- Letter of Intent

- Posts

- ☕️ Cettire shorts torched

☕️ Cettire shorts torched

Cettire's 79% surge burns short sellers after audit sign-off

Good morning.

Cettire shares soared 79% after auditors signed off on accounts, igniting a massive short squeeze that torched sellers.

Capital Brief’s Jack Derwin reports 11.21% of Cettire’s stock was shorted at the time of the squeeze. And with 60% of shares tied up by just three holders – founder and CEO Dean Mintz, Phil King's Regal Partners, and Connecticut hedge fund Cat Rock – the stock's limited float drove extreme volatility, adding $400 million to its market cap.

One trading desk called it "serious carnage," telling Derwin they’d never seen anything like it.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

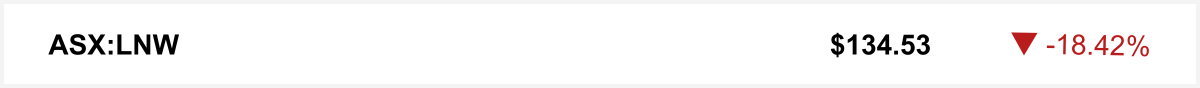

Dual-listed gambling company Light & Wonder's shares nosedived on the ASX on Tuesday, after a court ruling against its Dragon Train game, favouring competitor Aristocrat.

L&W insisted the hit is minor, reaffirming its 2025 EBITDA outlook. The market, though, wasn’t convinced.

The quick sync

Eucalyptus CEO Tim Doyle on the surprise withdrawal of the company’s hyped men’s longevity product Compound and plans for its relaunch. (Capital Brief)

Scalare Partners' backdoor IPO plan faces VC scepticism amid 'broken' model claims. (Capital Brief)

Passive funds fuel 33% month-end Treasury trading surge, New York Fed says. (Bloomberg)

Options traders rush into China rally bets after stimulus, eye FXI, PDD, and Alibaba gains. (Bloomberg)

Aldi, Metcash to gain as Coles, Woolworths face ACCC lawsuit fallout over ‘fake discounts’. (Capital Brief)(The Australian)

AustralianSuper, Australian Retirement Trust now manage half of new super inflows, as analysts warn of 'double-edged sword' growth. (AFR)

Trading floor

M&A

Magellan Financial Group's Airlie Funds is now a major Ampol holder as the firm stabilizes following years of underperformance and management changes. (Capital Brief)

HPX Group has acquired Salinger Privacy, a privacy consulting firm founded by former NSW deputy privacy commissioner Anna Johnston, betting on growth in the privacy sector. (AFR)

GCQ Funds Management, a significant investor in Rightmove, has urged the board to engage with REA Group over its $12bn takeover bid. (AFR)

SG Fleet's major shareholder, Super Group, has halted the sale of its 53% stake due to difficulties in finding a cash buyer, despite attempts through Bank of America. (The Australian)

Elanor Investor Group is close to finalizing a refinancing deal with Keyview Financial Group to stabilize its property management operations. (AFR)

Cettire's 79% short squeeze added $400m to its market cap, driven by auditors signing off on accounts, large short positions, and limited free float. (Capital Brief)

Banlaw, a Newcastle-based fluid management company, is for sale, expecting $58m in revenue this financial year. (AFR)

Morrison & Co is looking for a passive investor to buy Commonwealth Superannuation Corporation's $2bn stake in CDC Data Centres, with Barrenjoey facilitating the sale. (The Australian)

Coronado Global Resources has hired three banks for its $400m debut high-yield bond, after its earlier plan to sell a 51% stake was abandoned. (AFR)

Bidders for Anglo American’s $5bn steelmaking coal portfolio are finalizing offers due the week of November 11, after reviewing details of the sought-after assets. (The Australian)

Capital Markets

Ex-Regal PM Craig Collie and Madusha Dilshan Seneviratna are setting up a healthcare fund, backed by a $70m investment, to target top healthcare companies in Australia and Asia. (AFR)

InDebted raised $60m to expand into new markets, pursue acquisitions, and develop its products. (Capital Brief)

Evolt raised $20m for international growth and a potential IPO, driven by the popularity of weight loss drugs like Ozempic and Wegovy. (BNA)

Fletcher Building shares gained after completing a key portion of its NZ$700m equity raise. (Capital Brief)

FireFly Metals, a Canadian gold explorer valued at $502m, is raising $60m through a share placement priced at 95¢, supported by offshore investors. (AFR)

E&P Financial Group seeks ASX delisting, citing negative impacts from legal issues and a preference for private growth. (Capital Brief)

Scalare Partners plans to become Australia's first publicly listed tech accelerator through a reverse listing, raising up to $8m, with a $26.5mvaluation. (Capital Brief)

The Queensland government plans to transform Star Entertainment's looming tax bill into a Treasury loan, offering the casino operator much-needed financial relief as new CEO Steve McCann seeks to stabilize the company. (AFR)

VC

Restoke.ai raised $5.1m, led by Rampersand, to help restaurants manage rising costs with real-time insights, and plans to use the funds for US expansion. (Capital Brief)

People moves

Glen Richards, founder of Greencross Vets, has become chairman and investor at Arbor Permanent Owners, a private equity firm, aiming to uncover well-run small businesses. (AFR)

Lendlease plans to appoint a new chairman before its November 15 AGM, with three candidates considered, none from the real estate sector. (The Australian)

Three senior Smiggle execs - Chantelle Hayes, Emma Fulford and Chelsea Brunsdon - follow sacked CEO John Cheston ahead of possible demerger. (The Australian)

☝️ Know about a deal or people move we don’t? Hit reply.

Together with Silversea

Save, indulge & explore Australia this summer

From vibrant coastal cities to the silent fjords of New Zealand, we invite you to see more of your big backyard in ultra-luxury splendour.

Book by 31 October, 2024 to enjoy savings of $5,000 per suite, plus US$600 Shipboard Credit per suite and business class flights from $498 on more than 25 selected Australia and New Zealand voyages. Find out more at Silversea.com.

The watercooler