- Letter of Intent

- Posts

- ☕️Bought the Dip

☕️Bought the Dip

Morgan Stanley’s minted clients bought the tariff dip.

Good morning.

Wall Street firm Morgan Stanley said that its wealthy clients “bought the dip” after Trump’s tariffs unleashed bedlam across markets in April. The FT reports that net new assets at the bank’s wealth business came in at a not too shabby US$59.2 billion ($90.5 billion) in the quarter.

The lender posted a 15% increase in Q2 income to US$3.5 billion, courtesy of its wealth management and trading units…and no thanks to its investment banking division which (unlike its bulge bracket counterparts) posted a 5% decline in revenues which it blamed on “lower completed M&A transactions.”

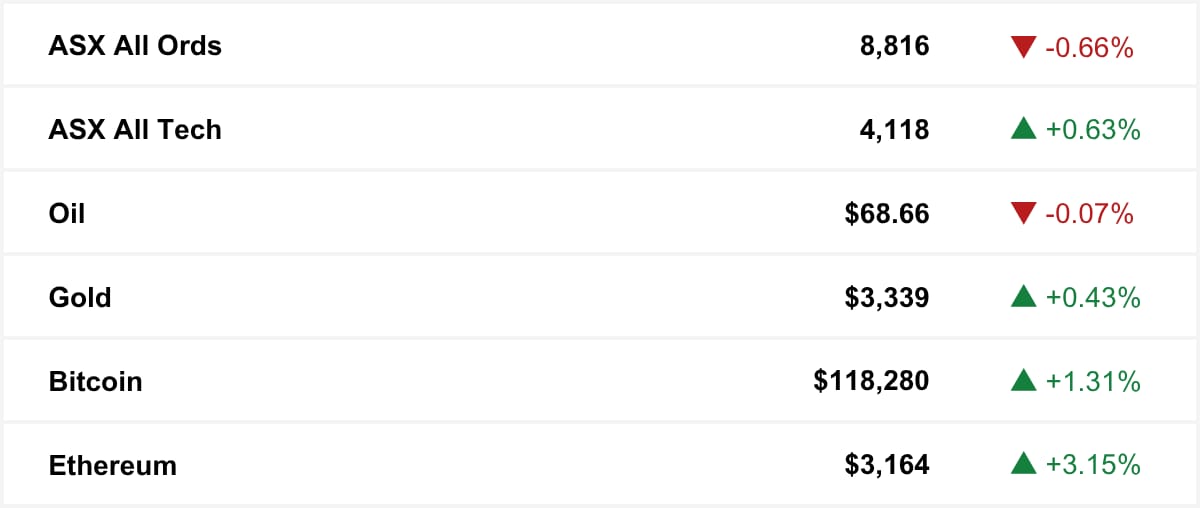

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

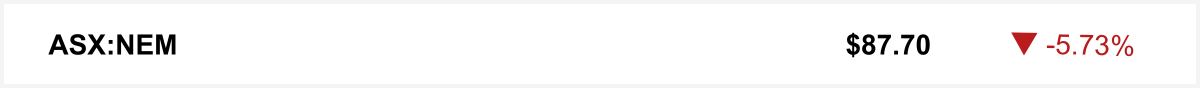

Market movers

Shares in Newmont fell Wednesday after the miner sold $470m in non-core assets and announced the sudden resignation of its CFO Karyn Ovelmen earlier this week.

The quick sync

Startup share trading is heating up, but a former ASX boss says Australia's secondaries market is too small, too tricky and may not stack up. (Capital Brief)

After a 17-year run and a 153% stock rally, Energy One boss Shaun Ankers is stepping aside, leaving big shoes to fill at one of the ASX’s hottest small caps. (Capital Brief)

Australian M&A is off to its strongest start since 2021, but the surge hinges on a single, uncertain $36.4b Santos deal. (AFR)

NYC mayoral candidate Zorhan Mamdani meets with NY’s business elite, grilled on tax hikes but stands firm on radical reforms as mayoral race heats up. (Bloomberg)

Mastercard and Equifax launch Open Score, the first credit rating tool built on Australia’s open banking regime. (Capital Brief)

A MESSAGE FROM BIRD & BIRD

Unlocking the EU Data Act: The Impacts for APAC

Bird & Bird, global tech & data law experts, are hosting a webinar diving into the EU Data Act which will come into force on 12 September. The EU Data Act will reshape data practices for all organisations and getting across this legislation is mission critical for Australian and APAC businesses. Register here to get ahead of the changes coming.

Trading floor

M&A

Lendlease secures Sydney site for $2.5b luxury apartment project, targeting 2027 build and 2030 completion. (Capital Brief)

Australian M&A up 97% in H1 2025, best start since 2021. (AFR)

Northern Star offloads 50% Central Tanami stake to Mount Gibson for $50m. (Capital Brief)

Endeavour scraps key Woolworths split plan. (AFR)

GemLife acquires eight Aliria projects in $270m deal, adding 2,200 sites. (Capital Brief)

Lactalis is leading the race to buy Fonterra’s $2b Mainland Group, while Bega’s role remains unclear. (The Australian)

CVC to buy stake in $2.1b Australian pubs group, Australian Venue Co. (AFR)

Newmont sells $470m in non-core assets, narrows focus to key gold and copper projects. (Capital Brief)

Healthscope plans to bid for itself and go not-for-profit to cut tax and keep its hospital network. (AFR)

Mable seeks $1b sale despite profit concerns. (The Australian)

Betr launches scrip bid for PointsBet, valuing shares up to $1.89 with synergies. (Capital Brief)

Santos’ $6.3b cleanup liabilities pose risk to ADNOC’s $36.4b takeover bid. (AFR)

Capital Markets

La Caisse invests $307m in QIC’s US-based renewables firm Renewa. (Capital Brief)

Rio Tinto beats Q2 production estimates with record iron ore and 13% copper growth. (Capital Brief)

Orica raises $599m in US private placement to refinance debt and extend maturity profile. (Capital Brief)

Evolution Mining hits FY25 targets with record cash flow; expects lower FY26 capital spend. (Capital Brief)

Magellan Powertronics seeks $15m to expand WA battery manufacturing. (AFR)

Iluka and Lynas rally after MP Materials secures $765m recycled rare earths deal with Apple. (Capital Brief)

Home building lifts in Q1 2025, but still trails pace needed for 1.2m housing target, says Master Builders. (Capital Brief)

Lumos shares surge 155% on $487m FebriDx deal with PHASE, pending FDA waiver. (Capital Brief)

Iron ore tops US$100, lifting Rio and Fortescue shares. (Capital Brief)

Bank of America posts record trading revenue, beating Q2 estimates despite lower investment banking fees. (Capital Brief)

Goldman Sachs profit jumps 22% on record trading and strong advisory fees amid tariff-driven market volatility. (Capital Brief)

KPMG audit unit surges as ex-staff flood boards; Macquarie eyes $750m PwC replacement. (AFR)

Morgan Stanley Q2 profit up 15%, fueled by wealth and trading gains amid tariff volatility; investment banking lags. (Capital Brief)

Mastercard and Equifax launch Open Score, the first credit product using Australia’s open banking system, aiming to replace screen scraping. (Capital Brief)

HBO Max to boost Aussie content despite stalled local quota rules. (Capital Brief)

NAB’s tidy growth narrative is being tested, with leadership churn and chatter around boss Andrew Irvine causing investor angst. (Capital Brief)

Trump Jr-backed online gun retailer GrabAGun slumps on NYSE debut, testing investor appetite for the rising 'anti-woke' economy. (FT)

VC

Ex-ASX exec doubts the sustainability of Australian startup share-trading platforms like FloatX and PrimaryMarkets. (Capital Brief)

Birchal’s Matt Vitale launches New Dialogue, a secure AI platform for regulated industries. (Startup Daily)

People moves

DFCRC names Elizabeth Reed and Tālis Putniņš as new co-CEOs. (Capital Brief)

New Rio Tinto CEO Simon Trott to drive global simplification, job cuts, and exec overhaul. (AFR)

Monash IVF has appointed Andrew MacLachlan as interim CFO, allowing current CFO Malik Jainudeen to focus on acting CEO duties. (Capital Brief)

Cue Clothing is restructuring under Hilco Capital, adding industry veteran Eric Morris to its board amid leadership changes. (The Australian)

Future Fund’s Peter McCosker exits, rejoins ADIA, leaving key role open. (AFR)

Energy One CEO Shaun Ankers to step down after 17 years, following major share price gains. (Capital Brief)

News Corp-REA tensions stall CEO search ahead of Owen Wilson’s 2025 exit. (AFR)

Myer’s Olivia Wirth hires the former boss of Cue and Veronika Maine, Simon Schofield, to run the department store’s private label fashion lines and Sass & Bide.(The Australian)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler