- Letter of Intent

- Posts

- ☕️ Conscious Uncoupling

☕️ Conscious Uncoupling

King & Wood Mallesons to split after 14 year China partnership.

Good morning.

In a tone echoing the carefully crafted words of Goop empress Gwyneth Paltrow and Chris Martin following their “conscious uncoupling” in 2014, King & Wood Mallesons (KWM) described their decision to split after 14 years as an “important strategic repositioning”.

A memo to staff announcing the split, seen by Capital Brief, was distributed ahead of a formal announcement expected over the next 24 hours.

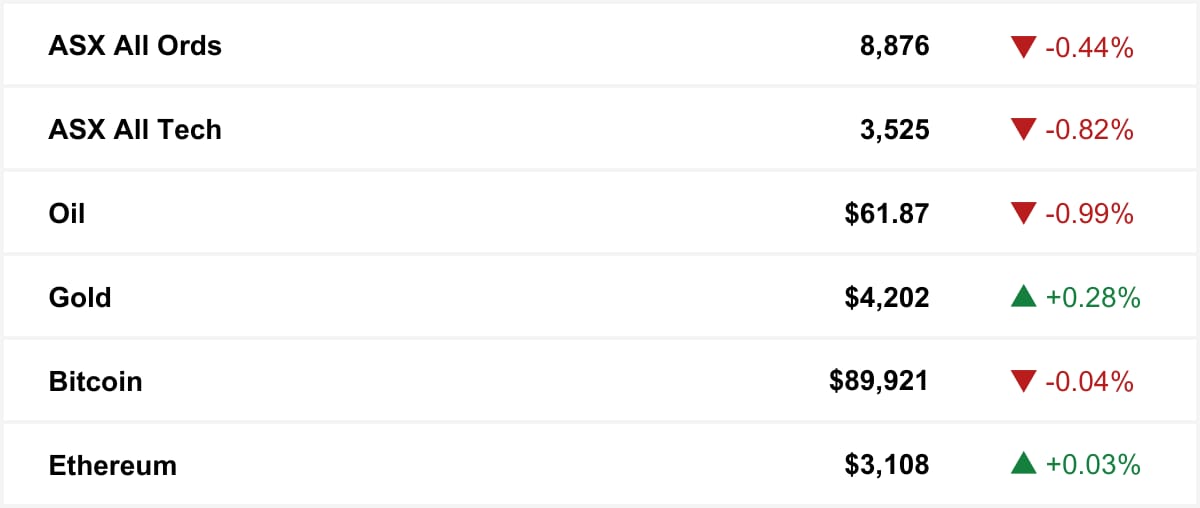

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in Bapcor plunged more than 20% on Tuesday after the Autobarn owner slashed its full-year profit guidance and flagged a first-half loss, citing weaker-than-expected trading in October and November and ongoing pressure in its Trade segment.

The update deepened investor concerns over the credibility of its turnaround plan, driving the stock to the bottom of the ASX200 and extending its year-to-date losses to nearly 60%.

🤝 You’re in good company. You’re reading this alongside new readers from KPMG, Andersen and Sodali. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Meta signs AI news deals overseas but stays silent in Australia as Labor finalises tech levy. (Capital Brief)

The NRF’s Arnott’s loan is sparking criticism it’s losing focus on backing innovative, high-risk ventures. (Capital Brief)

Fixing super rules could boost returns and drive innovation-led growth, writes Allegra Spender. (Capital Brief)

Australia’s child social media ban launches amid tech backlash and a ministerial scandal. (Capital Brief)

A MESSAGE FROM VANTA

Just released: The State of Trust: Australia

Don’t miss this deep dive into security, compliance, and the future of trust, featuring insights from Australian business and IT leaders.

Key findings:

👉 Nearly 6 in 10 say AI risks outpace their expertise

👉 65% of security teams are posturing more than protecting

But here’s the flip side:

Teams embracing AI are reaping real benefits—faster risk assessments, sharper accuracy, and quicker incident response. While others hesitate, adopters are proving outcomes matter more than optics. Read the full report.

Join 12,000 companies like Atlassian, Quantum Brilliance, Relevance AI, Instant, and Heidi Health that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

ADC acquires Canberra campus to expand secure digital infrastructure capacity. (Capital Brief)

Robex may exercise matching rights after Perseus’ takeover bid for Predictive Discovery. (AFR)

UniSuper boosts Qube stake to 9.95%, becoming a potential deal influencer in Macquarie’s $9.2b buyout. (The Australian)

Donald Trump has weighed in on Netflix and Paramount clash over Warner Bros Discovery takeover. (AFR)

Liontown signs two-year spodumene supply deal with Canmax Technologies. (Capital Brief)

PEP considers merging Opal with Estia to form a major aged-care operator with listing potential. (The Australian)

Gordon Brothers buys Barbeques Galore from Quadrant Private Equity. (AFR)

KKR weighs sale or privatization of Pepper Money after share price rally. (The Australian)

Rival bids challenge Lambo Guy’s takeover of Derrimut 24:7 Gym. (AFR)

BHP sells 49% of WAIO power network to GIP for $3b, keeping 51% and long-term production plans intact. (Capital Brief)

Capital Markets

Lifestyle Communities to introduce new DMF model after VCAT ruling voids old fees. (Capital Brief)

ASIC sues Diversa over alleged failures tied to the First Guardian fund collapse; Diversa denies wrongdoing and blames fraud. (Capital Brief)

Ore Resources launches $5m capital raise for WA gold projects. (AFR)

Bapcor cuts FY26 profit guidance after weak trading, triggering a major share price plunge and analyst concern. (Capital Brief)

TPG fronts Senate over Triple Zero outages amid probe and possible fatal incident. (Capital Brief)

Quadrant invests in New Zealand T-shirt retailer AS Colour. (AFR)

CBA fined $792k for allegedly breaching CDR rules, restricting data sharing for certain business accounts. (Capital Brief)

Coal power extended to 2049 as Australia’s grid transition costs hit $128b. (AFR)

RBA holds rates at 3.6%, rules out 2026 cuts, signals possible future hike if inflation persists. (Capital Brief)

JB Hi-Fi down 1.9% as Amazon emerges as a growing online retail threat, says RBC. (Capital Brief)

King & Wood Mallesons to split into separate Australian and Chinese firms. (AFR)

NRF faces criticism for $45m Arnott’s loan, prompting doubts about its focus on innovation. (Capital Brief)

KWM to split from China partner; Australian arm becomes Mallesons in 2026. (Capital Brief)

EU probes Google for using publishers’ content in AI, raising competition and compensation concerns. (Capital Brief)

Stonepeak lists a $300m infrastructure debt note on the ASX to tap demand from the phase-out of bank hybrids. (Capital Brief)

Brookfield and Qatar’s Qai are forming a USD20b venture to develop AI infrastructure in Qatar. (Capital Brief)

Five Sigma invests $10.5m to scale Uolo’s AI education tools across India. (Capital Brief)

China will restrict access to Nvidia’s H200 chips despite US export approval. (Capital Brief) (FT)

Microsoft commits USD23b to expand AI and cloud infrastructure in India and Canada. (Capital Brief)

Meta signs AI news deals overseas but avoids talks with Australian publishers pending Labor’s news levy plans. (Capital Brief)

Traders expect the biggest S&P 500 swing since March as a near-certain Fed cut and diverging views stir volatility. (Bloomberg)

VC

AI startup FAL hits a USD4.5b valuation after a Sequoia-led USD140m funding round. (Capital Brief)

PsiQuantum’s Brisbane quantum computer project faces delays, potentially a year behind schedule. (Startup Daily)

Fintech startup Hnry raises $30m to expand its automated fintech services in Australia and the UK. (Capital Brief)

Sydney-based alternative protein startup All G raises $10m and partners with French firm for global “cow-free dairy” expansion (Startup Daily)

People moves

PWR appoints ex-CFO Sharyn Williams as new CEO. (Capital Brief)

Iress CEO Andrew Russel open to buyout, clashing with board over shareholder sale pressure. (AFR)

Alexandra Campbell named CIO of NAB Private Wealth to lead investment strategy and JBWere oversight. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler