- Letter of Intent

- Posts

- ☕️ BHP-Anglo reloaded

☕️ BHP-Anglo reloaded

BHP’s fresh copper push puts pressure on Anglo-Teck vote

Good morning.

Bloomberg broke overnight that BHP’s taken another swing at Anglo, pitching a cleaner, part-cash deal to break up the Anglo-Teck merger before the 9 December vote. It’s not officially public yet, but apparently Anglo’s been notified and the structure this time is less convoluted than last year’s failed USD49 billion ($74.9 billion) play.

There’s a break fee of course, but the timing is sharp. Anglo has now offloaded platinum and is prepping exits from coal and diamonds, making it a far tighter copper story and exactly what BHP’s after. Good luck!

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

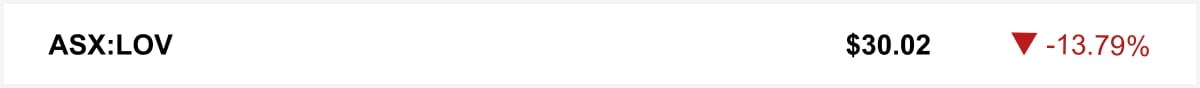

Shares in jewellery retailer Lovisa sank on Friday after the company reported a slowdown in like-for-like sales growth to 3.5% for the first 20 weeks of FY26. That was below market expectations, despite a 26% rise in total sales driven by global store expansion.

🤝 You’re in good company. You’re reading this alongside new readers from Corrs, AustralianSuper and Pitcher Partners. Know someone who should be here? Forward this. They can sign up here →

The quick sync

CBA follows Macquarie in curbing trust lending amid growing concern over risky borrowing. (Capital Brief)

Australia’s first full monthly CPI is due, but economists see little chance it alters the RBA’s next move. (Capital Brief)

Labor turns to Greens to pass streaming quotas amid rising US opposition. (Capital Brief)

Labor is seeking business support to secure enduring reforms and position itself as the long-term party of government. (Capital Brief)

Stephen Gageler says First Nations justice remains a critical legal challenge despite the Voice referendum loss. (Capital Brief)

A MESSAGE FROM VANTA

Just released: The State of Trust: Australia

Don’t miss this deep dive into security, compliance, and the future of trust, featuring insights from Australian business and IT leaders.

Key findings:

👉 Nearly 6 in 10 say AI risks outpace their expertise

👉 65% of security teams are posturing more than protecting

But here’s the flip side:

Teams embracing AI are reaping real benefits—faster risk assessments, sharper accuracy, and quicker incident response. While others hesitate, adopters are proving outcomes matter more than optics. Read the full report.

Join 12,000 companies like Atlassian, Quantum Brilliance, Relevance AI, Instant, and Heidi Health that use Vanta’s compliance program to build trust and prove security in real time.

Trading floor

M&A

DMGT is buying The Telegraph for GBP500m, creating a powerful combined right-leaning media group. (AFR) (FT)

BGH targets Webjet mainly for its cash, planning a leveraged buyout. (The Australian)

Ontario Teachers’ is selling its Sydney Desal stake to Morrison, giving Morrison full ownership. (AFR)

Chalmers blocked Cosette’s $600m Mayne bid on national interest grounds, defying rulings that supported conditional approval. (Capital Brief)

Livingbridge is seeking a buyer for Everlight Radiology with Morgan Stanley and Allier running the sale. (AFR)

BOQ is selling its $3.8b equipment finance portfolio, with bids due pre-Christmas. (The Australian)

A PE firm is targeting weakened Monash IVF after its embryo mix-up scandals hurt its share price. (AFR)

Agnico Eagle is eyeing $36b Northern Star but a deal depends on Hemi project value and capex needs. (The Australian)

Rio Tinto seeks a buyer for its non-core mineral sands and borates to fund debt and capex. (The Australian)

Capital Markets

Pay.com.au raised $53m, lifting its valuation to $630m and prompting ASX listing plans. (AFR)

Bill Ackman is exploring a 2026 IPO for Pershing Square Capital. (AFR)

ASIC hits $311m in fines as Longo’s exit nears. (AFR)

The ACCC investigates Domino’s over franchisee disputes tied to its overseas expansion losses. (AFR)

CBA and Macquarie are restricting trust-based property lending due to growing concerns over risky, unsustainable investor borrowing. (Capital Brief)

EnergyAustralia will turn Yallourn coal plant into a $5b+ low-carbon energy hub. (AFR)

Morse Micro is raising $32m ahead of a planned ASX listing in the next 12–18 months. (AFR)

Dreame’s Matrix10 Ultra robovac boosts suction and climbing, making it a top-rated AI-infused vacuum. (AFR)

PE firms flood junk debt market to pay themselves (Bloomberg)

VC

Regulatory hurdles are limiting super funds’ venture capital exposure by $54b, new research claims. (Capital Brief)

People moves

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler