- Letter of Intent

- Posts

- ☕️ Deal drought

☕️ Deal drought

Animal spirits vanish as Aussie deal pipeline dries up.

Good morning.

The Oz had a peek at the numbers, and the chart isn’t pretty. At USD66 billion ($101 billion) year-to-date, Australia’s M&A flow is tracking below even Covid lows, despite liquidity everywhere and private equity bursting with dry powder. What’s keeping boards on the sidelines seems to be shaky confidence driven by Trump tariffs, geopolitics and frothy local valuations.

A handful of names are still in play (think CoStar taking Domain, Insignia selling, Ampol doubling down in fuel, and Caterpillar circling RPM Global). But outside these, most deals are stalling or being pulled, from Blackstone walking on Iress to Santos cooling fast. For all the talk of animal spirits, boards are risk-off and shareholders have the knives out.

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

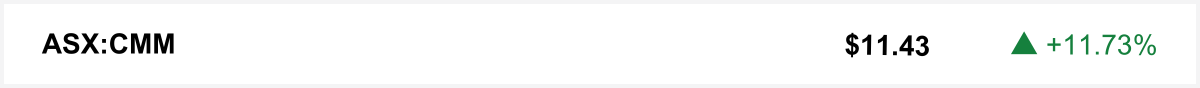

Shares in Capricorn Metals jumped over 11% on Monday to lead a rally in gold miners, with Genesis Minerals, Northern Star and Newmont also among the ASX 200’s top performers. The gains came as the broader sharemarket fell to a two-week low, while gold prices hovered near record highs on safe-haven demand and political pressure on the US Federal Reserve.

🎉 You’re invited to a party.

Join us at our unofficial start to the season: The Summit, presented with The Everest. Held on Thursday 9 October, 6pm to late in the Sydney CBD.

Spots are limited. Secure your spot →

The quick sync

Ledger sets up shop in Australia, betting on a crypto comeback and the rise of self-managed super funds. (Capital Brief)

Backed by the $3b Domain buyout, CoStar is bringing its ‘Bloomberg of real estate’ to Australia and taking direct aim at Murdoch-controlled REA. (Capital Brief)

Nuno Matos is wasting no time at ANZ, with thousands of jobs on the chopping block as he moves to stamp his authority on the struggling bank. (Capital Brief)

Dell’s CTO and AI officer John Roese says the US can’t afford to get “5G’d” again, backing Trump’s Intel stake as vital to securing future chip supply. (Capital Brief)

US President Donald Trump’s family amasses USD6b fortune after WLFI crypto token launch. (WSJ)

A MESSAGE FROM VANTA

From compliance to confidence

A robust vendor management program isn’t just a compliance checkbox for frameworks like SOC 2 and ISO 27001 — it’s a core component of a holistic trust management strategy.

In our guide, “From reactive to proactive: How to minimise third-party risk with strong vendor management,” you’ll learn:

Insights from other leaders on how to proactively manage third-party vendor risk

Tips on dealing with challenges like limited resources and repetitive manual processes

How security teams can enable business to move quickly instead of being inadvertent gatekeepers

Join 11,000 companies like Atlassian, Relevance AI, Handle, InDebted, FireAnt, Traffyk.ai, Everlab, Lumin Sports and Tactiq.io that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

MAC Copper shareholders back $1.6b Harmony Gold takeover. (Capital Brief)

West African Resources suspended over delay in disclosing Burkina Faso stake deal. (Capital Brief)

Lightsource bp nears $800m solar sale to Macquarie-backed buyer. (AFR)

Platinum hit by $580m client redemption amid merger with L1 Capital. (Capital Brief)

ADNOC nears due diligence finish on $30b Santos bid. (The Australian)

Caterpillar bids $1.1b for RPMGlobal, potentially taking the last listed mining-tech company off the Australian market. (AFR)

The Reject Shop to rebrand after its $259m acquisition by Dollarama, marking Dollarama’s entry into the Australian market. (Smart Company)

Supercars signs $200m broadcast deal, adds Toyota in 2026. (AFR)

Sodali & TPG deny sale talks despite rival approaches. (The Australian)

Capital Markets

Genesis Minerals doubles exploration budget to $40–50m after strong drilling results. (Capital Brief)

Elanor targets November ASX trading return after $125m Rockworth deal and Firmus acquisition. (Capital Brief)

Temas Resources launches IPO, pursues dual listing. (AFR)

PolyNovo halts trading ahead of response to US Medicare skin substitute reforms. (Capital Brief)

Pro Medicus wins US Veterans’ Affairs approval for cloud imaging platform. (Capital Brief)

El Jannah seeks private equity partner for 500-store expansion. (AFR)

Government launches Investor Front Door pilot to streamline approvals for major projects. (Capital Brief)

Harvey Norman surges as Citi lifts target price to $7.70 on strong earnings. (Capital Brief)

MinRes enlists Baowu, POSCO, and ACMI in WA port levy legal battle. (The Australian)

Gold stocks jump as Macquarie backs Northern Star and Genesis over Newmont. (Capital Brief)

Federation Mining shifts from IPO to private capital for NZ gold mine. (AFR)

Dell CTO backs US government’s 10% Intel stake to secure chip supply. (Capital Brief)

Revolut valuation jumps to USD75b in staff share sale. (Capital Brief)(Reuters)

Rokt valuation jumps to $7.2b, IPO talk revived. (AFR)

CoStar to debut real estate data platform in Australia after $3b Domain deal. (Capital Brief)

Ledger enters Australia to target SMSF crypto boom. (Capital Brief)

Westpac defends business lending strategy against CBA criticism. (AFR)

1.2 million immigrants are gone from the US labor force under Trump, preliminary data shows (AP)

Heloise Pratt and Alex Waislitz edge closer to peace in their $1b Thorney fight after months of acrimony. (AFR)

Under pressure Macquarie shifts commodities trading unit out of bank. (AFR)

VC

Top VCs, Airtree and Blackbird, fall short on gender diversity; women-only founders get 2% of funding. (AFR)

People moves

Worley adds ex-Incitec Pivot CEO Jeanne Johns to board, as Sharon Warburton retires. (Capital Brief)

Mike Johnson returns to Macquarie as syndication director. (AFR)

Austal founder John Rothwell retires after 38 years. (Capital Brief)

Crowdfunding platform Birchal has restructured, cutting 30% of staff and changing its pricing, favouring larger raises. (Smart Company)

Greg Chubb to replace Anthony Mellowes as Region Group CEO in 2026. (Capital Brief)

COSBOA CEO Luke Achterstraat resigns after 2.5 years. (Smart Company)

Nestlé fires CEO Laurent Freixe following probe of romantic relationship with subordinate. (WSJ)

ANZ's Nuno Matos mulls cuts of up to 5,000 jobs. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler