- Letter of Intent

- Posts

- ☕️ Bonus Hold-up

☕️ Bonus Hold-up

ANZ delays bonus cheques for laid-off staff.

Good morning.

In this week’s instalment of ANZ’s HR blunders, former employees of the big four bank were expecting to receive their final payments from the bank on Wednesday, but have been told they will have to wait another two weeks to receive their final bonus cheques.

"There'd be a number of people in a tight spot after losing their job who would really be holding out for this", an anxious irate former ANZ employee told Capital Brief.

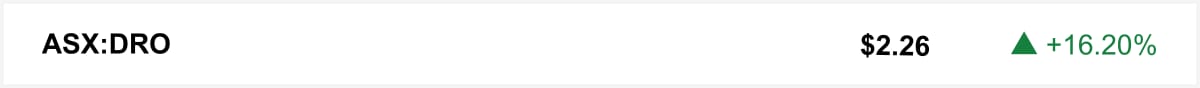

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in DroneShield jumped Wednesday, after a steep month-long slide, as retail investors moved back into the stock. The rally follows a 30% drop triggered by share sales from CEO Oleg Vornik and other executives.

🤝 You’re in good company. You’re reading this alongside new readers from KPMG, Andersen and Sodali. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Fourteen percent of Westpac shareholders backed a climate resolution, signalling growing pressure on NAB and ANZ. (Capital Brief)

KWM’s chaotic split lays bare the failure of its China tie-up and the future direction of Mallesons. (Capital Brief)

Mayne may head to court over Cosette’s termination of their failed $600m deal and possible claims beyond the $6.72m break fee. (Capital Brief)

Labor’s female candidate quotas delivered equity, but some now want them scrapped. (Capital Brief)

UK’s Earthly launches $100m WA fund to boost carbon credit integrity. (Capital Brief)

A MESSAGE FROM THE INTERNATIONAL

Craft Extraordinary Client Experiences at The Grill

Want to offer your clients something no one else can? The Grill at The International in Martin Place combines world-class dining with tailored, high-touch experiences – from sommelier-curated tastings and winemaker meet-and-greets, to bespoke cocktails and food stations, and tableside service by Culinary Director Joel Bickford. Discover what’s possible.

Trading floor

M&A

The ACCC blocked IAG’s $1.4b RAC Insurance takeover over competition concerns, and IAG will pursue approval under the new merger rules. (Capital Brief)

Mayne Pharma ended its deal with Cosette, blaming Cosette’s breaches for the failed takeover and refusing to pay the break fee. (Capital Brief)

Mayne and Cosette may go to court over disputed takeover break fees. (Capital Brief)

BGH Capital eyes Webjet’s $110m cash in $357m takeover bid. (The Australian)

Predictive Discovery rejects Perseus, amends Robex deal with new share terms. (Capital Brief)

Sembcorp buys Alinta Energy for $6.5b to boost Australian renewables. (Capital Brief)

Bob Iger says Netflix-WB deal may give streamer too much pricing leverage. (Variety)

Capital Markets

AE urges Westpac to restore stricter Paris-aligned climate lending standards. (Capital Brief)

Transurban proposes scrapping admin fees and supporting NSW’s upcoming toll cap reforms. (Capital Brief)

ACCC to probe Patrick and DP World over high container fees. (AFR)

Myer sales rise 3% and Solomon Lew secures a board seat, boosting shares. (Capital Brief)

Medallion Metals raises $55m to fund Ravensthorpe Gold Project. (AFR)

AMP settles long-running advice commissions class action for $29m. (Capital Brief)

HESTA apologises after APRA adds licence conditions due to poor oversight and service issues during its admin provider transition. (Capital Brief)

Oracle shares fell after disappointing cloud sales and rising AI costs worried investors. (Capital Brief)

Ellerston-backed Whiskey Project Group plans ASX IPO with $7m pre-IPO raise. (AFR)

HomeCo Daily REIT gained $219m in valuations and reaffirmed its FY26 outlook. (Capital Brief)

Wisr pilots tokenised ABS under Project Acacia, with results expected in Q1 2026. (Capital Brief)

Secrets Shhh jewellery enters administration after 25 years, seeks sale or recapitalisation. (Smart Company)

Flight Centre jumps after acquiring UK cruise agency Iglu to boost cruise business. (Capital Brief)

HSBC scales back sale of Australian retail loan book after full-sale plan stalls. (AFR)

KWM China and Australia announce split amid internal confusion and misalignment. (Capital Brief)

Bupa fined $35m for misleading health insurance entitlements and unfair claims conduct. (Capital Brief)

Healthscope CEO opposes private equity sale amid $1.6b debt struggles. (AFR)

Origin Energy invests $80m to expand Eraring battery, boosting capacity to 700 MW. (Capital Brief)

Westpac comes under shareholder pressure over climate at AGM. (Capital Brief)

Amart Furniture hires Jarden and Jefferies for $1b ASX listing. (The Australian)

Airwallex to invest $590m to grow UK and EMEA operations. (Capital Brief)

Disney invests $1b in OpenAI, licenses 200+ characters for Sora AI videos. (Capital Brief)

ANZ delays final pay cheques for laid-off staff by two weeks. (Capital Brief)

Altman expects OpenAI’s exit of ‘code red’ by January after GPT-5.2 model launch (CNBC)

Rivian shares fall after unveiling AI chip for automated driving, ditching Nvidia. (Bloomberg)

Investors say Elon Musk's SpaceX trading debut will be 'craziest IPO' ever. (Reuters)

Novo Nordisk is trading as if the obesity drug craze never happened. (Bloomberg)

Eli Lilly’s experimental obesity shot cut body weight by 23%, potentially making it the most effective drug yet. (Bloomberg)

BlackRock’s crew of quant PhDs are On Track for a Record Year. (Bloomberg)

Microsoft's AI head Mustafa Suleyman says giant now building its own superintelligent AI. (Bloomberg)

China and EU countries block US carve-out from global tax deal. (FT)

VC

UK startup Earthly launches WA fund to boost carbon credit integrity via biodiversity projects. (Capital Brief)

People moves

Damian Kassabgi joins Bradfield Development Authority board after leaving Tech Council. (Capital Brief)

Aware Super hires bankers for $3b Victoria land titles registry. (AFR)

Macquarie Capital sees senior departures, raising questions about Joyce’s leadership. (AFR)

Bank of America promoted 387 to MD, up 16%, with over half from underrepresented groups. (Bloomberg)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler