- Letter of Intent

- Posts

- ☕️Fratboy Fund

☕️Fratboy Fund

Point72 is being sued for US$20m by former intern.

Good morning.

Steve Cohen’s hedge fund, Point72, is being sued by a former intern from the 2023 summer class who claims the US$40 billion fund fired him after he asked for accommodations for his PTSD.

Andrew Pardo said that when he asked the firm to swap desks with another intern in an area with less foot traffic, he was met with suspicion and viewed as a liability before being terminated.

Pardo’s lawsuit also calls out the firm’s fratty culture as "characterized by heavy drinking” and alleges that a firm employee smoked marijuana with interns.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in the ASX plunged Thursday, with the Australian bourse lurching from one failure to the next with little accountability and no fix in sight.

📱The Capital Brief app is here. Keep across the day with breaking news briefings and all our original reporting.

Download now. App Store | Google Play

The quick sync

Labor races to finish its long-delayed news bargaining rules before Google’s five-year media deals run out. (Capital Brief)

Employment Hero claims Seek shut down years of JV talks before blocking API access, triggering its lawsuit against the jobs giant. (Capital Brief)

A super fund-backed takeover of Cboe Australia could be the market shake-up ASX needs, Dimitri Burshtein and Patrick Young write. (Capital Brief)

In Australia’s class action system, funders and lawyers reap the rewards as victims wait by the phone wondering when, and if, they’ll get paid. (Capital Brief)

Uncertainty is stalling Australia’s AI momentum, but ambition, adaptability and people-first thinking could turn it into a global leader, Paul Migliorini writes. (Capital Brief)

A MESSAGE FROM VANTA

From compliance to confidence

A robust vendor management program isn’t just a compliance checkbox for frameworks like SOC 2 and ISO 27001 — it’s a core component of a holistic trust management strategy.

In our guide, “From reactive to proactive: How to minimise third-party risk with strong vendor management,” you’ll learn:

Insights from other leaders on how to proactively manage third-party vendor risk

Tips on dealing with challenges like limited resources and repetitive manual processes

How security teams can enable business to move quickly instead of being inadvertent gatekeepers

Join 11,000 companies like Atlassian, Relevance AI, Handle, InDebted, FireAnt, Traffyk.ai, Everlab, Lumin Sports and Tactiq.io that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

v2food acquires Daring Foods and partners with Ajinomoto to drive global plant-based expansion and clean-label innovation. (Capital Brief)

Warburg, KKR, CVC, and Bain circle $2.5b+ La Trobe Financial auction. (AFR)

Elanor disputes Lederer Group's takeover claims and forms independent board committees to assess the offer and manage conflicts. (Capital Brief)

APG bids for $2b stake in Transgrid amid major ownership shake-up. (AFR)

Sendle merges with ACI Logistix and FastMile to form FAST Group and expand in the US. (Capital Brief)

Santos extends due diligence for ADNOC-Carlyle’s $30b bid amid final deal preparations. (The Australian)

Capital Markets

AMP’s profit dipped to $98m as legal and restructuring costs rose, offsetting gains across its core businesses. (Capital Brief)

ASX faces up to $35m in added FY26 costs amid ASIC probe. (Capital Brief)

Light & Wonder lifts Q2 profit, to delist from Nasdaq for sole ASX listing. (Capital Brief)

Liontown raises $266m led by NRF to support lithium project and boost liquidity. (Capital Brief)

NRF CEO David Gall says its $50m investment in Liontown backs lithium production and future processing, not a bailout. (Capital Brief)

Santana Minerals launches $61m equity raise following Kalgoorlie pitch. (AFR)

Neuren's US Daybue sales rise 14%, royalties up 9%, with more growth expected. (Capital Brief)

Silex raises $130m to fund US uranium tech rollout through Global Laser Enrichment. (Capital Brief)

Federation Mining may list on ASX and is seen as a potential acquirer of Santana Minerals, which is raising $50m. (The Australian)

Rio Tinto greenlights $277m for Norman Creek bauxite project, targeting 2027 production. (Capital Brief)

Domain halts trading as court clears $3b CoStar takeover; shareholders to receive $4.342 per share. (Capital Brief)

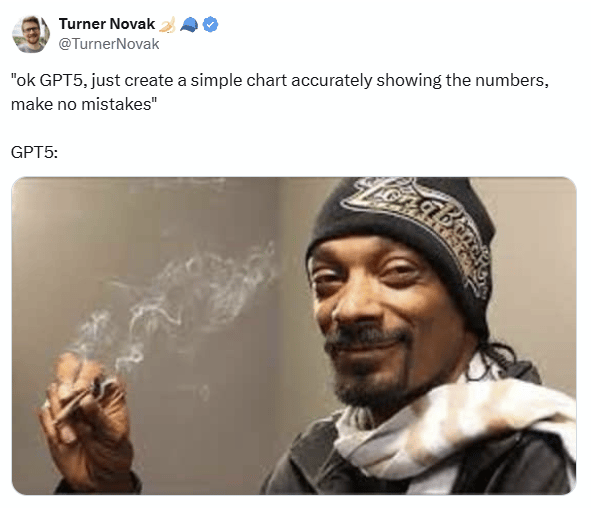

OpenAI unveils GPT-5, its smartest AI yet, available to all ChatGPT users from Friday. (AFR)

Wambal Bila wins 5% stake in $340m Bulabul Battery project, setting a national precedent for First Nations equity in renewables. (Capital Brief)

ARN may take Kyle and Jackie O national, starting with Brisbane next year. (Capital Brief)

Alinta and NRN launch a free solar-and-battery Virtual Power Plant to cut household bills and meet rising energy demand. (Capital Brief)

PwC Australia’s federal work ban has ended after it met ethical reforms following a 2023 tax leak scandal. (Capital Brief)

Jayne Hrdlicka brings in Bain to review Endeavour, with asset sales or restructuring possible amid share price pressures. (AFR)

Bank of England cuts rates to 4% for the fifth time since August 2024 to manage inflation risks. (Capital Brief)

AWS offers US agencies US$1B in cloud discounts to boost tech and AI adoption. (Capital Brief)

VC

UNSW debuts Barker Street Ventures to connect investors with its deep tech startups. (Capital Brief)

AI startup Deeligence wins Startup World Cup regional, heads to San Francisco to compete for US$1 million. (Startup Daily)

People moves

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler