- Letter of Intent

- Posts

- ☕️Gains Navigator

☕️Gains Navigator

Blue Owl-back Navigator Global Investments makes waves on the ASX.

Good morning.

Regal Funds Management, L1 Capital Management and Perpetual Investments are among a who’s-who of Australian investing who have been piling into a newly-revived 25-year-old stock that boasts exposures to the hottest trends in global markets.

The flood of smart money into Navigator Global Investments, formerly Lighthouse Partners, has underpinned an 86% gain in the name over the past year. Notably, NY-based alternatives giant Blue Owl is also the company's single biggest shareholder. “Many of our investors are asset managers so they understand alignment, but they can’t get exposure to alternatives. Navigator provides a unique way of doing it,” chief executive Stephen Darke told Capital Brief.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

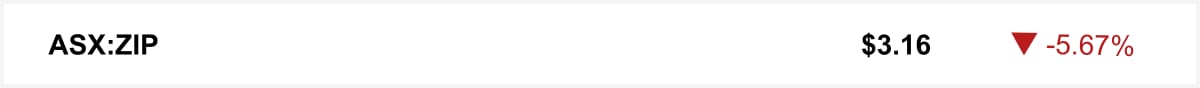

Shares in Zip fell Monday as investors rotated out of rate-sensitive names. The buy now, pay later firm was the worst-performing technology stock on the ASX 200, hit by profit-taking after a strong 2025. The drop came as bond markets continued to price in the possibility of interest rate hikes, which could raise funding costs for fintech lenders and weigh on consumer spending.

🤝 You’re in good company. You’re reading this alongside new readers from JP Morgan, Macquarie and HMC Capital. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Canberra’s muted response to Trump’s Venezuela strike shows the strain between backing the US and upholding global rules. (Capital Brief)

Vield is securing up to $50m in debt after an ATO ruling paved the way for Bitcoin-backed loans in Australia. (Capital Brief)

Hedge fund Tribeca is immediately sending a team to Caracas as it eyes a Venezuela gold rush triggered by Maduro’s capture and Trump’s intervention. (Bloomberg)

Journalism-powered hedge fund finds good news can be profitable. (WSJ)

Australia ‘on notice’ after US breach of international law. (AFR)

Trading floor

M&A

ACCC says WiseTech pushed ahead with acquisition despite concerns. (Capital Brief)

BlueScope confirms $30-per-share takeover bid from SGH–Steel Dynamics consortium. (Capital Brief)

Capital Markets

Coronado shares slide after fatal mine incident. (Capital Brief)

Australian Agricultural Company flags earnings downgrade after Queensland flooding. (Capital Brief)

Northern Star trims gold output after Super Pit breakdown. (AFR)

Gold miners rally on safe-haven demand after Maduro capture. (Capital Brief)

Ikea Australia is disputing a USD17m tax claim from the ATO following a long-running audit covering the 2016–2020 financial years. (The Australian)

Vield moves to secure $50m credit line for crypto-backed loans. (Capital Brief)

Apollo invests USD1.2b in QXO to back acquisitions. (Capital Brief)

Alceon blames Temu and Amazon for Cheap as Chips collapse. (AFR)

Foxconn posts record revenue on strong AI-driven demand. (Capital Brief)

US oil stocks rise after Maduro’s capture. (Capital Brief)

Smart money backs Navigator Global Investments, driving strong share price gains. (Capital Brief)

With platinum trading well below gold, the white gold Rolex Day-Date delivers more intrinsic value at a lower price point. (Bloomberg)

China’s financial regulator asked banks to report Venezuela exposure after the US removed pro-Beijing Maduro. (Bloomberg)

Deutsche Bank shares exceed book value for first time since 2008. (FT)

Dollar retreats from haven gains after weak US manufacturing data. (Bloomberg)

Popular Japanese sushi chain pays record USD3.2m for tuna in New Year auction. (Reuters)

VC

None

People moves

None

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler