)

Bevan Shields exits the SMH with Jordan Baker set to replace him in early 2026. (Capital Brief)

Australia needs more risk-taking and capital to turn its biotech strengths into global success, writes Arjun Balaji. (Capital Brief)

Property buyers agents are under scrutiny as unlicensed investment advice spreads and banks pull back from trust lending. (Capital Brief)(Capital Brief)

Google, the sleeping giant in global AI race, now ‘fully awake’ (Bloomberg)

A MESSAGE FROM SMOKEBALL

Smart Lawyers use Smokeball

Smokeball is the only AI-powered legal practice management software that boosts your productivity through automatic time tracking, document automation, and law society approved billing.

See how much our customers love Smokeball.

Trading floor

M&A

Iress rejects claims of exclusive Blackstone takeover talks but is still engaging multiple suitors amid a sharp share price jump. (Capital Brief)

Blackstone launches $1.5b sale of AirTrunk’s Malaysian JHB1 data centre, its first divestment since acquisition. (AFR)

Woodside and Timor-Leste revive the Sunrise LNG project, targeting production by 2032-35. (AFR)

West African Resources is in talks with Burkina Faso over a proposed extra 35% stake in its Kiaka project, with trading still suspended during negotiations. (Capital Brief)

BHP’s surprise bid for Anglo American failed in three days, leaving its strategy under scrutiny. (AFR)

Chronosphere sold for $5.2b to Palo Alto, showcasing AI-ready data platform. (Smart Company)

Capital Markets

Private credit’s sketchy marks get warning shot from Wall Street’s top cop. (Bloomberg)

SRG Global won $650m in contracts across various sectors, driven mainly by industrial/resources deals and strong remediation and marine services. (Capital Brief)

Permira preps $3b IPO for radiology firm I-MED after prior offers fell short. (AFR)

Web Travel Group’s TTV jumped 22%, boosting revenue and earnings, while CFO Tony Ristevski will depart in 2026. (Capital Brief)

Lynas’ Kalgoorlie plant suffered major power outages, cutting rare earth production and impacting Malaysian output, prompting the company to seek urgent off-grid power solutions. (Capital Brief)

AUSTRAC may act against Bendigo Bank over AML failures. (AFR)

Ramsay Health Care beat Q1 estimates and reaffirmed its outlook, with strong Australian revenue and EBIT growth. (Capital Brief)

CSIRO sells $85m Chrysos shares at a 6.7% discount, with Macquarie Capital managing the block trade. (AFR)

DroneShield gained a $5.2m European military contract, lifting shares and adding to $70m in total deals with the reseller. (Capital Brief)

Summerset denies equity raise despite NZD1.8b debt, reporting 26% profit growth. (The Australian)

Mesoblast expects a 37% revenue jump from Ryoncil, continuing strong US growth supported by new billing access. (Capital Brief)

Star Entertainment may be privatised if financial woes persist, seeking new lenders again. (AFR)

Bendigo Bank shares fell after a review uncovered major shortcomings in its anti-money laundering controls. (Capital Brief)

Ashurst predicts 2026 IPOs will rise, driven by global activity and its deal pipeline. (AFR)

Blackpearl Group begins ASX trading with 87% revenue growth, driven by its AI Pearl Engine platform and US acquisition. (Capital Brief)

Netball Australia plans a $10m loan and free-to-air return to expand the sport by 2035. (AFR)

Cbus fined $23.5m for delayed insurance claims; compensations made and reforms underway to speed processing. (Capital Brief)

Sea Forest ASX listing backed by Fanning and Foster Blake, raising $20.5m for methane-reducing cattle feed. (AFR)

Macquarie curbs lending as property influencers push risky, high-leverage investment strategies. (Capital Brief)

Marex backs Ruminant Biotech to trade cow methane carbon credits in NZ. (AFR)

Perseus Mining extends its $100m buy-back to 2026, noting it may not use the full amount due to major project investments ahead. (Capital Brief)

NDIS providers face up to $16.5m fines and jail for harming participants or operating illegally. (AFR)

US retail sales rose less than expected in September, signalling consumer strain amid rising prices and a softer job market. (Capital Brief)

Nvidia shares fell after reports that Meta may buy Google’s AI chips, increasing competitive pressure on Nvidia. (Capital Brief)

PayTo is growing fast, but bad banking app UX is limiting its adoption. (Capital Brief)

Peloton’s new AI-powered bikes, treadmills get off to slow start. (Bloomberg)

VC

Kiki, a short-term subletting startup, struggles in the UK after NYC exit, using invite-only and vetting to navigate regulations. (Startup Daily)

People moves

PEXA hired Web Travel’s CFO Tony Ristevski as its next CFO, starting June 2026. (Capital Brief)

Star Entertainment board shake-up looms after Bally’s and Mathieson take control. (The Australian)

E&P Capital hires five staff to strengthen its capital markets sales and research teams. (AFR)

Sydney Morning Herald editor Bevan Shields steps down for health reasons, with Jordan Baker named successor. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler