- Letter of Intent

- Posts

- ☕️Cool Hand Kouk

☕️Cool Hand Kouk

Scammers are making AI deepfakes of 'the Kouk' and other economists.

Good morning.

After being impersonated one too many times across Instagram, Facebook and TikTok and not making progress with complaints to the platforms, Stephen ‘The Kouk’ Koukoulas told Capital Brief he's now tempted to take matters into his own hands and send scammers messages to tease out the scheme process.

The Kouk is not alone in being the subject of scam posts impersonating him, or using clips from media appearances to suggest a scheme has his endorsement, with former ANZ and Bank of America chief economist Saul Eslake and AMP’s head of investment strategy and chief economist Shane Oliver also being targeted.

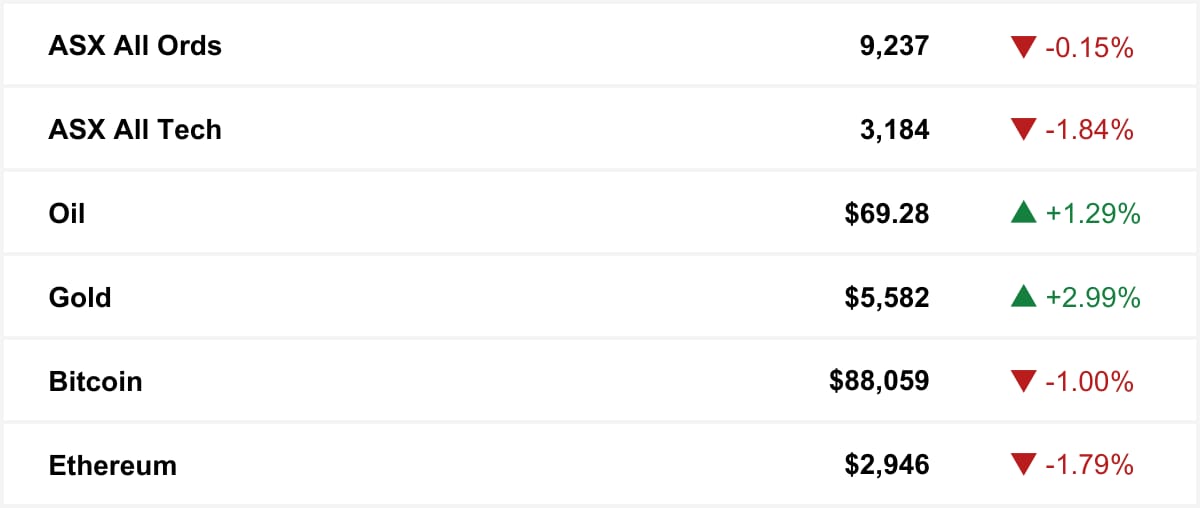

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

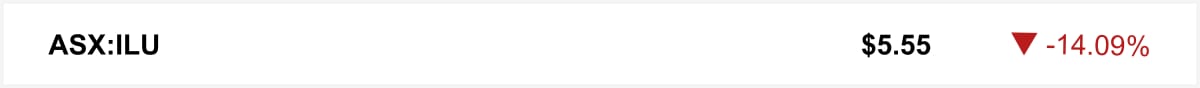

Shares in critical minerals and rare earths producer plunged Thursday after the company flagged a $565 million pre-tax hit for the year to December 31 and as reports emerged the Trump administration may abandon US price support for rare earths.

🤝 You’re in good company. You’re reading this alongside new readers from Pitcher Partners, Lendlease and Westpac. Know someone who should be reading? They can sign up here →

The quick sync

Private credit funds are hiring AI talent to improve governance as ASIC ramps up oversight. (Capital Brief)

First home buyer schemes are fuelling demand and driving up prices, creating a policy trap that could leave buyers worse off, writes Lisa Jennings. (Capital Brief)

In a make-or-break second year, NRF CEO David Gall is targeting $1.5b in investments to prove the $15b fund’s purpose. (Capital Brief)

Tesla shifts from EVs to AI-driven robots and energy systems as Musk retools the company into the physical front-end of his growing AI empire. (Capital Brief)

The EU has approached Australia to revive trade talks amid growing global instability triggered by Trump’s return. (Capital Brief)

Microsoft, Meta and Tesla are throwing billions at AI in 2026, shrugging off market jitters and doubling down on the arms race. (Capital Brief)

Trading floor

M&A

Nine Entertainment plans to sell its radio network, likely to Arthur Laundy, following last year’s Domain sale. (Capital Brief)(AFR)(The Australian)(SMH)

Macquarie negotiates with UniSuper ahead of $11.6b Qube bid. (AFR)

Rio Tinto considers Glencore merger amid investor push for more copper exposure. (The Australian)

David Vitale buys back Starward, returning brand to founder control. (Smart Company)

Mayne Pharma seeks legal costs from failed Cosette takeover. (AFR)

Musk's SpaceX in merger talks with xAI ahead of planned IPO, source says. (Reuters)

Capital Markets

Iluka beat production targets but flagged $565m in exceptional charges. (Capital Brief)

Ioneer launches $72m share raising at a discount to attract investors. (AFR)

Microsoft profits surged, but shares dropped on AI spending concerns. (Capital Brief)

Tesla beat Q4 earnings estimates, lifted shares, and unveiled a USD2b xAI investment. (Capital Brief)

Brightstar Resources launches $150m share raising to fund Goldfield hub construction. (AFR)

Meta stock jumped on an upbeat Q1 sales outlook, easing concerns over its heavy AI spending. (Capital Brief)

Mineral Resources lifted lithium output guidance on stronger production and pricing in Q2. (Capital Brief)

Specialty high-priced coffees like Good Measure’s $12 Mont Blanc are boosting cafe profits and going global. (AFR)

IGO’s lithium output and prices rose at Greenbushes, but Kwinana refinery production fell sharply and remains unprofitable. (Capital Brief)

Healthscope receivers back not-for-profit plan, reject landlord criticism. (AFR)

Coles is defending a SA class action over past employee entitlements tied to repealed holiday laws. (Capital Brief)

Alpha HPA raises $225m, including $75m from the NRF, to fund expansion of its high-purity alumina project. (Capital Brief)

Rare earth stocks drop as US cools on price support plans. (AFR)

Mayne Pharma dodged a shareholder strike at its AGM despite investor anger over the failed Cosette takeover and weaker earnings. (Capital Brief)

Early Big Tech earnings confirm AI spending is ramping up sharply in 2026, with no sign of a slowdown. (Capital Brief)

NRF profits from Liontown stake and invests $75m in Alpha HPA. (AFR)

Private credit funds are hiring AI talent to boost governance and compliance as ASIC tightens scrutiny. (Capital Brief)

Tesla exemplifies Big Tech’s AI shift by pivoting from luxury EVs to AI-powered robots and energy. (Capital Brief)

iPhone issues on Telstra worsen Triple Zero call problems. (AFR)

US trade deficit jumps to $56.8b in November as imports rise and exports fall. (Capital Brief)

Blackstone may become top shareholder of Hong Kong’s New World, aiding its debt restructuring and asset sales. (Capital Brief)(Bloomberg)

Wiluna Mining to relist via $400m IPO as gold prices surge. (The Australian)

Scammers are using AI deepfakes of economists to push fake investments online. (Capital Brief)

NRF’s David Gall plans a “year of delivery,” boosting $15b fund investments in Australian industries. (Capital Brief)

First home buyer programs are boosting demand, but risk pushing prices higher. (Capital Brief)

BNY wins dismissal of all claims in Epstein victim’s lawsuit. (Bloomberg)

Brent crude settles at highest level since July on Trump’s Iran threats. (Bloomberg)

How a BlackRock loss reignited worries about what is siding in private credit. (WSJ)

VC

Nvidia, Microsoft, Amazon in talks to invest up to USD60b in OpenAI. (The Information)

People moves

Woolworths names ex-Walmart and Google executive Jon Alferness to its board. (Capital Brief)

The top-performing trio behind Cooper Investors’ Park Road Fund have resigned and may start their own funds management business. (AFR)

Quadrant’s Simon Pither exits after 17 years, returns to UK. (The Australian)

JP Morgan Australia boosts banker bonuses and hires amid strong deal activity. (AFR)

Genesis Minerals promotes COO Matthew Nixon to CEO as part of a leadership shake-up focused on growth. (Capital Brief)

AustralianSuper hires Spencer Stuart to find new CIO after Delaney’s departure. (AFR)

UBS names Adam Quaife head of ANZ asset management. (The Australian)

Catherine Allfrey leaves WaveStone PM role, becomes strategic adviser. (AFR)

ASX names a new seven-member corporate governance advisory group, chaired by Philip Lowe, to lift oversight and risk management after regulatory concerns. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler