- Letter of Intent

- Posts

- ☕️Big Four-Played

☕️Big Four-Played

NAB culls consumer finance team post Citi Australia integration.

Good morning.

NAB quietly axed one of its consumer finance teams as it finally completes the migration of Citigroup's Australian retail assets, a spokesperson from the big four bank confirmed to Capital Brief.

NAB acquired Citigroup's Australian consumer banking business in June 2022 for $1.2 billion.

The bank is eliminating 14 roles within its personal banking division, including senior leadership figures, while more than a dozen other staff members will be redeployed within the bank after consultation. Four personal banking execs will leave NAB as part of the restructure, having been attached to white label roles across cards, personal lending and consumer sales, reducing the senior leadership team's headcount from 13 to nine.

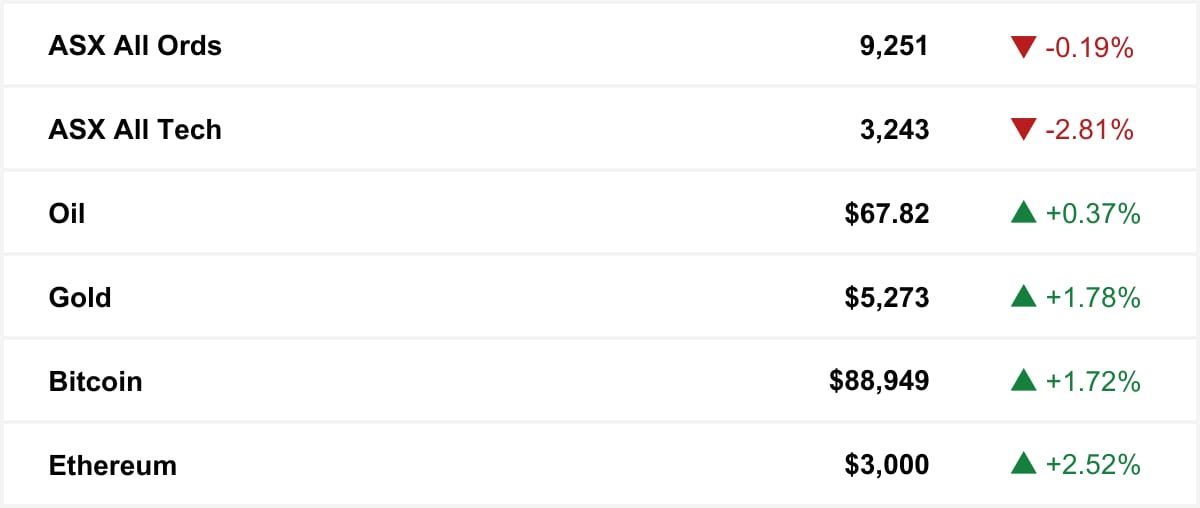

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

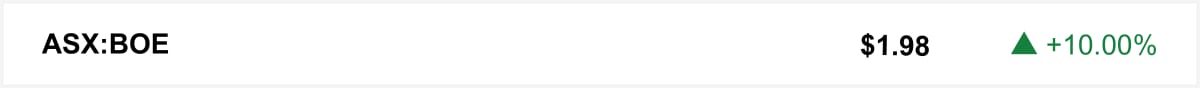

Shares in uranium producer Boss Energy surged Wednesday after it cut cost guidance for its Honeymoon mine, reporting strong December quarter production that lifted inventory and supported a solid cash position.

🤝 You’re in good company. You’re reading this alongside new readers from Pitcher Partners, Lendlease and Westpac. Know someone who should be reading? They can sign up here →

The quick sync

A surprise inflation jump has markets tipping a rate rise and intensifying pressure on the treasurer over rising spending. (Capital Brief)

Market views are split on the Aussie dollar’s rise, but it is fuelling a commodity rally that could drive ASX miners higher. (Capital Brief)

Australia’s top VCs are sitting on record funds but investing selectively as AI drives deal flow and raises the bar for startups. (Capital Brief)

US Fed Reserve holds rates steady as Trump-aligned governors dissent in favour of cut. (Capital Brief)

ASX faces its first annual shrinkage since 2005 as takeovers outpace new listings. (AFR)

Trading floor

M&A

Glencore directors have little skin in the game amid Rio Tinto merger talks. (AFR)

Blackstone delays Iress buyout amid price and earnings review. (The Australian)

Allevia Hospitals may be sold, drawing Australian investor interest. (The Australian)

Smartgroup eyes scrip merger with FleetPartners amid PE interest. (The Australian)

Capital Markets

Mastercard successfully tested AI-driven autonomous shopping in Australia, putting the country at the forefront of agentic e-commerce. (Capital Brief)

GigaComm raises $65m and names new CEO for expansion. (AFR)

Ampol’s sales fell, but higher refining margins are driving stronger profits. (Capital Brief)

Energy Transition Minerals seeks $20m to pursue Nasdaq listing. (AFR)

Woodside topped production targets with a record full-year output. (Capital Brief)

IT services firm Interactive seeks equity partner to drive growth and M&A strategy. (AFR)

Greatland’s revenue rose on higher prices, even as gold sales declined. (Capital Brief)

Koala preps $400m IPO, emphasizing growth beyond mattresses. (AFR)

ASX raised expense growth guidance to fund reforms and technology upgrades. (Capital Brief)

AUB raised $400m to fund its takeover of Prestige. (Capital Brief)

Boss Energy lowers Honeymoon costs and posts record uranium output. (Capital Brief)

BlueScope shares rise despite Steel Dynamics’ buyout push. (The Australian)

Short-term rental platform Hometime raises $19m to fuel acquisition growth. (AFR)

December inflation boosts bets on an RBA rate hike next week. (Capital Brief) (Capital Brief)

Victor Churchill to launch steakhouse at Crown Melbourne. (AFR)

ASML hits record orders on AI demand and plans continued growth. (Capital Brief)

The Australian dollar has risen to a three-year high against the US dollar, potentially benefiting ASX mining stocks. (Capital Brief)

Rokt rules out IPO in 2026 amid AI anxiety. (AFR)

Former Lazard deal maker Justin Kim negotiates guilty plea to insider trading charges. (Bloomberg)

UK bond rule changes give US credit investors earlier price signals and could lower trading costs. (Bloomberg)

VC

Australian VCs have record capital and are investing cautiously amid the AI boom. (Capital Brief)

Checkbox AI, an Australian artificial intelligence software start-up, secures $32m funding, valued over $100m for US expansion. (AFR)

People moves

Vanessa Guthrie has joined Cleanaway’s board, strengthening it with her broad leadership and industry experience. (Capital Brief)

Domino’s added Judith Swales to its board amid ongoing board renewal. (Capital Brief)

Chinese investor seeks Northern Minerals chair’s removal. (AFR)

Carmel Monaghan joins Regis Healthcare’s board. (Capital Brief)

Myer trims a third of management jobs at Apparel Brands. (AFR)

Rod Finch is named CEO of Bank of Queensland. (Capital Brief)

Square Peg partner James Tynan has left the VC firm after five years, including 2.5 years as a partner. (Startup Daily)

Amazon confirms 16,000 job cuts following accidental email leak. (Capital Brief)

Baker McKenzie hires IP litigator Dean Gerakiteys from Clayton Utz. (AFR)

NAB has cut 14 consumer finance roles and redeployed others as it completes the integration of Citigroup’s Australian retail business acquired in 2022. (Capital Brief)

Africa’s Dangote Industries appoints MTN CEO Ralph Mupita to fertilizer unit board with IPO plans. (Bloomberg)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler