- Letter of Intent

- Posts

- ☕️ Delicate Disclosure

☕️ Delicate Disclosure

Brandon Capital chief discloses relationship with senior employee.

Good morning.

Perhaps wanting to avoid the fallout of an Astronomer-Coldplay fiasco or a debacle à la Nestlé’s very own Don Juan, VC firm Brandon Capital has taken the unusual step of informing staff of an internal relationship involving one of its co-managing directors and co-founders, Chris Nave, and investment manager Jess Smith.

Co-managing director Stephen Thompson told Capital Brief the situation had been handled appropriately, with the relationship disclosed to senior leadership some time ago and communicated internally to staff this week. Smith advised the company that she will depart the firm at the end of the year.

A person familiar with the matter, who requested anonymity given the personal nature of the situation, confirmed it was Smith’s decision to leave, driven by personal and professional factors, and not initiated by the firm.

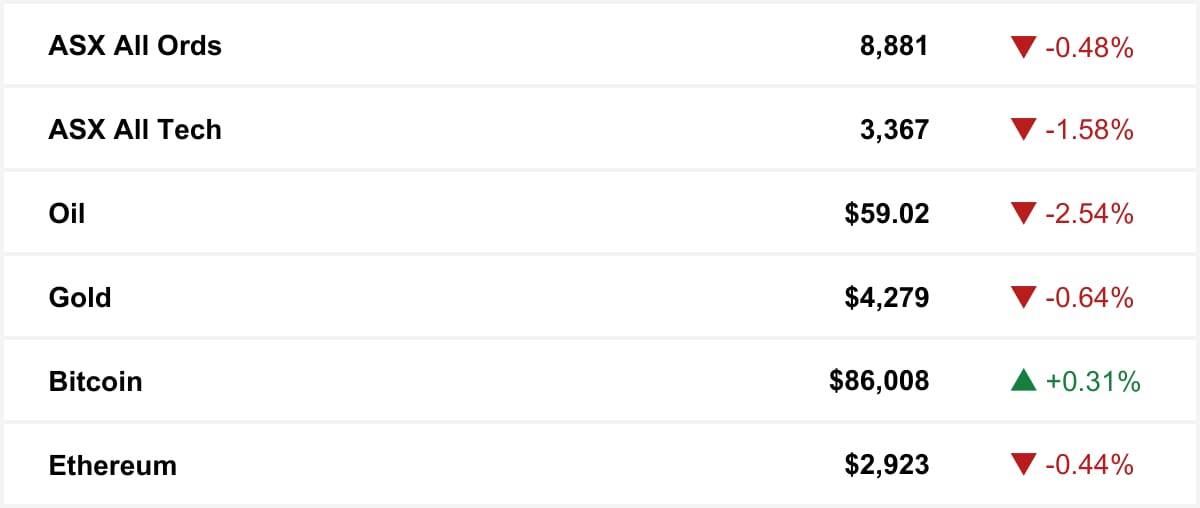

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in DroneShield soared Tuesday after the counter-drone technology company said it had secured a $49.6m contract with an unnamed European military end-customer. The deal covers handheld counter-drone systems, accessories and software updates, with most stock ready to ship and delivery and cash payments expected to be completed in Q1 2026.

🤝 You’re in good company. You’re reading this alongside new readers from JP Morgan, Macquarie and HMC Capital. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Ivanhoe Atlantic delays its ASX float to mid-2026 amid political scrutiny and governance questions and as it focuses on building its Guinea iron ore project. (Capital Brief)

Metrics expects more co-lending with big banks in 2026 as banks return to commercial real estate lending amid larger housing projects. (Capital Brief)

Rising geopolitical tensions are increasing cyber risks to Australia’s payments system, pushing the RBA and security agencies to keep cash and legacy systems as critical fallbacks. (Capital Brief)

The Bondi attack unleashed unusually harsh criticism of Anthony Albanese over antisemitism, setting up a fraught period as he tries to lead a divided national response. (Capital Brief)

The Coalition has delayed its immigration policy reset after the Bondi attack, as business groups warn against any cuts to skilled migration. (Capital Brief)

Trump chief of staff Susie Wiles says president has ‘alcoholic’s personality’, blasts inner circle. (VF Part 1)(VF Part 2)

A MESSAGE FROM VANTA

Just released: The State of Trust: Australia

Don’t miss this deep dive into security, compliance, and the future of trust, featuring insights from Australian business and IT leaders.

Key findings:

👉 Nearly 6 in 10 say AI risks outpace their expertise

👉 65% of security teams are posturing more than protecting

But here’s the flip side:

Teams embracing AI are reaping real benefits—faster risk assessments, sharper accuracy, and quicker incident response. While others hesitate, adopters are proving outcomes matter more than optics. Read the full report.

Join 12,000 companies like Atlassian, Quantum Brilliance, Relevance AI, Instant, and Heidi Health that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

Perseus drops revised bid but says Robex deal is inferior. (Capital Brief)

Westgold acquires 19.9% of Alicanto in Mt Henry mine sale. (AFR)

HMC Capital in advanced talks to lease/sell Healthscope hospitals; Epworth targets multiple sites. (The Australian)

Top bankers vie in Paramount-Netflix Warner Bros bidding war. (AFR)

Sembcorp’s $6.5b Alinta deal faces $2bn Loy Yang mine remediation costs, split with AGL. (The Australian)

Ramelius buys Lake Rebecca tenements for $500k. (Capital Brief)

BOQ’s $3.8b equipment finance portfolio attracts bids from Apollo, Cerberus, and Blackstone; sale process extends into 2026. (The Australian)

Ausgrid plans to sell its smart metering business Plus Es, potentially raising $2–3b. (AFR)

Capital Markets

DroneShield surges on $50m European military contract. (Capital Brief)

Rio Tinto starts $294m feasibility study for Pilbara iron ore project. (Capital Brief)

Insight invests in Sydney lender Midkey to boost local growth. (AFR)

AusPayNet drops 2030 deadline to retire BECS payments system. (Capital Brief)

ACCC sues HelloFresh and Youfoodz over alleged subscription traps. (Capital Brief)

Comfresh Group hunts partner, eyes $250m valuation. (AFR)

MEQ Solutions raises $23m to expand AI red meat quality technology worldwide. (Capital Brief)

REA Group dips on Google’s new property ads, but direct traffic cushions impact. (Capital Brief)

Northern Rivers fund Tectonic holds 7% of AI firm Firmus ahead of $11.3b IPO. (AFR)

Australian consumer sentiment drops in December; households “cautiously pessimistic” amid inflation concerns. (Capital Brief)

RBA and intelligence agencies warn Australia’s payment system faces rising cyber risks amid geopolitical tensions. (Capital Brief)

Region Group ups half-year dividend to 6.9¢ as property portfolio rises $129m to $4.503b. (Capital Brief)

Regal Fund backs KTEK Systems’ $2.5M pre-IPO raise for 2026 ASX listing. (AFR)

TotalEnergies to supply Google Malaysia data centres with 1 TWh of solar power under 21-year deal starting 2026. (Capital Brief)

Databricks targets USD134b valuation with Series L funding, citing 55% YoY revenue growth and AI expansion plans. (Capital Brief)

Metrics to expand co-lending with big banks in 2026 as commercial property lending rebounds. (Capital Brief)

Ivanhoe Atlantic delays $300m ASX IPO to mid-2026 amid China-related scrutiny. (Capital Brief)

VC

IND Technology raises $50m to boost bushfire-preventing powerline fault detection. (Startup Daily)

People moves

Articore names Derek Yung as CFO effective 2026. (Capital Brief)

Lendlease CFO Simon Dixon to step down in 2026. (Capital Brief)

James Merlino named chairman of Slater and Gordon, replacing James MacKenzie amid leadership transition. (AFR)

Star Entertainment rallies after CEO Steve McCann exits. (Capital Brief)

AustralianSuper’s CIO Mark Delaney to depart after 25 years; global search for successor underway. (Capital Brief)

ANZ probes director Jane Halton after complaints about derogatory remarks on US board trip. (AFR)

Brandon Capital reveals co-MD Chris Nave is in a relationship with a departing senior staff member, stressing transparency. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler