- Letter of Intent

- Posts

- ☕️ FinTok fraudsters

☕️ FinTok fraudsters

Macquarie dodges lax diligence claims amid calls for scrutiny of property influencers.

Good morning.

Macquarie Group sidestepped claims it engaged in lax due diligence before it ceased lending to housing investors using trust structures to amplify their borrowing power, as mortgage brokers urged regulators to take action against buyers agents and influencers promoting property on social media.

Several mortgage brokers told Capital Brief that before it made the decision, Macquarie had become the preferred lender in the space due to its relatively light due diligence and speedy approval times. Sources said Macquarie was known to approve loans to property investors using trusts who self-declared their ability to meet repayments with little scrutiny.

Macquarie responded that trust and company accounts made up less than 5% of its total loan book and that it has “As a fast-growing lender with a prudent credit policy, we were well-positioned to pause lending to the segment and have no plans to restart this soon.”

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

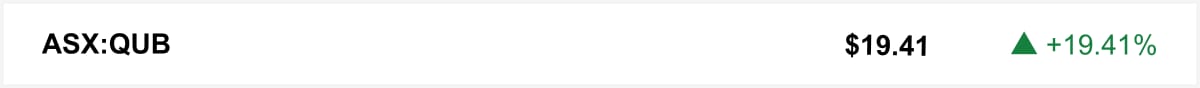

Shares in logistics group Qube surged nearly 20% on Monday after it received an $11.6 billion takeover offer from Macquarie Asset Management. The board has entered into exclusive talks and intends to unanimously recommend the deal to shareholders.

🤝 You’re in good company. You’re reading this alongside new readers from Corrs, AustralianSuper and Pitcher Partners. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Blackbird tips big gains for Airwallex and Canva, writes down Culture Amp and Safety Culture. (Capital Brief)

AI demand is surging but the economics still do not add up, writes Matt Vitale. (Capital Brief)

Blackbird says Canva is IPO-ready for 2026 with growth still accelerating. (Capital Brief)

Sonder’s collapse leaves Marriott facing losses and fresh scrutiny over hotel-startup tie-ups. (WSJ)

Trading floor

M&A

Anglo American declined BHP’s offer, preferring its $57b Teck merger. (Capital Brief)

Pacific Equity Partners leads the $1b Aidacare acquisition race. (AFR)

Monash IVF rejected an 80c takeover bid it deemed undervalued, sending shares sharply higher. (Capital Brief)

Australians sell software company to Palo Alto Networks for $5b. (AFR)

Qube shares surged after receiving an $11.6b takeover offer from Macquarie. (Capital Brief)

Genesis Capital, eyeing Healius before, sees its Monash IVF bid rebuffed. (The Australian)

Omega Oil & Gas is acquiring a strategic stake in Elixir Energy. (AFR)

MA Financial is buying the Hyperdome for $679m, boosting its retail real estate portfolio. (Capital Brief)

The blocked Mayne Pharma sale has rattled Australia’s M&A market and exposed new deal risks. (AFR)

Capital Markets

Australis Scientific raised $9.3m to advance its wearable bladder-treatment patch. (Capital Brief)

Pro Medicus’ shares rose after winning three US imaging contracts worth $29m. (Capital Brief)

TikTok wins naming rights to Sydney’s 9,000-capacity Darling Harbour venue in a world first. (AFR)

DroneShield admits engagement issues after director share selldowns and launches an independent review. (Capital Brief)

Corporate Travel likely to miss November accounts deadline after audit errors. (AFR)

Banks and APRA are tightening controls as investor-driven housing risks rise. (Capital Brief)

EVP raises $100m fund, moving past StrongRoom AI controversy. (AFR)

Nvidia’s results show the AI boom is real, but AI economics remain strained. (Capital Brief)

Reece shares jump after Macquarie upgrades the stock on improving revenue and low valuation. (Capital Brief)

Oroton aims to double sales as profits rise on expanded clothing and accessories. (AFR)

Iress halts trading ahead of a major announcement amid acquisition interest. (Capital Brief)

Social enterprise Yume Food enters liquidation after a decade of redistributing surplus food. (Startup Daily)

Canva is reportedly ready for a 2026 IPO, says investor Blackbird. (Capital Brief)

Gina Rinehart urges shareholders to challenge Rio Tinto and BHP on net zero spending. (AFR)

Revolut’s latest share sale values the fintech at $116b as revenue and profits surge. (Capital Brief)

AI can lift productivity, but most Australian firms are still in early adoption stages. (Capital Brief)

Santos’ Narrabri gas project faces a four-month court delay after judge recusal. (AFR)

Novo Nordisk shares plunged after its Alzheimer’s trial showed no clinical benefit. (Capital Brief)

Vinarchy will drop 40% of brands to focus on Hardys and Jacob’s Creek. (AFR)

The US wants the EU to relax digital rules in exchange for a steel and aluminium tariff deal. (Capital Brief)

Walker Wayland boosted female partners by tailoring parental leave and flexibility. (AFR)

Nyrstar urges a domestic ore-sale requirement to aid local smelters. (AFR)

Blackbird marked down Culture Amp and SafetyCulture, while Airwallex and Eucalyptus are emerging as strong performers. (Capital Brief)

Macquarie defends its lending practices as brokers call for regulation of property influencers. (Capital Brief)

VC

South Asian Australian founders have raised $1.6b, boosting their influence in local startups. (Startup Daily)

Failed logistics startup GetSwift co-founders banned for life from Canadian directorships after company collapse. (Startup Daily)

Boman Group launches $60m fund to back modular housing tech in Australia. (Startup Daily)

People moves

CBA CIO Gavin Munroe is leaving, with two executives stepping in as interim tech co-leads. (Capital Brief)

UBS hires JPMorgan’s Solomon Zhang as real estate research co-head. (AFR)

Bapcor reshaped its board, naming Lachlan Edwards chair and moving CEO Angus McKay off the board to focus on the business turnaround. (Capital Brief)

Lendi CEO David Hyman to step down, succeeded by co-founder Sebastian Watkins. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler