- Letter of Intent

- Posts

- ☕️Hockey’s High Roller

☕️Hockey’s High Roller

Joe Hockey is now chair of a billionaire casino whale's family office.

Good morning.

Joe Hockey has built one of the most successful careers of any former Australian politician. He parlayed his time as federal Treasurer into a stint as the US ambassador, where he became known as Australia's “Trump Whisperer”.

Few would have guessed his next career move would be to help the little-known 25-year-old son of a controversial billionaire Chinese property developer and high roller, who has variously fought with the Australian Tax Office (ATO), Star Entertainment Group and even Port Stephens Council, to invest his family's wealth.

And yet, Capital Brief can reveal that’s exactly what Hockey has done, quietly accepting the chair role at the Lee Family Office, which is managed by Felix Lee, the son of billionaire Phillip Dong Fang Lee and his wife Xiaobei Shi.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

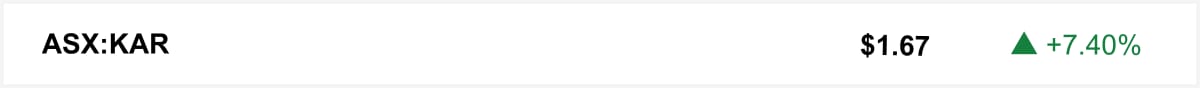

Shares in Karoon Energy rose over 7% Wednesday as oil prices climbed to a two-month high amid violent unrest in Iran, fuelling gains across the energy sector.

🤝 You’re in good company. You’re reading this alongside new readers from Jefferies, Grant Thornton and Citi. Know someone who should be reading? They can sign up here →

The quick sync

BlueScope’s $438m payout raises pressure on SGH and Steel Dynamics to lift their offer. (Capital Brief)

Didier Elzinga exits as Culture Amp CEO after 15 years, naming Caroline Rawlinson to lead its next phase of AI-driven growth. (Capital Brief)

Startup sector divided as SXSW Sydney ends after three years. (Capital Brief)

OmnigeniQ is building a physics-based holographic human twin that could Upend how drugs are developed. (Capital Brief)

Big year for tech deals despite sluggish return to public markets. (AFR)

Trading floor

M&A

Netflix plans an all-cash bid to fast-track its Warner Bros acquisition. (Capital Brief)

Advent Partners is merging its radiology business Imaging Associates with a rival in a $700m deal, with UBS backing. (AFR)

Monadelphous won a $300m, five-year maintenance deal with Rio Tinto. (Capital Brief)

Endeavour may sell its vineyard and winemaking business, say analysts. (AFR)

Quadrant advances QMS Media sale, enlists Macquarie. (AFR)

BlueScope issues $438m special dividend to fend off takeover bids. (Capital Brief) (Capital Brief)

Canavan brother’s Mayfair takes stake in Gladstone coal power plant. (AFR)

Capital Markets

Wasabi Technologies raised $70m to grow its AI-focused cloud storage. (Capital Brief)

Macquarie explores exit options for Bingo Industries. (AFR)

SXSW Sydney will not return in 2026 due to market conditions. (Capital Brief)

Neuren Pharmaceuticals forecasts Rett syndrome drug Daybue sales of about $1b by 2028. (Capital Brief)

The Australian Banking Association is urging the government to make the Compensation Scheme of Last Resort means-tested, restricting payouts to wealthy investors. (AFR)

Australian job vacancies dipped 0.2%, led by private sector declines. (Capital Brief)

Clayton Franklin, founder of Electric Power Conversions Australia, is retrofitting large diesel mining trucks with electric systems, attracting interest from major Australian miners. (AFR)

Victorian student data breached, affecting names, emails, and school info. (Capital Brief)

Emails reveal that Telstra failed to inform TPG of a death tied to Triple Zero outages. (AFR)

Saks Global files for bankruptcy, securing $2.62b and appointing new CEO. (Capital Brief)

Bank of America beats Q4 forecasts on trading and lending gains. (Capital Brief)

Wells Fargo Q4 profit rises but misses estimates due to severance costs. (Capital Brief)

Beijing tells Chinese firms to stop using US and Israeli cybersecurity software. (Reuters)

Trump administration enacts security rules for Nvidia’s China chip sales. (WSJ)

Wall Street groups hire traders to wade into prediction markets. (FT)

Australian Unions and Microsoft sign workers rights agreement on AI. (Capital Brief)

VC

Adelaide startup OmnigeniQ wants to build a holographic human twin to speed up drug discovery. (Capital Brief)

Australian startups posted $3.5b in exits in 2025, their strongest year since the pandemic. (AFR)

SXSW Sydney’s closure has drawn mixed reactions from the startup community. (Capital Brief)

Pleasant State, sustainable cleaning startup, closes after six years. (Smart Company)

People moves

Greg Field will start as Deep Yellow CEO earlier than expected. (Capital Brief)

Mayne Pharma’s chair Frank Condella is stepping down after the failed Cosette takeover. (Capital Brief)

Jefferies tech analyst Wei Sim to depart under uncertain circumstances. (AFR)

Humm Group’s board is urging shareholders to reject an activist-led board spill. (Capital Brief)

Culture Amp’s founder Didier Elzinga has stepped aside as CEO, appointing Caroline Rawlinson to the role. (Capital Brief)

EY recruits four senior PwC tax partners to bolster its team. (AFR)

Matt Benham will become Amazon Australia’s new country manager. (Capital Brief)

Joe Hockey is now chair of Lee Family Office, advising the son of billionaire Phillip Dong Fang Lee on managing the family’s wealth. (Capital Brief)

Airbnb names Meta’s head of generative AI as chief technology officer. (Bloomberg)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler