- Letter of Intent

- Posts

- ☕️ Earnings roulette

☕️ Earnings roulette

ASX investors brace for volatile reporting season.

Good morning.

Reporting season is almost here and Capital Brief’s Hugo Mathers reports markets are primed to overreact.

After one of the most volatile seasons on record last year, investors are bracing for another round of sharp moves, where even minor earnings misses could trigger major selloffs.

It looks like the market’s tolerance for disappointment will be quite low.

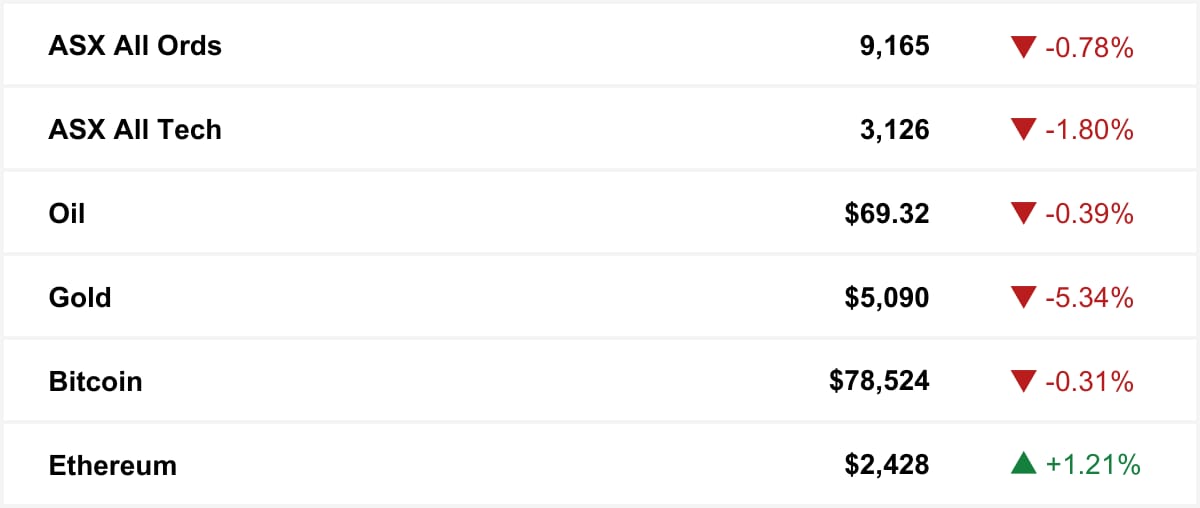

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

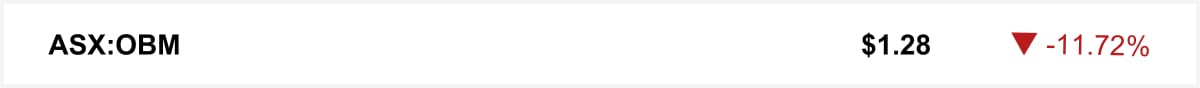

Shares in Perth-based gold producer Ora Banda Mining fell over 11% on Friday as a plunge in bullion prices sparked a sector-wide selloff that dragged the ASX into the red.

🤝 You’re in good company. You’re reading this alongside new readers from Pitcher Partners, Lendlease and Westpac. Know someone who should be reading? They can sign up here →

The quick sync

Banks shut 16,000 mule accounts last year as financial crime surges and Airwallex faces scrutiny. (Capital Brief)

The RBA is expected to raise rates Tuesday, but a stronger dollar and market moves complicate what follows. (Capital Brief)(Capital Brief)

Liberals push for Monday resolution as Hastie exits and Taylor prepares to challenge Ley. (Capital Brief)

Trump’s disruption has pushed the EU to reopen trade talks, offering Australia new diplomatic leverage. (Capital Brief)

Nine CEO Matt Stanton says the $850m QMS Media deal followed a year of due diligence and was not off the cuff. (Capital Brief)

Trading floor

M&A

Spark NZ sold 75% of its data centre arm to PEP in a deal valuing it up to NZD705m. (Capital Brief)

Rio Tinto and Chinalco buy $1.3b Brazilian aluminium stake. (AFR)

Bupa and HCF seek ACCC block on Ramsay–Healthscope deal. (The Australian)

Qoria plans merger with US tech firm Aura. (AFR)

Nine to acquire QMS for $850m and exit radio to boost digital growth. (Capital Brief) (Capital Brief)

Pharmacy Guild alerts ACCC on Priceline store sales. (AFR)

AUI to merge with DUI in an all-scrip deal. (Capital Brief)

Bain could sell part of Virgin Australia stake after first-half results. (AFR)

Capital Markets

Amazon may invest USD50b in OpenAI, becoming its biggest investor. (Capital Brief)

Apple beat Q1 forecasts on surging iPhone demand. (Capital Brief)

Greenlit Brands posts $120m profit from Freedom Furniture sale. (The Australian)

ResMed beat estimates on strong Q2 growth. (Capital Brief)

Disney earns $1b+ in Australia, mostly sent offshore. (AFR)

Star swung back to Q2 EBITDA profit. (Capital Brief)

Bain Capital prepares $700m+ IPO for Estia Health. (AFR)

States secure $25b in new federal hospital funding. (Capital Brief)

Australian Unity hit with $7m penalty for compliance breaches. (Capital Brief)

Homart Pharmaceuticals readies $100m ASX IPO. (AFR)

RBA likely to hike rates in first 2026 meeting. (Capital Brief)

Australian property values up 0.8% in January, driven by regional growth. (Capital Brief)

Westpac-backed ShopBack weighs Australian IPO. (AFR)

Crime ‘mule accounts’ surge, disrupting Australia’s fight against financial crime. (Capital Brief)

Colonial First State staff may earn $208m if business sells. (AFR)

ASX reporting season set for high volatility and sharp share swings. (Capital Brief)

OpenAI investment wasn’t ‘a commitment,’ Nvidia’s Huang says. (Bloomberg)

Xi Jinping calls for China’s renminbi to attain global reserve currency status. (FT)

Chinese speculators set the stage for gold and silver crash. (Bloomberg)

Artificial intelligence researchers hit by flood of ‘slop’. (FT)

JPMorgan should ‘threaten’ UK over banker tax, Mandelson told Epstein. (FT)

Apollo chief Marc Rowan consulted Epstein on firm’s tax affairs. (FT)

DP World boss discussed masseuse with Epstein, emails show. (FT)

Former Microsoft Windows boss sought Epstein advice on career. (Bloomberg)

Bitcoin price slides to lowest level since 2025 tariff shock. (FT)

Trump-linked crypto firm secured USD500m from UAE royal days before inauguration, raising fresh conflict questions. (FT)

Rare SpaceX bet turns USD1.1b fund into a retail magnet. (Bloomberg)

AI boom is triggering a loan meltdown for software companies. (Bloomberg)

No humans needed: New AI platform Moltbook takes industry by storm. (Axios)

VC

Alex McLeod’s Serval hits $1b unicorn valuation. (AFR)

People moves

Bell Potter’s head of institutional equities Jamie Gordon leaves; Unger promoted. (AFR)

Northern Star CEO Stuart Tonkin’s future under scrutiny. (The Australian)

Shaw and Partners has hired a veteran adviser from Wilsons Advisory for its Sydney office. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler