- Letter of Intent

- Posts

- ☕️ HESTA v Aware

☕️ HESTA v Aware

Not everyone thinks the performance test is holding venture back.

Good morning.

Looks like not everyone agrees regulation is holding venture back.

While HESTA is pushing for changes to fee and performance rules it argues constrains investment, Aware Super PE boss Jenny Newmarch told Capital Brief’s Jassmyn Goh the $200 billion fund is allocating 15-20% of member portfolios into VC, secondaries and early-stage plays — and still hitting return targets.

“There will be some shorter time periods where VC doesn’t perform as well as buyout, but over 10-year periods, it’s, in our view, more likely than not to be a return enhancer, so the performance test hasn’t been a barrier,” she said.

Meanwhile, HESTA boss Debby Blakey is convinced that change is needed. Their arguments here.

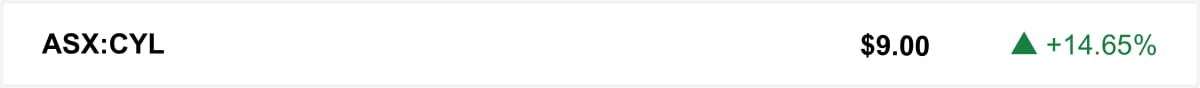

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in Catalyst Metals surged 15% on Friday after the gold miner reported record quarterly production in the three months to December.

🤝 You’re in good company. You’re reading this alongside new readers from Jefferies, Grant Thornton and Citi. Know someone who should be reading? They can sign up here →

The quick sync

Mayne Pharma may spin off its US business to return value after its blocked $600m takeover deal. (Capital Brief)

AI use by untrained young lawyers is exposing Australian firms to serious legal and security risks, writes Denise Farmer. (Capital Brief)

A December jobs bounce is expected, but stubborn labour tightness will keep the RBA on edge over inflation. (Capital Brief)

Filipino nurses accuse Eucalyptus of burnout and unpaid overtime as it chases a $1.3b valuation. (AFR)

‘No reasons to own’: software stocks sink on fear of new AI tool. (Bloomberg)

Trading floor

M&A

Qube says Macquarie is still conducting due diligence on its $11.6b takeover bid. (Capital Brief)

BlueScope shareholders push board to explore sale or breakup of North American business. (AFR)

Rio–Glencore merger could be “cleaner” if coal assets are spun off, say fund managers. (AFR)

Elanor Commercial Property Fund's board urges shareholders to reject Lederer’s takeover proposal. (Capital Brief)

Capital Markets

SXSW Sydney was shut down after the NSW government pulled funding over a licensing fee dispute. (Capital Brief)

Kalshi and Polymarket race to offer multi-leg sports bets in the US market. (AFR)

Big banks are blasting Meta for allowing Facebook to be used to trade mule accounts linked to scams. (Capital Brief)

Airwallex seeks removal of critical media coverage before its IPO. (AFR)

The US–Taiwan trade deal lowers tariffs and boosts massive Taiwanese chip investment in the US. (Capital Brief)

Peter Cook’s Nico Resources launches $3m capital raising for Wingellina project. (AFR)

James Hardie shares jumped after it flagged $25m in annual savings from US plant closures. (Capital Brief)

HungryPanda nears $800m in annual Australian sales, beating Uber Eats and DoorDash. (AFR)

The federal government will spend about $25m on a national solar panel recycling scheme. (Capital Brief)

$60b spent globally on food and drink M&A in 2025 as healthier products gain attention. (The Australian)

CBA has scrapped Bankwest’s standalone employer status, drawing union concerns over staff conditions. (Capital Brief)

38sth and Cheviot emerge as Australia’s newest private equity firms. (AFR)

IperionX secured $6.8m in final US government funding to expand titanium production. (Capital Brief)

Deep Yellow jumps as Macquarie forecasts higher uranium prices in 2026. (Capital Brief)

UK moves to ban social media for under-16s, following Australia. (AFR)

Capstone Copper jumps after 22% boost in 2025 production. (Capital Brief)

Blackstone eyes exit from Australia’s top phase-1 clinical trials firm, Nucleus Network. (AFR)

NRF leads $20m Series D investment in Omniscient Neurotechnology. (Capital Brief)

Orthocell boosts stake in Marine Biomedical to secure PearlBone distribution rights. (AFR)

TikTok tightens age verification in EU to curb under-13 accounts. (Capital Brief)

Infinity Pharmacy collapse costs Wesfarmers over $100m. (AFR)

ChatGPT to test ads and launch $8 “Go” subscription to boost revenue. (Capital Brief)

Many young Australian lawyers use AI without proper training, creating compliance risks. (Capital Brief)

Trump says he’ll sue JPMorgan for allegedly cutting him off after US Capitol riot. (The Guardian)

Janet Yellen says Trump’s moves against Powell are backfiring. (Bloomberg)

BlackRock’s Rick Reider bid for Fed chair is gaining traction. (Bloomberg)

Musk seeks up to USD134b from OpenAI and Microsoft. (Reuters)

Euro pain from Trump limited by US asset exposure, Deutsche says. (Bloomberg)

Fed turmoil is threatening dollar supremacy just as China pushes the yuan. (WSJ)

VC

Aware Super says regulation hasn’t blocked its venture capital investments. (Capital Brief)

People moves

Atlassian has added Google product VP Anil Sabharwal to its board. (Capital Brief)

Sarah Court leads contenders to replace Joe Longo as ASIC chair. (AFR)

Jarden hires Adam Reid’s team from Gresham to grow resources advisory. (AFR)

BHP executive Geraldine Slattery has joined the Business Council board. (Capital Brief)

Filipino nurses allege overwork and underpayment at Eucalyptus after higher performance targets. (AFR)

Joe Hockey joins Lee Family Office to manage a Chinese billionaire’s wealth. (Capital Brief)

JPMorgan launches private market advisory team to boost capital-raising services. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler