- Letter of Intent

- Posts

- ☕️ IPO fiesta

☕️ IPO fiesta

All eyes on Guzman y Gomez' $22 per share float

Good morning.

The ASX is set for an IPO fiesta today!

Hosting it will be Steve Marks, the CEO of burrito-joint Guzman y Gomez, along with IPO underwriters Barrenjoey and Morgan Stanley. They were tasked with persuading investors that the popular Mexican food chain is worth $2.2b or 32.5 times earnings on an EV to pro forma FY25 EBITDA basis.

In attendance will be pre-IPO fans, or shall we say "Guzmaniacs," including TDM Growth Partners, Aware Super, QVG Capital, Cooper Investors, Hyperion Asset Management, Firetrail Investments, and even the Hearts & Minds charity fund HM1, which was convinced to make an exception to its previous listed-only mandate to join in the pre-listing ranks.

The float is scheduled for midday. Have fun!

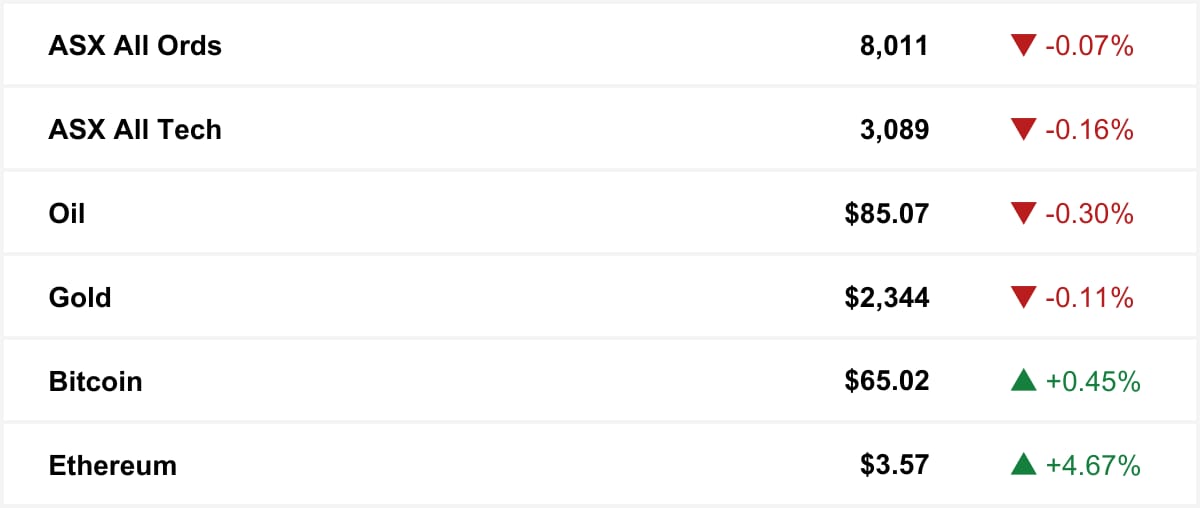

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

🚨 End of financial year sale

Capital Brief is the publication for the people shaping the future of Australian commerce.

Its original journalism covers finance, tech, politics and the law.

Sign up before June 30 to save 50%.

Market movers

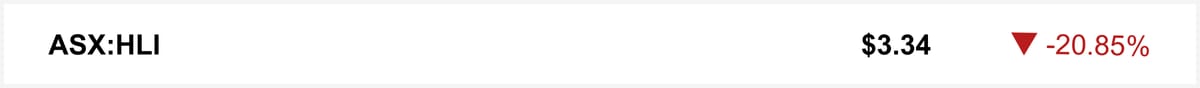

A bargaining manoeuvre by Commonwealth Bank has sent shares in Helia, formerly Genworth, into a nosedive.

Shares plummeted over 20% after Helia’s biggest client said it would open its lenders mortgage insurance contract to tender.

CEO Pauline Blight-Johnston talked up the possibility of extending the relationship, but investors weren't buying it—the market’s reaction was pure panic at the potential end of the lucrative affair.

The quick sync

Newly revealed documents shed light on 'strategic' goals behind Labor's $940m PsiQuantum bet (Capital Brief)

How Melbourne startup Phonely got into Y Combinator, and why it thinks voice is the next AI frontier (Capital Brief)

Former News Corp chief Kim Williams wants a better ABC - and more funding to achieve it (Capital Brief)

Kurraba Group unveils plans for commercial life sciences campus with a $490m project in Sydney (The Australian)

Hack wipes $140m from Melbourne mansion-owning crypto pioneer (AFR)

Trading floor

M&A

Pacific Equity Partners is considering a bid for the Queensland government's 33% stake in New Zealand's Powerco, with bids due in five weeks. (AFR)

Fletcher Building sells half of its Fiji construction business amid management departures, shareholder discontent, and earnings downgrades. (Capital Brief)

Camms, a risk and compliance software start-up backed by Ellerston Capital, is sold to Riskonnect for over $100m. (AFR)

Singapore Power is selling its 40% stake in an Australian energy company, valued at $1.6bn, with interest from GIP and Australian super funds, expected to sell for about $2bn. (The Australian)

Tanarra Capital, led by John Wylie, is nearing its first private equity exit as Accel-KKR plans to acquire INX Software. (AFR)

Floatspace, Sydney's 'Airbnb for boat experiences', is acquired by yacht charter business Ahoy Club. (Startup Daily)

Three ex-UBS bankers launch Denison Partners, a new M&A advisory firm focused on real estate and funds management, entering Australia's competitive corporate advisory market. (AFR)

Brookfield plans to sell Aveo, Australia's major retirement village operator, in a potential $3bn deal. (The Australian)

REA Group acquires the remaining 63% of prop-tech Realtair, taking full ownership after a successful partnership since 2020. (BNA)

Smaller financiers have placed companies linked to Jon Adgemis's Sydney hotels into external administration. (The Australian)

Capital Markets

VC

Breakthrough Victoria invests in Liquid Instruments, which offers adaptable and cost-effective test and measurement devices for global use. (Capital Brief)

People moves

People First Bank appoints Steve Laidlaw as CEO effective July 1st, succeeding Peter Lock. (Capital Brief)

Josh Griggs officially becomes CEO of ACS starting July 1st, following his interim leadership after Chris Vein's departure. (Startup Daily)

☝️ Know about a deal or people move we don’t? Hit reply.

Together with Silversea

Suite upgrades on worldwide ultra-luxury Silversea voyages

Whether you’re seeking a Mediterranean summer in the sapphire waters of the Greek Islands or an immersive expedition through the British Isles and stunning fjords of northern Europe, indulge your wanderlust with Silversea’s suite upgrades– plus a $1,000 shipboard credit per suite and 15% reduced deposit on voyages departing May 2024 through 2026. Learn more at silversea.com.

Watercooler

/