- Letter of Intent

- Posts

- ☕️Catching Ls

☕️Catching Ls

Traders who shorted Maersk are facing massive losses.

Good morning.

Shorting the stock of the world’s largest listed shipping company during a global trade war sounds like a pretty sure bet, Bloomberg reports, but it turns out that investors who backed the short have caught nothing but a fat L.

Just under a third of AP Moller-Maersk A/S’s free float are currently out on loan, according to S&P Global Market Intelligence, the highest level since data collection began in 2014. The measure, which is indicative of short interest, is up from about 15% at the beginning of April when Trump unleashed his trade tariffs.

After an initial dip on the tariff news, the shares are now up about 50% since and Maersk is performing solidly, even raising its 2025 forecast on growing demand outside the US.

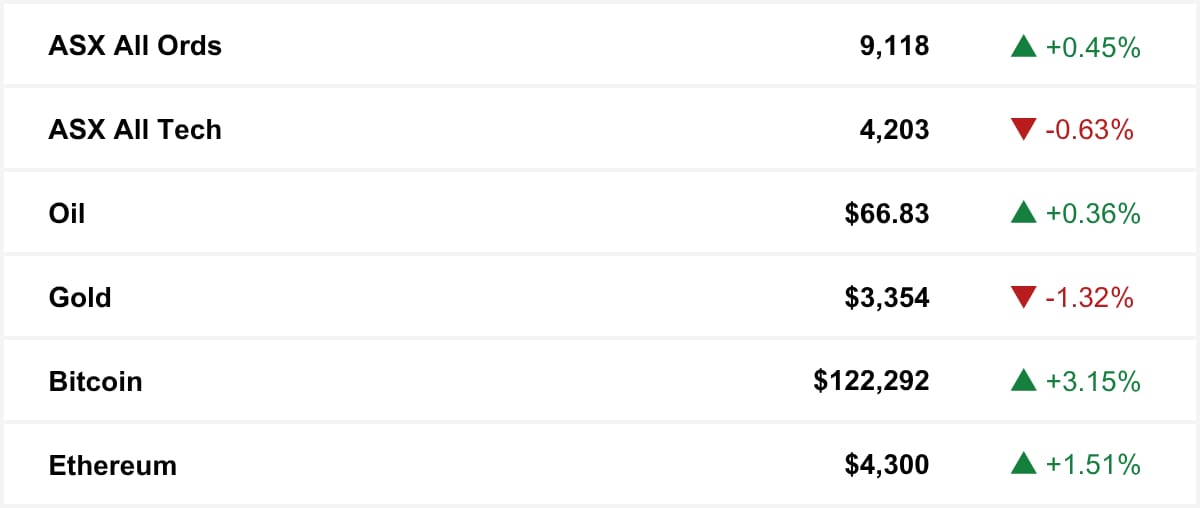

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in Pilbara Minerals skyrocketed 19.7% following reports that Chinese battery giant Contemporary Amperex Technology (CATL) suspended production at a major lithium mine.

📅 Join us On The Call: earnings season

This Thursday, the Capital Brief newsroom goes live for 30 minutes of candid conversation on what we’re watching this earnings season. Normally, On The Call is subscribers only. This week, we’re bending the rules.

Just for LOI readers, we’re offering a cheeky free trial to Capital Brief. You’ll receive the invite to Thursday’s call, plus two weeks of full access. No payment details required.

The quick sync

Meta calls leak on scraping Aussie news “bogus” yet leaves door open to having used it for AI training. (Capital Brief)

Black Sky Industries lands $3.6m boost as Vu Tran pivots from edtech to fuel Australia’s missile-making ambitions. (Capital Brief)

Victoria’s $2b taxpayer-backed innovation fund is veering off course, chasing shifting priorities with no clear purpose or plan, Will Richards writes. (Capital Brief)

Matt Comyn keeps CBA firing as rivals trip over cultural resets and leadership shake-ups. (Capital Brief)

A MESSAGE FROM VANTA

From compliance to confidence

A robust vendor management program isn’t just a compliance checkbox for frameworks like SOC 2 and ISO 27001 — it’s a core component of a holistic trust management strategy.

In our guide, “From reactive to proactive: How to minimise third-party risk with strong vendor management,” you’ll learn:

Insights from other leaders on how to proactively manage third-party vendor risk

Tips on dealing with challenges like limited resources and repetitive manual processes

How security teams can enable business to move quickly instead of being inadvertent gatekeepers

Join 11,000 companies like Atlassian, Relevance AI, Handle, InDebted, FireAnt, Traffyk.ai, Everlab, Lumin Sports and Tactiq.io that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

Spark NZ says data centre sale talks still underway. (Capital Brief)

Santos extends $30b XRG takeover talks to August 22. (Capital Brief)

Eagers Automotive teams with Mitsubishi to pursue automotive and mobility growth. (Capital Brief)

Tuas halts trading for M1 acquisition funding. (Capital Brief)

Five V Capital and UK family office Kaltroco buy BlastOne for $200m+. (AFR)

Mineral Resources and Livium partner on lithium tech commercialisation. (Capital Brief)

Paramount lands US$7.7b UFC rights, ends PPV for Paramount+. (Capital Brief)

Novomatic’s $1-per-share bid to take Ainsworth Game Technology private is likely to fail after major investors pledged to vote against it. (AFR)

Black Sky wins $3.6m in defence deals, plans rapid growth. (Capital Brief)

Accel-KKR’s Smart Communications buys Pendula. (AFR)

China’s Luye Medical revived plans to sell Aurora Healthcare’s 17 specialty hospitals. (AFR)

Capital Markets

Nvidia and AMD to give US 15% of China chip revenues for licences. (Capital Brief) (FT)

Nvidia eyes Firmus’ pre-IPO raise. (AFR)

Car Group posts $275m profit, lifts dividend, forecasts growth. (Capital Brief)

PEXA reviews digital arm, cuts guidance after impairment. (Capital Brief)

Iress profit flat, EBITDA down; guidance intact amid asset sales, takeover talks. (Capital Brief)

Waratah Minerals seeks $30m placement. (AFR)

DroneShield debuts subscription drone tracking system for civilian use. (Capital Brief)

Thiess mulls IPO amid stronger mining and coal sentiment. (The Australian)

DigiCo SYD1 gains top govt hosting certification, opening leasing to government clients. (Capital Brief)

Atmos Renewables raises $400m for Hornsdale Wind Farm buy. (AFR)

CQE swings to $71m profit, eyes 10.5% higher FY26 payouts. (Capital Brief)

NRN secures $67m for free-install solar plan. (AFR)

DigitalX to quadruple Bitcoin holdings to 2,100 by 2027. (Capital Brief)

Challenger is on track to raise $350m for its listed debt fund in just one day due to strong investor demand. (AFR)

ACCC backs Woolies–Coles-led soft plastics recycling plan. (Capital Brief)

Funds eye La Trobe stake as IPO prospects fade. (The Australian)

Bullish upsizes IPO to US$990m, eyes US$4.8b valuation. (Capital Brief)

SQM Research pulls ratings on frozen private credit funds as it puts the entire sector under review. (The Australian)

VC

Cuttable raises $4.5m bringing total seed funding to $10m. (Capital Brief)

People moves

JB Hi-Fi CEO Terry Smart will retire in October, with COO Nick Wells named as successor. (Capital Brief)

Carsales owner Car Group’s outgoing CEO Cameron McIntyre exits after 18 years, reporting a double-digit profit rise. (AFR)

Former iSignthis CEO John Karantzis will appeal a court ruling banning him for six years and fining him $1m. (AFR)

Anthony Miller’s captain’s pick sees Carolyn McCann set to take the reins of Westpac’s retail bank. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler