- Letter of Intent

- Posts

- ☕️ AI pivot

☕️ AI pivot

Investors now hedging, not chasing the AI trade.

Good morning.

The AI bubble talk is taking the AI trade from FOMO to risk management. The FT is telling us CDS volumes on major tech names are booming (up 90% since September) with investors more than a bit scared by cracks in the AI capex frenzy.

Oracle’s CDS is now at its most expensive since 2009, after missed earnings, delayed data centres and rising debt tied to a single client: OpenAI. Meta, CoreWeave and others are reportedly in similar territory.

Others, like Apollo, have been quietly exiting software credit, slashing exposures and shorting names like SonicWall and Perforce. According to the FT, the real concern isn’t valuations (yet), but duration mismatch: companies are taking on long-term debt for AI returns that may not show up until the 2030s (if ever).

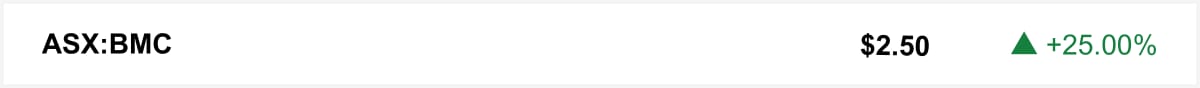

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in BMC Minerals surged 25% on Friday in a strong ASX debut, closing at $2.50 after opening at the IPO offer price of $2. The rally gave the Yukon-focused miner a market capitalisation of about $687 million following a heavily oversubscribed float that raised $550 million.

The company owns the polymetallic KZK project in Canada’s Yukon Territory, comprising the ABM deposit (expected to become the country’s largest silver and zinc producer) and the copper-rich Kona deposit.

🤝 You’re in good company. You’re reading this alongside new readers from JP Morgan, Macquarie and HMC Capital. Know someone who should be here? Forward this. They can sign up here →

The quick sync

Elizabeth Whitelock named AIIA CEO as the tech sector resists tighter AI copyright rules. (Capital Brief)

A teen social media ban campaign group used a draft sponsorship deck featuring the Prime Minister’s department logo to pitch $150,000 packages and sell influence. (Capital Brief)

MYEFO will show a narrower deficit though economists see deeper fiscal challenges ahead. (Capital Brief)

A ministerial scandal, ANZ cuts and a law firm split show 2025 isn’t done causing trouble. (Capital Brief)

Wells’ travel scandal has hijacked Labor’s agenda and renewed pressure to fix rules MPs wrote and won’t change. (Capital Brief)

A MESSAGE FROM DEEL

AI Is Reshaping Work...Are You Ready?

AI is transforming jobs fast: 66% of companies expect slower entry-level hiring and 91% report roles already shifting. But with 67% investing in AI skills, there’s a path forward. Discover how organisations are adapting and what comes next. Download the full report today.

Trading floor

M&A

Rob Silverwood and BGH Capital launch consulting roll-up, eyeing mature firm acquisitions. (AFR)

Ioneer eyes Rio Tinto’s US boron assets to grow its Nevada project. (AFR)

Estia eyes merger with premium aged-care player Regis Healthcare. (The Australian)

Peet Ltd explores sale with Goldman Sachs courting buyers. (AFR)

Sembcorp to buy Alinta Energy for $6.5b, sparking debate over high price. (The Australian)

BHP backs $1.69b Chinese bid for SolGold. (AFR)

Igneo, Orix, and Northleaf vie for Macquarie’s EUR900m Dutch data centre stake. (AFR)

Billionaire Brett Blundy and the Armstrong family sell Beetaloo Station to CPC for $315m with 80,000 cattle. (The Australian)

Capital Markets

Boral wins $25m grant to cut cement emissions by replacing coal with alternative fuels. (Capital Brief)

Dexus launches a new fund series with a $683m buy into Westfield Chermside, boosting its total stake to 50%. (Capital Brief)

Federation AM freezes fund over issues with shipping investment Fast Group. (AFR)

Austal shares slide after Chalmers approves Hanwha lifting its stake to 19.9%, under tight security and governance conditions. (Capital Brief)

Nickel Industries lifts its Indonesian iron ore sales quota to 10 million tonnes, enabling immediate resumption of stockpiled ore sales. (Capital Brief)

Ravenswood Gold Mine to raise $300m via royalties before sale amid record gold prices. (The Australian)

Myer shares jumped after Morgan Stanley praised its trading update and outlook. (Capital Brief)

Sharon AI upsizes pre-IPO to $150m, eyes $2b debt before ASX listing. (AFR)

Ex-ANZ boss Shayne Elliott is suing the bank over a $13.5 million bonus clawback. (Capital Brief)

4DMedical jumps after $30.2m funding via Bell Potter option underwriting. (Capital Brief)

Court rejects shareholder lawsuit over SkyCity’s $67m AUSTRAC penalty. (AFR)

Russia sues Euroclear over EUR185b frozen assets, warning EU of retaliation. (Capital Brief)

Albanese secures Tomago deal, saving 1,000 jobs with renewable energy support. (Capital Brief)

Scarcity Partners-backed January Capital closes $200m credit fund. (AFR)

Oracle delays some OpenAI data centres to 2028 amid cost and labour pressures. (Capital Brief) (Bloomberg)

Government bans Coles and Woolworths from excessive mark-ups, fines up to $10m. (Capital Brief)

Advocacy group 36 Months used teen social media ban influence to pitch corporate sponsorships. (Capital Brief)

Emerging market private credit surges to record USD18b. (FT)

VC

Squizify, a digital food safety startup, expands to Japan after $10m Series A for digital food safety. (Startup Daily)

People moves

Claude Group names Adam Lang as CEO after Kirsty Dollisson steps down. (Capital Brief)

Cbus COO Nancy Day resigns amid executive turnover. (AFR)

Several senior staff have resigned from Morgan Stanley Wealth Management’s Brisbane offices. (AFR)

AustralianSuper names Mike Backeberg as chief platform officer to lead tech and AI strategies. (Capital Brief)

Elizabeth Whitelock named permanent CEO of AIIA amid AI copyright and tech policy debates. (Capital Brief)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler