- Letter of Intent

- Posts

- ☕️Buy-Now, Regret-Later

☕️Buy-Now, Regret-Later

Activists team up to fight 'extremely problematic' Humm takeover.

Good morning.

Investor Jeremy Raper has ramped up his criticism of Humm Group chairman and major shareholder Andrew Abercrombie after teaming up with Melbourne fund Collins Street Asset Management in an attempt to thwart a takeover of the buy now, pay later business, Capital Brief reports.

As the third and fourth largest Humm shareholders, Raper's Raper Capital and Collins Street will use their combined 7.36% stake to heap pressure on the Humm board at next month's AGM. Raper and Collins Street plan to vent their frustrations (à la James Hardie shareholders) by voting against the re-election of directors Robert Hines and Teresa Fleming.

The drama is expected to make for an explosive AGM on 12 November which the company has closed to non-shareholders and the media, according to its notice of meeting 👀👀👀

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

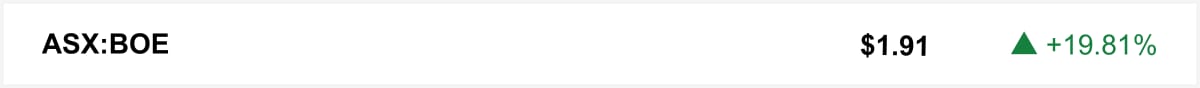

Shares in uranium miner Boss Energy jumped on Wednesday, buoyed by record quarterly production at its Honeymoon project and a surge in investor interest following the US government’s USD80 billion plan to build nuclear reactors.

🤝 You’re in good company. You’re reading this alongside new readers from HSF, KPMG and A&M. Know someone who should be here? Forward this on. They can sign up here →

The quick sync

The Daily Aus launches Futureproof to advise companies on Gen Z engagement and expand beyond media. (Capital Brief)

Rising debt and inequality are eroding the fair go and only bold reform can restore it, writes Dan Jovevski. (Capital Brief)

With AirTrunk’s $4.6b Saudi deal, warnings grow that Australia could miss the next wave of AI investment. (Capital Brief)

Labor flags tough AI trade-offs ahead as it balances innovation, productivity and regulation. (Capital Brief)

Trading floor

M&A

Rio Tinto plans a multibillion-dollar sale of non-core assets, advised by UBS and JPMorgan, to refocus on core minerals. (The Australian)

Nine’s talkback stations, including 2GB and 3AW, are attracting buyer interest as part of a strategic review. (AFR)

Igneo’s Tuatahi First Fibre is leading the NZD150m bid for Vector’s Auckland fibre assets. (The Australian)

Morgan Stanley will buy EquityZen in CEO Ted Pick’s first deal, strengthening its push into private markets as demand for pre-IPO investments surges. (Capital Brief)

TA Associates has rejoined talks to buy Perpetual Wealth Management as Oaktree remains in the race. (The Australian)

Pepper Money is close to buying Westpac’s $30b+ RAMS loan book after gaining exclusivity. (AFR)

Ipush back on a 58 cent takeover bid from Humm’s chairman Andrew Abercrombie, calling it conflicted ahead of a decisive AGM. (Capital Brief)

Capital Markets

Medibank targets $200m in annual health earnings and a higher market share by FY30. (Capital Brief)

Helia reaffirms FY guidance as Q3 claims stay “extremely low” despite lower premium volumes. (Capital Brief)

Aeris Resources is raising $85m to repay Soul Patts debt and fund exploration. (AFR)

Woolworths Q1 sales up 2.7%, boosted by ecommerce, though CEO says growth fell short of targets. (Capital Brief)

SiteMinder reaffirms FY26 outlook with ARR growth of 27.2%, beating forecasts. (Capital Brief)

Pay.com.au is raising $25m at a $600m+ valuation ahead of an ASX listing and US expansion. (AFR)

Lynas to spend $180m expanding Malaysia plant with new heavy rare earth separation facility. (Capital Brief)

Ansell lifts FY26 earnings forecast on stronger FX trends and margin gains. (Capital Brief)

Saluda Medical is launching a USD150m IPO targeting a $750–$800m valuation by December. (The Australian)

APRA issues new consultation on capital and risk rules for longevity products, including a revamp of the illiquidity premium. (Capital Brief)

NAB will lend $30b to housing developers and another $30b to first-home buyers by 2030. (AFR)

CPI rose 1.3% in Q3, lifting annual inflation to 3.2% — above forecasts and driven by higher housing and energy costs. (Capital Brief)

Nick Scali shares jumped 12% after Q1 sales rose 11.6%, outpacing peers despite slightly lower-than-expected profit guidance. (Capital Brief)

Nvidia’s Jensen Huang rejects claims of an AI bubble, arguing AI is now profitable, but upcoming OpenAI and Big Tech results will test that conviction. (Capital Brief)

Crown Resorts made its first profit under Blackstone after cost cuts and asset sales.(AFR)

US pending home sales stalled in September, held back by job market worries despite lower mortgage rates and a strong stock market. (Capital Brief)

Microsoft’s Azure and 365 services went down globally due to Azure Front Door and DNS issues, only hours before the company’s earnings report. (Capital Brief)

InfraBuild’s losses doubled to $250m, raising doubts over its future amid debt and cheap imports. (AFR)

Australia’s traditional “fair go” ethos is weakening amid high debt, housing stress, and persistent inequality. (Capital Brief)

The Daily Aus has launched a Gen Z-focused corporate advisory arm to help major companies engage younger audiences and diversify its revenue. (Capital Brief)

Wendy’s opened its Brisbane flagship as part of plans to expand to 200 Australian outlets. (Smart Company)

The Fed cut rates to 3.75%-4.00% amid mixed views, slower job growth, and elevated inflation, ending balance sheet runoff on December 1. (Capital Brief)

Boeing books USD4.9b charge as 777X jet faces new delay. (Bloomberg)

Distressed fund’s takeover of Palisades Center triggers USD231m in losses, hitting AAA bonds. (Bloomberg)

VC

Perth startup Uluu raised $16m to scale its seaweed-based plastic alternative, attracting global investors and celebrity-backed partners. (Capital Brief)

People moves

L1 Group CEO Jeff Peters exits; firm launches $330m raise to fund growth and new strategies. (Capital Brief)

Shaw and Partners hired top advisers from Macquarie and Canaccord, including $1b manager Toni Bozinovski. (AFR)

Uniseed CEO Peter Devine will step down in 2025, with Monash’s Alistair Hick to succeed him. (Startup Daily)

ASIC is probing WiseTech chair Richard White and executives over suspected insider trading. (AFR)

PwC leak probe head Michael O’Neill is moving from TPB CEO to a junior role at the charities regulator. (AFR)

ASX CHESS project head Clive Triance to retire in June 2026 after Release 1 launch. (Capital Brief)

UBS hired FTI’s Vaughan Strawbridge and White & Case’s Timothy Sackar to assess First Brands’ bankruptcy impact in Australia. (AFR)

Ex-DNR manager Scott Kelly joins Jarden’s Brisbane equity sales team. (AFR)

James Hardie investors ousted chair Anne Lloyd and two directors over the $14b Azek deal. (AFR)

Cable billionaire John Malone to step down as chair of Liberty empire. (FT)(Bloomberg)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler