- Letter of Intent

- Posts

- ☕ Botox bidding war

☕ Botox bidding war

Open AI wants to turn ChatGPT into a “supersmart personal assistant for work”

Good morning.

Open AI reportedly wants to turn ChatGPT into a “supersmart personal assistant for work” capable of drafting emails and documents and who knows what else for users.

It sounds pretty like useful tool but also could be awkward for Open AI, pitting the company against its key partner and investor, Microsoft.

—

ps. if this was forwarded to you, you can sign up for LOI at letterofintent.com.au

LOI Subscriber #TBD

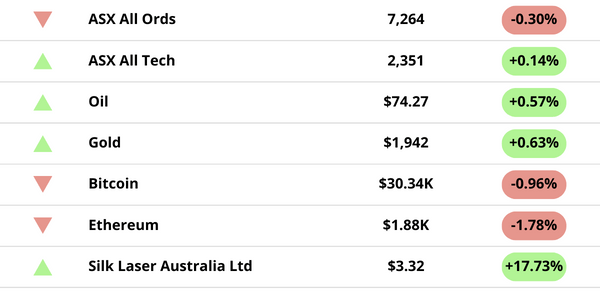

MARKET MOVERS

*Stock data as of the market close. Commodities and crypto data in USD.

Market News: Shares of small cap Silk Laser Australia caught a bid after Wesfarmers subsidiary API (the owner of the Priceline pharmacy chain) lobbed a fresh $180 million offer for the company.

Silk Laser Australia one of the country’s largest owners of botox and laser hair removal clinics - a booming and controversial corner of the economy - which has obvious potential to compliment Priceline’s business. Yesterday’s rise lifted the stock to within a whisker of the $3.35/sh bid price.

Only a few weeks ago Wesfarmers walked away from talks with Silk Laser after its initial bid was gazumped by EC Healthcare, a relatively small and obscure Hong Kong firm. The Perth conglomerate is now back in the driver’s seat, unless EC Healthcare (which has a market cap of ~ $1bn vs Wesfarmers $55bn) decides to return with another offer.

THE QUICK SYNC

Open AI is planning a ChatGPT for work, putting it on a collision course with its primary partner Microsoft (The Information)

Oil markets breathed a sigh of relief overnight after Russian mutiny was aborted (CNBC)

China’s ‘Tesla killer’ has stumbled in the EV pricing war (WSJ)

Hollywood stars Ryan Reynolds and Rob McElhenney have acquired a 24% stake in the Alpine F1 team from Renault for €200 million (Guardian)

Goldman Sachs has nominated a former trading boss and ally of CEO David Solomon its board of directors (FT)

TRADING FLOOR

M&A:

The board of SILK Laser Australia unanimously recommended that shareholders approve an $180 million acquisition offer from Wesfarmers’ Australian Pharmaceutical Industries (API). (Reuters)

EC Healthcare could still return with a higher offer as it secures the funding for a bid in SILK Laser Australia. (The Australian)

Perenti’s $300m-plus acquisition of DDH1 could be the start of more scrip mergers in the mining services sector (The Australian)

UK stockbroker SI Capital has lined up backers for a tilt at BWX Australia (AFR)

Morgan Stanley is looking at the possibility of hiving off of its lower-value accounts to Ord Minnett as part of a strategic review. (AFR)

PwC Australia’s restructuring unit could be the next in line to be sold after its government advice unit’s deal with Allegro. (The Australian)

Capital Markets:

Barrenjoey was mandated for Tamboran Resources’ $70m equity raise. (AFR)

Fifth Estate Asset Management has locked in $60m for its second pre-IPO fund. (AFR)

Global Alternatives Fund is in the final stages of closing an investment into Brazil’s FitzWalter Capital Fund II. (AFR)

One of the major lenders to Quadrant Private Equity’s Pacific Hunter has distanced itself from the hospitality business ahead of an EOFY refinancing deadline (AFR)

VC:

Nullify, a cybersecurity startup, has raised $1.1m in a pre-Seed round led by OIF Ventures. (StartupDaily)

Others:

Immutable has slashed the strike price for options held by employees by almost two-thirds. (AFR)

Jarden has hired Credit Suisse’s Doron Kur for its equities research team. (AFR | The Australian)

Cath Bowtell will replace Greg Combet as chair of IFM Investors (Investor Daily)

Danny Younis resigned from Shaw and Partners and is due to pop up at Automic Markets as an executive director. (AFR)

Baker McKenzie has hired Norton Rose Fulbright partners Emanuel Confos and Harriet Oldmeadow. (AFR)

Kyle Macintyre of Firetrail Investments is hired by Pinnacle Investment Management to lead its $22.2bn retail business. (AFR)

THE WATERCOOLER