- Letter of Intent

- Posts

- ☕️Abercrombie & Snitch

☕️Abercrombie & Snitch

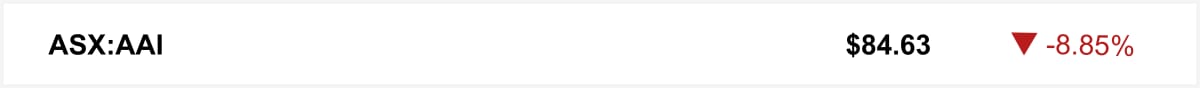

Humm Group faces Takeovers Panel over handling of Credit Corp bid.

Good morning.

Humm Group shareholder Akat Investments launched a new attack on the buy now, pay later firm, requesting that the Takeovers Panel investigate the Humm Group board’s handling of Credit Corp’s takeover offer submitted late last year and chair Andrew Abercrombie’s interestingly-timed purchase of 15 million shares over a few days in December.

Among other things, Akat’s application alleges Abercrombie had access to a 100-page information pack on the state of Humm’s business and earnings projections on or around 12 December, the AFR reported, days before he bought the shares which increased his stake to 29.19%. It also reported that Abercrombie had knowledge that Humm had won a key contract with Flight Centre prior to amassing the stock.

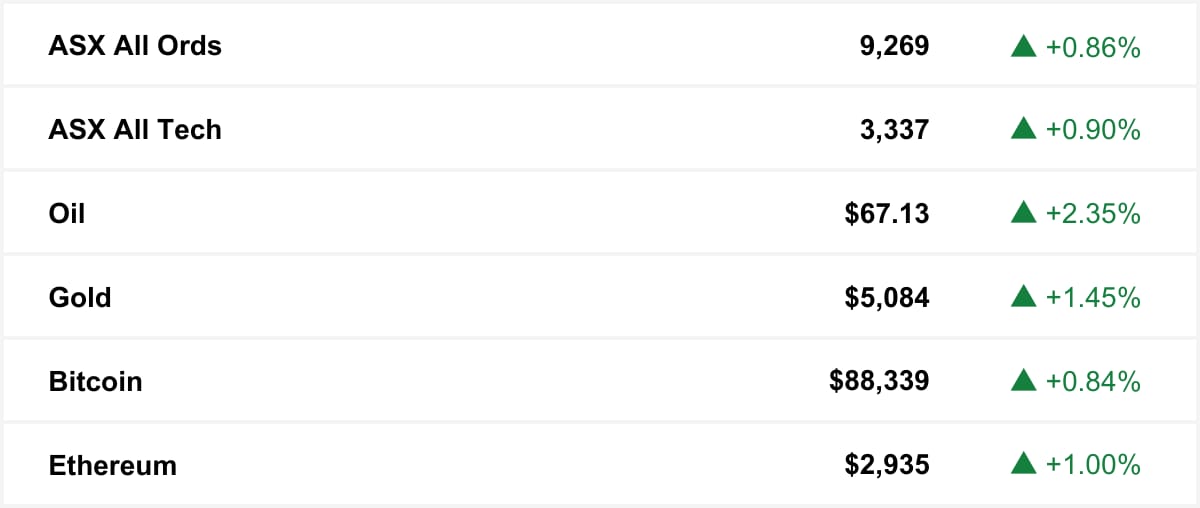

ASX as at market close. Commodities and crypto in USD.

🏆 LOI Subscriber #TBD

Market movers

Shares in Alcoa slumped Tuesday after the miner flagged $100 million in expected first-quarter headwinds and was downgraded by Morgan Stanley, despite a sharp rise in adjusted annual profit driven by higher aluminium prices.

🤝 You’re in good company. You’re reading this alongside new readers from Pitcher Partners, Lendlease and Westpac. Know someone who should be reading? They can sign up here →

The quick sync

Mastercard, CBA and Westpac trialled AI bots in Australia’s first verified agentic purchases. (Capital Brief)

Ley’s leadership is seen as doomed but internal deadlock is delaying the challenge. (Capital Brief)

The Capital Brief/DemosAU poll showing Hanson ahead of Ley as preferred PM complicates the Liberals’ electoral path and their internal arithmetic. (Capital Brief) (Capital Brief)

Factory raises $4.7m to expand its SaaS job-tracking platform for small manufacturers into the US and UK. (Capital Brief)

KPMG finds most startups exit unready, weakening valuations and widening a $15b funding gap. (Capital Brief)

Mark Millett’s first remarks on Steel Dynamics’ $30 bid accuse BlueScope’s board of rejecting engagement and mismanaging its US operations. (Capital Brief)

A MESSAGE FROM NOTION

Australian workers want more from current AI tools

AI adoption and spend is surging in APAC, forecast to hit $175B by 2028, yet returns lag as tools and workflows miss productivity promises. New research positions Australian workers as optimistic about AI tools, but 69% face an outcomes gap from quality, handoffs, and trust. The fix: agentic AI that finishes the busywork for you. Read more.

Trading floor

M&A

AUB to buy UK broker Prestige in $432m deal. (Capital Brief)

Edtech platform Compass Education buys Clipboard to streamline school extracurricular management. (Startup Daily)

Fortescue clears key step in Alta Copper buyout. (Capital Brief)

Quadrant prepares TSA Riley sale, global project management firm valued at $500m. (AFR)

BWP Trust sells Chadstone Homeplus shopping centre in Victoria to Centuria Capital for $86m. (Capital Brief)

Glencore’s bribery lawsuits put Rio Tinto merger talks under strain. (AFR)

Lincoln Place to go on sale in March; developers and PE firms expected to bid. (The Australian)

Steel Dynamics CEO slams BlueScope for rejecting $30/share takeover bid. (Capital Brief)

Amazon teams up with Harris Farm to deliver fresh food in Sydney, challenging Woolworths and Coles. (AFR)

Humm Group under Takeovers Panel review over alleged takeover bid mishandling and related-party stock dealings. (Capital Brief)

Loeb's Third Point plans to take aim at CoStar in new activist campaign. (Reuters)

Capital Markets

DroneShield revenue surges and cashflow turns positive. (Capital Brief)

AirTrunk secures $1.8b debt for Johor Bahru data centre, plans 80% equity sell-down. (AFR)

Santos ships first LNG from Barossa. (Capital Brief)

Galan Lithium raises $40m amid soaring lithium prices, share price triples in 12 months. (AFR)

NAB survey shows business confidence rebounded in December. (Capital Brief)

Star Entertainment swaps UBS for new bankers following Bally’s takeover. (AFR)

3D Energi was suspended after defaulting on gas JV funding obligations. (Capital Brief)

AutoGrab raises $80m to grow its AI car valuation platform internationally. (Startup Daily)

AUB Group launches $400m equity raise for acquisitions, hires Macquarie. (AFR)

BPS Financial fined $14m for unlicensed crypto product conduct. (Capital Brief)

AFCA bases a third of Shield and First Guardian fund payouts on victims’ hypothetical missed profits. (AFR)

EU-India free trade deal eliminates most tariffs, doubling EU exports to India and opening markets for Indian goods. (Capital Brief)

Polestar boosts Australian sales nearly 40%, led by SUV popularity amid slow EV market growth. (AFR)

Applied EV raises $57.8m Series B to scale sales, fleet software, and international deployment of its autonomous electric vehicles. (Capital Brief)

Brendan Gunn has pleaded guilty after being linked to a global scam network that defrauded nearly 40,000 Australians. (AFR)

TikTok settles social media addiction lawsuit ahead of a landmark trial. (NYT)

US health insurer stocks plummet on Trump Medicare spending plan. (FT) (WSJ)

US consumer confidence deteriorates to a more than 11-1/2-year low. (Reuters)(FT)

Dollar traders are paying a record to bet on deeper selloff. (Bloomberg)(FT)

Meta, Corning sign deal worth up to USD6b for fiber-optic cables in AI data centers. (Reuters)

Private credit firms sell debt to themselves at record rate. (FT)

Michael Bloomberg tops up climate spending to beyond USD3b. (FT)

Saudi Arabia looks to tap wealthy families in new quest for cash. (Bloomberg)

Big Tech earnings to test AI rally as resurgent Alphabet takes lead. (Reuters)

VC

Most Australian startups aren’t exit-ready, risking lower valuations and slower VC liquidity, says KPMG. (Capital Brief)

Brisbane startup On the House secures $1.7m to offer free period products in public bathrooms. (Startup Daily)

SaaS startup Factory raises $4.7m Series A to digitise workflow for Australia’s “forgotten majority” of small manufacturers. (Capital Brief)

Anthropic doubles VC fundraising to USD20b on surging investor demand. (FT)

People moves

Ron Levi joins Skip Capital from MA Financial. (Capital Brief)

Shaw and Partners loses four key staff, including mining analyst Dorab Postmaster to Barrenjoey. (AFR)

Brighter Super names Damien Webb as new CIO. (Capital Brief)

Freedom Furniture CEO Blaine Callard exits as Quadrant preps $1b+ furniture float; Amart’s Lee Chadwick to lead both businesses. (The Australian)

Tagliaferro challenges Humm board and chair at Takeovers Panel over takeover conduct. (AFR)

Pinterest to lay off 700 staff and shift resources toward AI-focused roles and products. (Capital Brief)

KPMG partners jostle for top UK job as boss seeks elevation to global role. (FT)

Goldman’s Solomon sees ‘slower’ trajectory for talent growth. (Bloomberg)

TikTok star Khaby Lame signs USD975m deal to monetize global fan base. (Bloomberg)

☝️ Know about a deal or people move we don’t? Hit reply.

The watercooler