- Letter of Intent

- Posts

- ☕️ Brain drain

☕️ Brain drain

Some think global tech can’t be built from Australia.

Good morning.

Aussie AI founders are ditching the build-from-home fantasy and heading to San Francisco, fast. The capital’s bigger, the customers are local and apparently serious players are expected to be on the ground.

"I think if you're not super ambitious, you can be in Australia. I think if you're super ambitious, you need to be here," Max Marchione, CEO of Superpower, an AI health startup, told Capital Brief’s Bronwen Clune.

How fast they’re moving, who’s funding them and why some teams are staying home is where the story gets interesting.

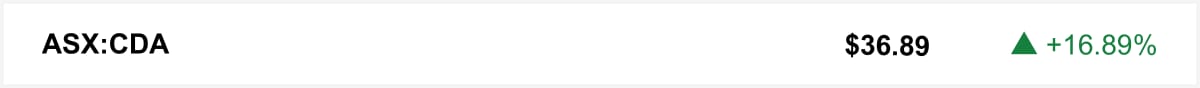

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in technology group Codan jumped Friday after the company told the ASX it expects first-half underlying net profit to rise 52%, supported by growing demand for metal detection equipment.

🤝 You’re in good company. You’re reading this alongside new readers from Jefferies, Grant Thornton and Citi. Know someone who should be reading? They can sign up here →

The quick sync

Trump’s Greenland push exposes a US bid for AI dominance via Arctic infrastructure and resources. (Capital Brief)

US inflation and bank earnings set to drive markets as new data tests the pulse of Australian spending. (Capital Brief)

Albanese’s royal commission U-turn, One Nation’s polling surge, Trump’s Venezuela shock and BlueScope’s rejected bid, all point to a volatile 2026. (Capital Brief)

Rio Tinto’s talks with Glencore clash with its new cost-focused strategy and have caught investors off guard. (Capital Brief)

One Nation matching Coalition support puts pressure on Sussan Ley to balance her immigration pitch. (Capital Brief)

A MESSAGE FROM NOTION

Australian workers want more from current AI tools

AI adoption and spend is surging in APAC, forecast to hit $175B by 2028, yet returns lag as tools and workflows miss productivity promises. New research positions Australian workers as optimistic about AI tools, but 69% face an outcomes gap from quality, handoffs, and trust. The fix: agentic AI that finishes the busywork for you. Read more.

Trading floor

M&A

Rio Tinto slumped after confirming early merger talks with Glencore. (Capital Brief)

Rio Tinto’s $300b Glencore merger talks spark shareholder concern, shares fall 6%. (Capital Brief)

UniSuper’s stake build raises pressure on Macquarie’s Qube takeover bid. (AFR)

SIMPEC won an $11m contract for construction work at Tianqi’s Kwinana lithium plant. (Capital Brief)

AustralianSuper backs BlueScope’s rejection of $13b takeover offer. (Capital Brief)

Bids are due for Garnaut-backed renewable energy firm Zen Energy. (AFR)

AMP weighs bidding for Colonial First State in major M&A deal. (AFR)

ctrl:cyber hits $100m milestone with elevenM acquisition. (AFR)

Capital Markets

Strava has filed for an IPO and appointed Goldman Sachs to lead the process. (Capital Brief)

Aristocrat lifted its share buyback to $1.5b. (Capital Brief)

UK weighs banning X over Grok AI sexualised image concerns. (AFR)

Indonesia temporarily blocks access to Grok over sexualised images. (Reuters)

Codan surged after forecasting a 52% rise in first-half profit. (Capital Brief)

KFC tests breakfast menu with Brekkie Tower burger in Sydney. (AFR)

Mesoblast jumps on 60% revenue growth from Ryoncil sales. (Capital Brief)

China’s annual inflation hits 3-year high at 0.8%. (Capital Brief)

Morgan Stanley bonuses surge, kicking off Wall Street pay season. (AFR)

eSafety flags X over Grok AI creating sexualised deepfakes. (Capital Brief)

Meta secures multi-gigawatt nuclear deals to power US AI data centres. (Capital Brief)

US adds 50,000 jobs in December as labour market cools. (Capital Brief)

Piercing and jewellery chain SkinKandy lines up bankers for a $400m ASX float. (AFR)

Vestas Australia bullish on Australia’s wind-farm growth and 2030 renewable target. (AFR)

Star Entertainment shuts head office, moves management to casinos. (AFR)

Meta removes 544,000 underage accounts after Australia’s social media ban. (Capital Brief)

Labor hospital funding plan could push 560,000 off private cover. (AFR)

VC

None

People moves

The US Securities and Exchange Commission drops long-running fraud case against former Rio Tinto CFO Guy Elliott. (AFR)

Australian AI founders are returning to San Francisco to chase growth and funding. (Capital Brief)

Peter Fox on leave as Linfox non-family directors take charge. (AFR)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler