- Letter of Intent

- Posts

- ☕️Deal Pause

☕️Deal Pause

Are tariffs making the art of the deal trickier for bankers?

Good morning.

Investment bankers, particularly those covering sectors and businesses ultra-exposed to the US import tariffs (notably retail and tech), are seeing months of blood, sweat, and tears (and fees, obvs) go down the drain as deals collapse on market uncertainty. Sure, it’s understandable that bidders probably don’t want to buy businesses that are near impossible to value thanks to the unpredictable shifting sands of trade tariffs, but is a 90-day pause enough to Make M&A Great Again?

Maybe bankers can take a smidgen of fur-lined-luxury-hope, in Prada’s decision to go ahead with its US$1.38 billion ($2.2 billion) deal to buy Versace in the face of impending tariffs.

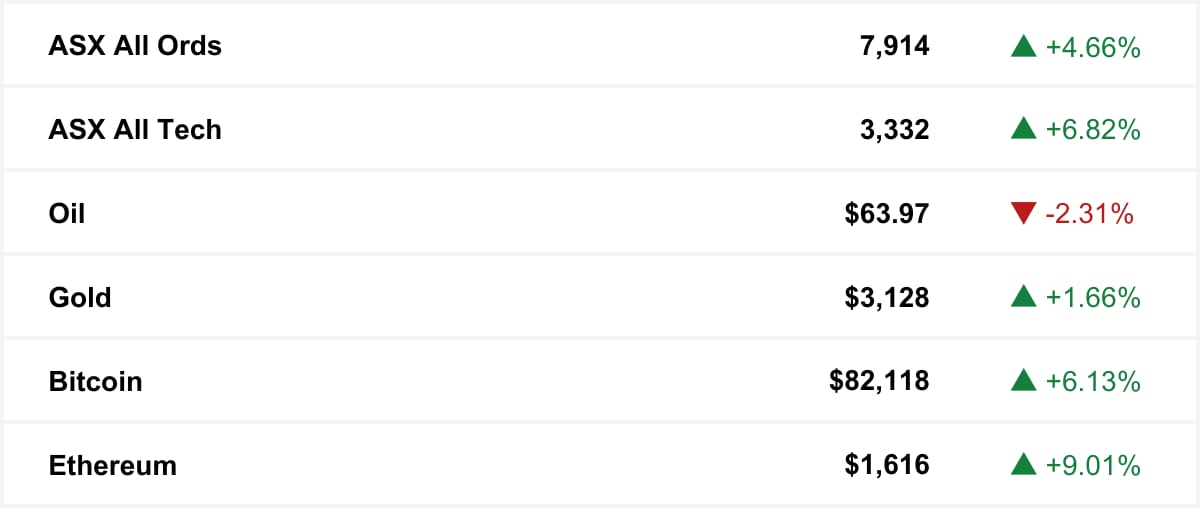

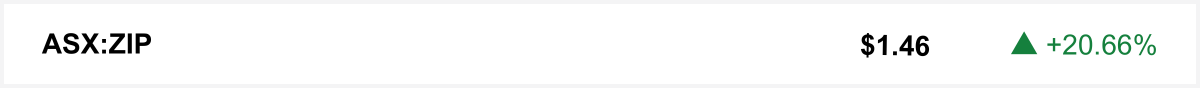

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

The stock market had its best day since the pandemic recovery after Trump’s tariff pause triggered a global rally. Tech and mining stocks led the rebound, while Zip jumped over 20% as gains from its earlier buyback announcement extended.

📍 Get the latest from the trail. Political Capital now lands every weekday during the campaign. Join Capital Brief chief political correspondent Anthony Galloway, alongside Jennifer Duke and Finn McHugh as they deliver actionable news from the campaign trail.

Sign up to Political Capital here →

(Receiving the newsletter is free; full access is just for paid subscribers.)

The quick sync

PepsiCo’s High Court tax battle could set a precedent for how Australia taxes IP-rich deals, with major implications for US tech firms. (Capital Brief)

As Flavia Tata Nardini writes, Australia is poised to lead a once-in-a-century transformation in mineral exploration, driven by AI, real-time data and sovereign space technology. (Capital Brief)

Australian VCs are bracing for extended volatility as Trump’s tariff shocks ripple through global markets, urging startups to prioritise runway, resilience and real value. (Capital Brief)

Dutch billionaire Laurens Last buys superyacht maker Heesen, betting wealthy buyers will keep the high-end market afloat despite global tariff and economic uncertainty. (Bloomberg)

Australia’s $750m property spree by international fugitives prompts sweeping crackdown on dirty money in real estate. (Bloomberg)

A MESSAGE FROM BLACKBIRD

The Sunrise Australia 2025 full program is now live!

Sunrise Australia 2025 has just released its full festival schedule! Trust us. You don’t want to miss this lineup. Sunrise is Blackbird’s love letter to founders and the beautiful things they create. A festival of creativity, technology and ambition. Where people from our startup community come together to dream up the future. 30 April & 1 May - Carriageworks.

Explore the program & get your tickets here before they’re gone!

Trading floor

M&A

Spartan to fully own Dalgaranga after $2.5m buyout of remaining stake. (Capital Brief)

EQT Partners plans to sell its majority stake in Nexon Asia Pacific, appointing Houlihan Lokey as its sell-side adviser. (AFR)

ACCC clears Qube’s $332.5m MIRRAT buyout with competition safeguards. (Capital Brief)

Steven Lew’s Global Retail Brands has acquired Salt&Pepper, bolstering his retail empire. (AFR)

Santos has been looking for LNG opportunities in the US and considered merging with Woodside but did not find a suitable deal. (The Australian)

Versace’s rebranding strategy failed, resulting in a $700m loss for Capri Holdings, which sold the brand to Prada for $1.38b. (Bloomberg)

Hicksons Lawyers is merging with Hunt & Hunt’s NSW division to cope with AI-related cost pressures, driving consolidation among smaller law firms. (AFR)

Private equity considered a bid for Endeavour Group amid market volatility, with CEO vacancy and a 35% drop in share price making it a takeover target. (The Australian)

Capital Markets

Australian dollar jumps after US tariff pause boosts market sentiment. (Capital Brief)

Trump’s 90-day tariff pause calms markets, but uncertainty still hampers business investment. (Capital Brief)

Trump's trade policies spark market chaos, leaving investors uncertain despite recent rebounds. (Capital Brief)

China's leaders meet to plan economic stimulus after Trump's tariff hike, focusing on key sectors like housing and technology. (Capital Brief)

Marles rejects China's proposal to unite against US tariffs, highlighting Australia's focus on its own interests and strengthening ties with other countries. (Capital Brief)

The EU pauses counter-tariffs for 90 days after Trump delays US tariffs, providing room for negotiations. (Capital Brief)

US stocks fell, led by tech, despite weaker-than-expected inflation data and a positive CPI report, as trade war concerns persist. (Capital Brief)

The Macquarie Australia Conference, with 1,000 investors, will focus on market volatility, fueled by Trump’s tariff pause, as Australian CEOs share insights. (AFR)

Stockland-led group to build 3,000+ homes in Waterloo, with half for social housing. (Capital Brief)

Healthscope seeks to end its involvement with the Northern Beaches Hospital due to debt and ongoing issues with the public-private partnership (The Australian)(AFR)

NAB tips 50bps RBA rate cut in May amid slowing growth. (Capital Brief)

Reddit earned $160m from Google and OpenAI for access to its content, helping train generative AI models like ChatGPT and Gemini. (AFR)

Bell Potter upgrades JB Hi-Fi to 'buy' after stock dip. (Capital Brief)

Business turnover grew modestly in February, led by manufacturing, while several industries like mining and wholesale trade declined. (Capital Brief)

Federation Mining, backed by AustralianSuper, is preparing for an ASX IPO later this year following its acquisition of Siren Gold. (AFR)

Coalition promises $20b fund for regional Australia, targeting infrastructure, health, and economic growth. (Capital Brief)

NZME hires UBS alongside Jarden to defend against activist investors aiming to replace the board and improve company performance. (The Australian)

EBOS halts trading for $184m placement, shares up 1.3%. (Capital Brief)

RBA Governor Bullock declines to comment on potential rate cuts, citing uncertainty and market volatility, but assures Australia's financial stability. (Capital Brief)

Oaktree Capital is refinancing GenesisCare’s debt, working on a new facility for the Australian business as part of a turnaround plan. (AFR)

Canva's major product launch marks a strategic shift to defend against AI competitors, expanding into productivity tools with features like Canva Sheets and Magic Studio. (Capital Brief)

Uber Eats plans to expand to 67 new regional locations by 2025, helping restaurants earn an extra $45m and doubling its regional footprint. (Smart Company)

The US House approved a Republican budget blueprint, clearing the way for significant tax cuts and federal spending reductions. (Capital Brief)

Westpac faces a PR nightmare after denying a customer’s $50k cryptocurrency transfer, citing a potential scam, but failing to provide clear reasons. (AFR)

Perpetual Private is focusing on offshore private credit markets, particularly in the US and Europe, due to the immaturity of the Australian market. (Capital Brief)

PepsiCo is fighting the ATO over royalty taxes related to its bottling agreements in Australia, a case that could impact US companies. (Capital Brief)

RayGen secured $127m in Series D funding, led by SLB, marking one of Australia's largest clean-tech raises. (BNA)

Perpetual Private shifts focus offshore as CIO Kyle Lidbury warns Australia’s private credit market is immature, high risk and exposed to growing creditor-on-creditor violence. (Capital Brief)

Prada snaps up Versace for US$1.38b in a bold challenge to global giants like LVMH and Kering, bucking market jitters and tariff-fuelled uncertainty. (Bloomberg)

A fast-escalating US–China trade war is tearing apart decades of economic ties, threatening global recession and upending supply chains worldwide. (NYT)

Market chaos and elite pressure forced Trump into a dramatic tariff U-turn, exposing cracks in his hardline trade push. (Bloomberg)

Despite federal denials, an Australian-designed weapon by EOS has surfaced in Israeli military trials, exposing loopholes in arms export oversight during the Gaza conflict. (ABC)

VC

Australian VCs advise startups to prioritize profitability and runway due to potential disruptions from Trump’s trade policies, even for software businesses. (Capital Brief)

People moves

JD Sports hires ex-Rebel Sport executive Tom Leak to lead local operations amid the upcoming competition from Sports Direct. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler