- Letter of Intent

- Posts

- ☕️Hug Doctor

☕️Hug Doctor

Superpower CEO Max Marchione is every bit your eccentric San Fran healthtech founder.

Good morning.

While Australian Max Marchione greets everyone with a hug, regularly injects his employees with peptides and convinced early team members to make a blood oath to the company mission, his ambitions are nothing but serious.

Co-founder and CEO of San Fran-based healthtech, Superpower, Marchione told Capital Brief he is betting the future of medicine will be built not by hospitals or doctors, but by algorithms, biomarkers and a class of experimental compounds known as peptides.

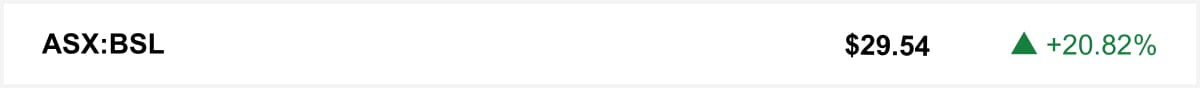

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in BlueScope soared Tuesday after the steelmaker confirmed it had received a $13 billion takeover offer from Ryan Stokes’ SGH and US-based Steel Dynamics, following three earlier proposals that were rejected on valuation and regulatory risk grounds.

The new bid is structured to bypass FIRB scrutiny, with SGH to acquire BlueScope outright before on-selling its North American assets to Steel Dynamics. SGH is being advised by Goldman Sachs and Barrenjoey, while Steel Dynamics is working with JPMorgan. BlueScope is being advised by UBS.

🤝 You’re in good company. You’re reading this alongside new readers from JP Morgan, Macquarie and HMC Capital. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Canva’s IPO will test if Australia can turn one big exit into lasting startup growth, writes Carta’s Bhavik Vashi. (Capital Brief)

The $13b takeover bid for BlueScope by Indiana-based Steel Dynamics and billionaire Ryan Stokes faces political and boardroom hurdles. (Capital Brief)

SGH and Steel Dynamics believe their $13b BlueScope bid avoids FIRB by keeping it Australian. (Capital Brief)

A clash over the Bondi attack has ended Frydenberg and Albanese’s friendship and sparked comeback talk. (Capital Brief)

Fund managers prepare for ‘reckoning’ in US tech sector. (FT)

Trading floor

M&A

Life360 completes Nativo deal and hits record users. (Capital Brief)

WiseTech buys CCES to expand global customs education. (Capital Brief)

Steel Dynamics’ $13b bid for BlueScope puts US suitor in ASX spotlight. (Capital Brief)

M&A activity set to surge in Australia, driven by private equity and data centres. (AFR)

Ripple-owned GTreasury buys Sydney fintech Solvexia. (Capital Brief)

Accenture buys UK AI firm Faculty to boost AI capabilities. (Capital Brief)

Goldman Sachs tops global M&A rankings with USD1.48 trillion in deals. (Reuters)

Capital Markets

Infratil gains $174m from CDC Data Centres revaluation. (Capital Brief)

Macquarie expands mortgage share, outpaces major banks. (AFR)

Monadelphous wins $175m BHP car dumper contract. (Capital Brief)

BlueScope rallies on confirmed SGH–Steel Dynamics takeover bid. (Capital Brief)

Nvidia launches faster, more efficient ‘Rubin’ AI chip. (AFR)

IAG has folded RACQ Insurance into its main reinsurance arrangements following the $855m acquisition. (Capital Brief)

TPG to manage USD12b for Jackson Financial under new partnership. (Capital Brief)

Costco Australia posts $12.6b sales, $300m dividend to US parent. (AFR)

Saudi Arabia opens stock market to all foreign investors. (Capital Brief)

Canva IPO tests whether Australia can turn startup success into momentum. (Capital Brief)

UK wealth cracks widen as family offices start scaling back. (Bloomberg)

China slaps export controls on Japan military for Taiwan remarks. (Bloomberg)

Gold miner aims to retake Venezuela assets after Maduro’s fall. (Bloomberg)

Chevron lines up 11 ships as Venezuela’s dark fleet vanishes. (Bloomberg)

VC

AI health startup Superpower, led by Aussie Max Marchione, bets $75m on AI-driven health. (Capital Brief)

Former VC Vice President sues Insight Partners for being ‘impossible for women’. (Bloomberg)

Musk’s xAI closed USD20b funding round with Nvidia backing. (Bloomberg)

People moves

AIG picks insurance veteran Andersen to replace CEO Zaffino. (FT)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler